- The Ethereum market is front-running like it’s already priced in alpha.

- Whether it fuels the next leg up or triggers a reset depends on whether the bid can absorb the unlock.

Ethereum’s [ETH] Pectra upgrade is almost here, and the market’s moving like it knows something big is brewing.

Whale wallets are quietly stacking, underwater holders are staying glued to their bags, and the estimated leverage ratio is creeping up. In short, classic signs of a shift toward risk-on behavior.

However, is this a textbook accumulation phase or just a “hype cycle” with a short fuse? If HODLers start offloading once the price flips above their cost basis, we could see a liquidity squeeze.

Either way, Pectra might just be the catalyst that decides it.

Conviction capital underpins Ethereum’s risk-on rally

Ethereum’s whale address count (1k – 10k ETH) has been defying price action since ETH broke $4,000 on the 7th of December.

At that price, 4,643 whale addresses were in the game. Fast-forward to today, and even as ETH dips to $1,843, the whale count has surged to 4,953.

What’s going on?

Source: Glassnode

These whales are holding their ground, sitting on unrealized losses, waiting for ETH’s spot price to flip their cost basis. CryptoQuant data tells the story: ETH holders aren’t budging. Instead, they’re accumulating more.

On the 10th of March, they held 15.5356 million ETH, and by the 3rd of May, that had jumped to 19.0378 million ETH – a 22.54% increase.

This behavior is textbook structural conviction, with whales betting on short-term upside. If Pectra delivers, expect those sidelined bags to rotate into realized gains – a long-awaited payoff for their patience.

Market leaning bullish, yet hedged

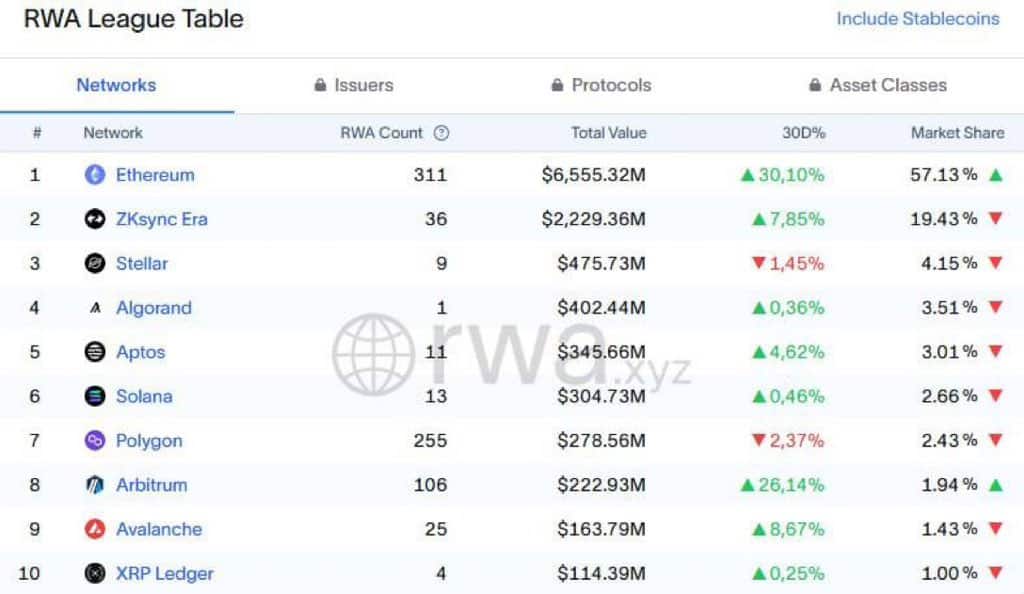

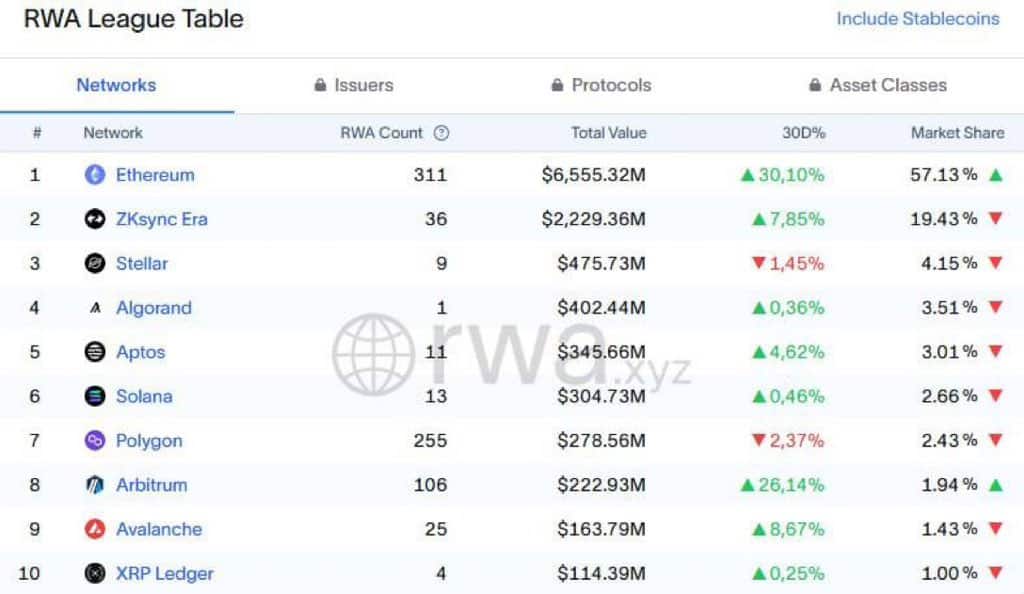

Ethereum is flexing its on-chain dominance with $6.5 billion in real-world asset (RWA) TVL – far outpacing the rest of the L1 pack. The gap isn’t close either – ZKsync Era trails with just $2.2 billion locked.

Source: X

No doubt, when it comes to real-world asset adoption, Ethereum stands unmatched. Pair that with whale conviction, and its fundamentals are looking rock solid.

But price action? Still stuck below $2,000. It’s like Ethereum’s got all the right wiring, but the light’s just not flickering on yet.

Enter Pectra. This is where the next spark could come from, and why the market’s watching so closely. If Pectra lives up to the “hype”, we might just see ETH finally turn the lights on.

The countdown’s on: Can the hype turn into gains?

Caution persists. Ethereum’s Exchange Reserves have been volatile, spiking from 19.10 million to 19.8 million ETH in April, signaling hesitation in the market.

For ETH to kick off a real rally, it needs to crack $2,000 with reserves on a steady decline. Without that, a solid surge is still in the “maybe” zone.

Meanwhile, futures traders are feeling more confident. The Estimated Leverage Ratio (ELR) has been climbing since November, showing they’re gearing up for a potential move.

Source: CryptoQuant

As a result, liquidity squeezes are likely to tag along with any bullish momentum.

That said, current market signals point to a hype-driven cycle, with limited upside potential, unless there’s a shift in structural demand. Therefore, whales may have to wait a bit longer for their rewards.