- Ethereum rebounded and reclaimed a previous support of $3.5k on the charts

- Will positive seasonality trends in January extend ETH’s recovery?

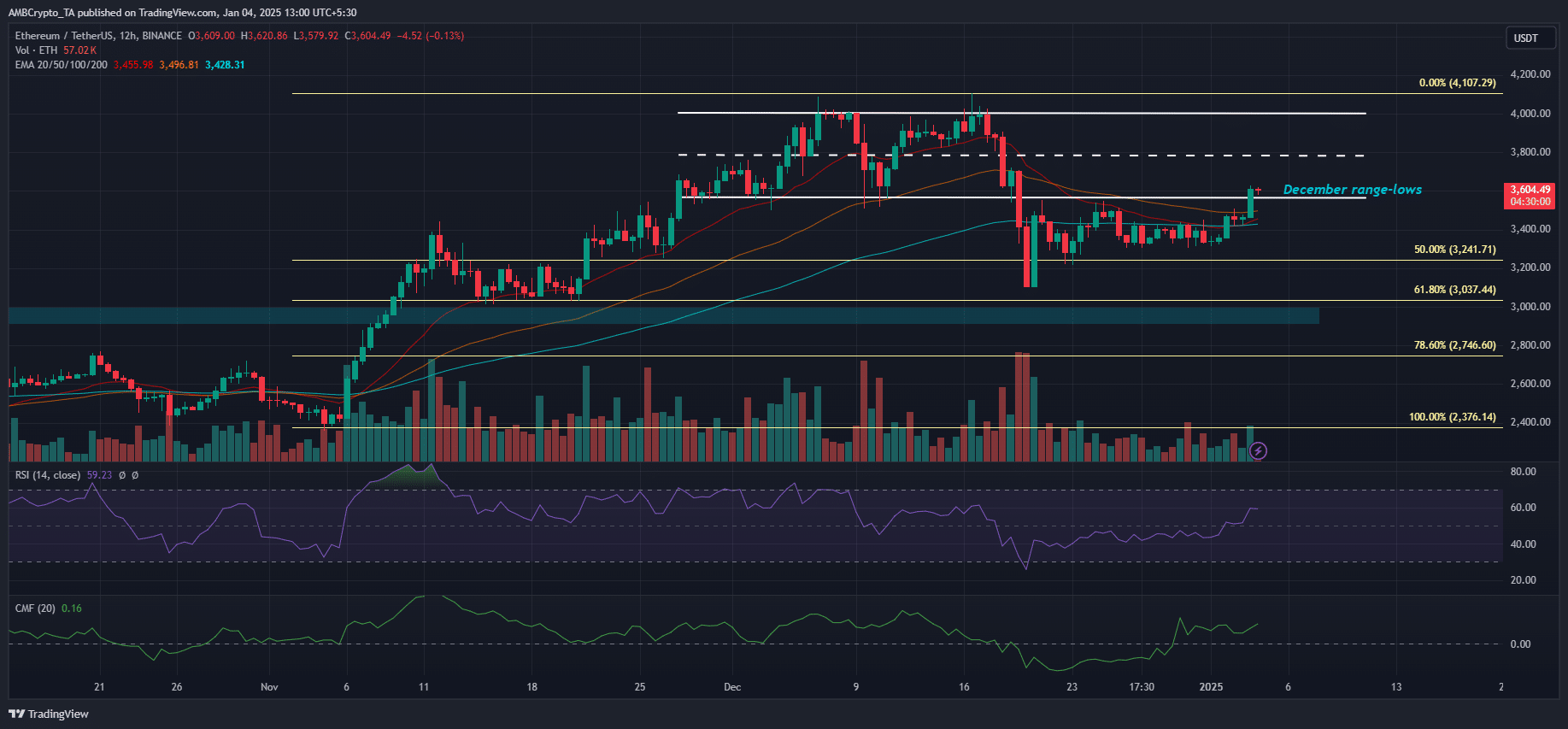

Ethereum [ETH] rallied by 4% on Friday and in doing so, reclaimed its December range-lows – A move that signaled a potential extended recovery on the charts.

Interestingly though, the king altcoin saw its mindshare drop to a 12-month low during the most-recent holiday sell-offs.

Source: Kaito

Over the same period, it declined from over $4k but entered a narrow consolidation above $3,300 in late December. Hence, the question – Will the recovery extend itself after the altcoin reclaimed its December range lows?

ETH: Is $4k next target?

On the 12-hour chart, ETH soared above key moving averages of 20-day, 50-day, and 100-day EMA. In fact, the Friday breakout pump closed above $3.6k and flipped the market structure bullish.

This could set ETH for an extended recovery on the charts, at least in the short term.

Source: ETH/USDT, TradingView

The immediate bullish targets were the mid-range of $3.8K and the upper channel of $4k. The 12-hour chart RSI and CMF were above key median levels, underscoring greater demand and capital inflows.

Should the positive trend continue over the next few days, ETH could climb to $3.8k, $4k, or even higher. However, a bullish outlook would be invalidated if ETH declines below $3.5K.

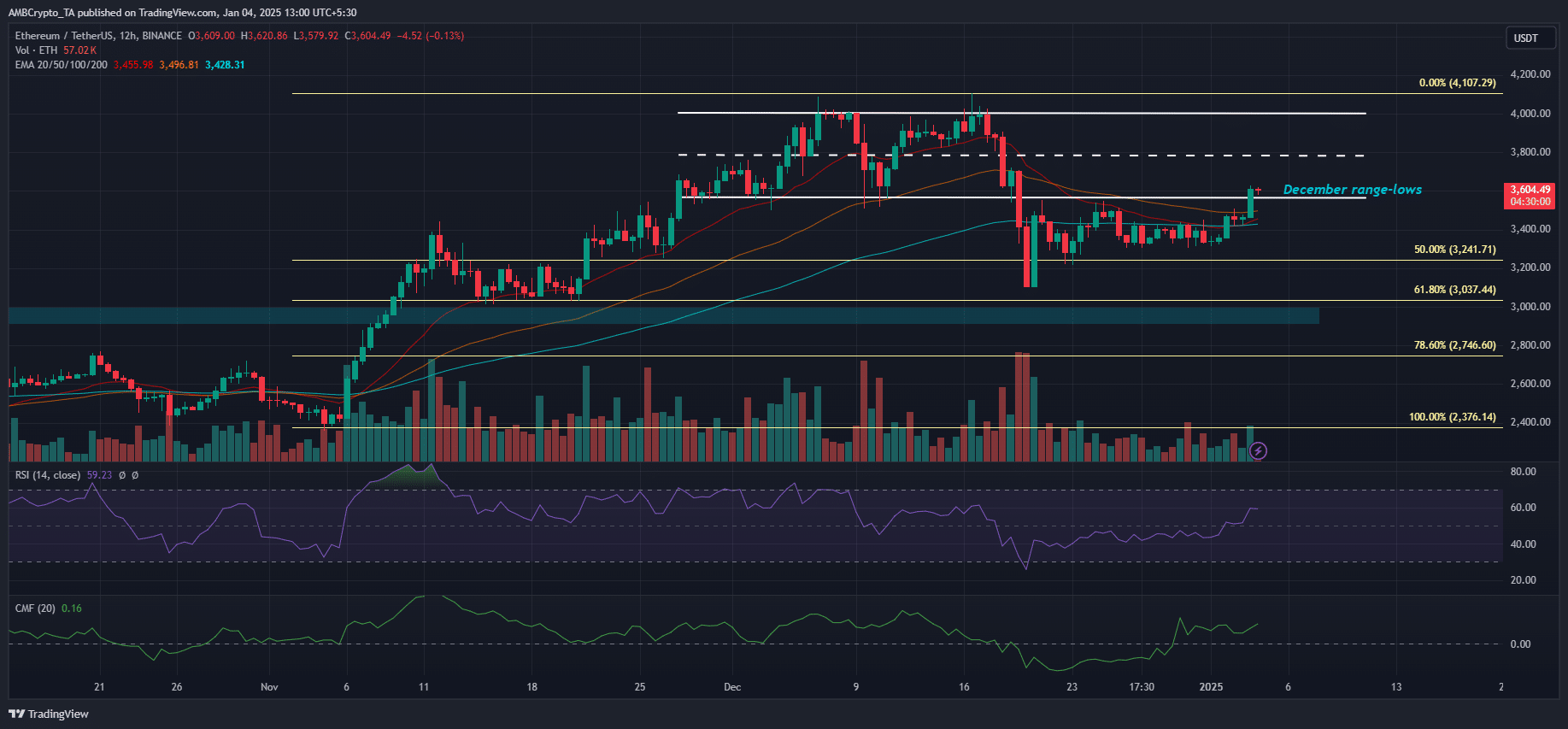

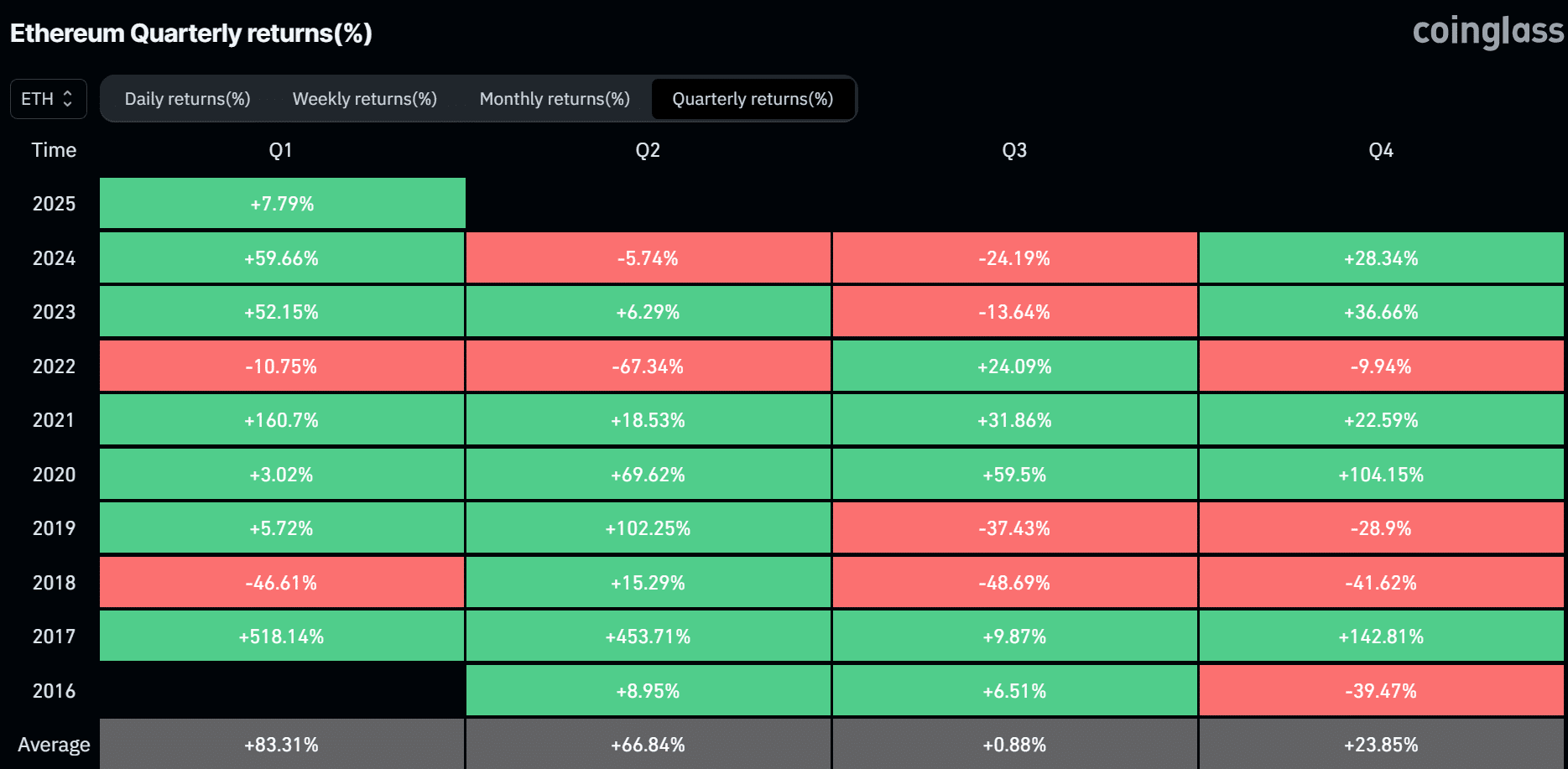

However, ETH seasonality returns also alluded to a positive outlook. Q1 has been the strongest performer, with average gains of 83%. In fact, Coinglass data revealed that January and March have been the best months of Q1, with 21% and 22% returns, respectively.

Source: Coinglass

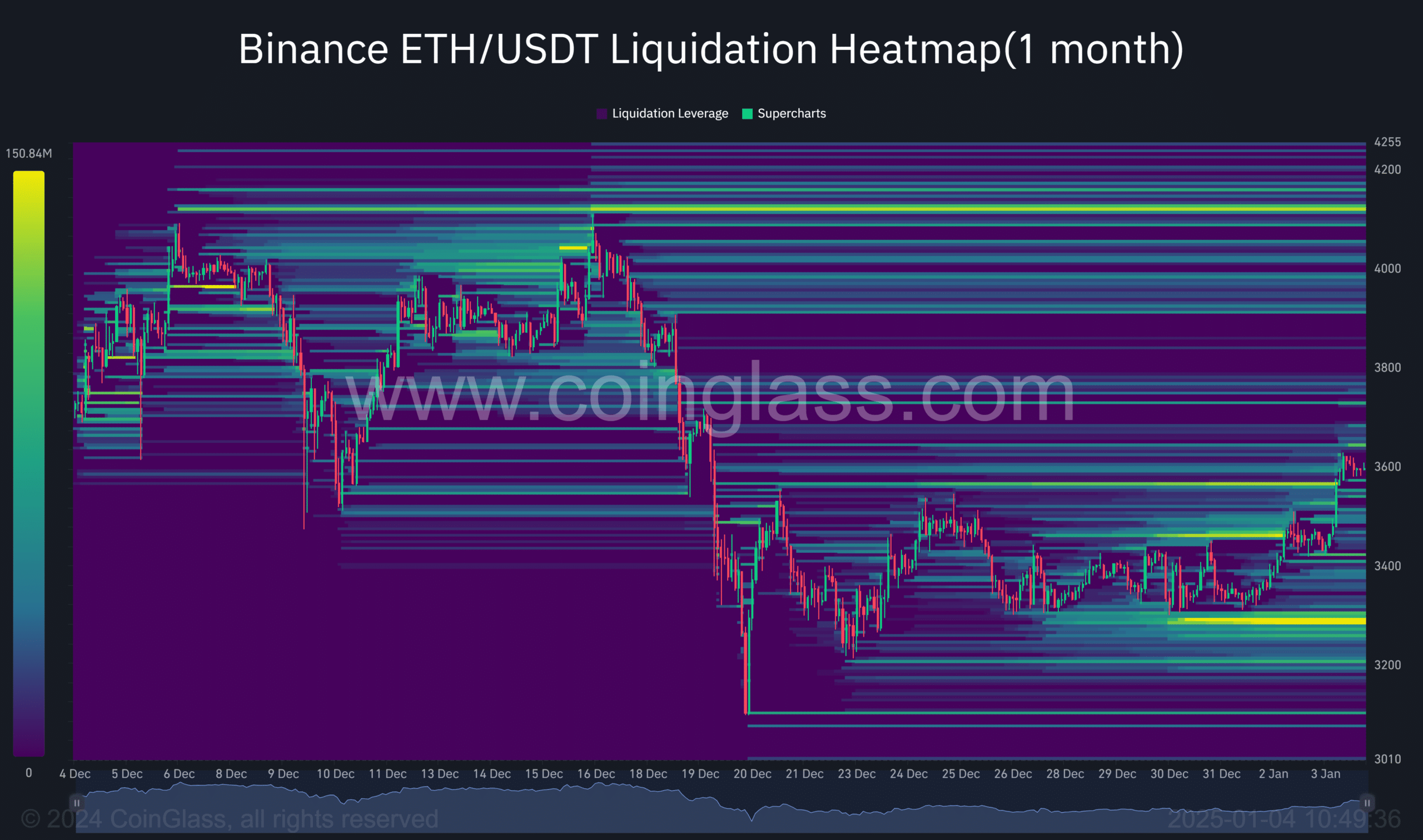

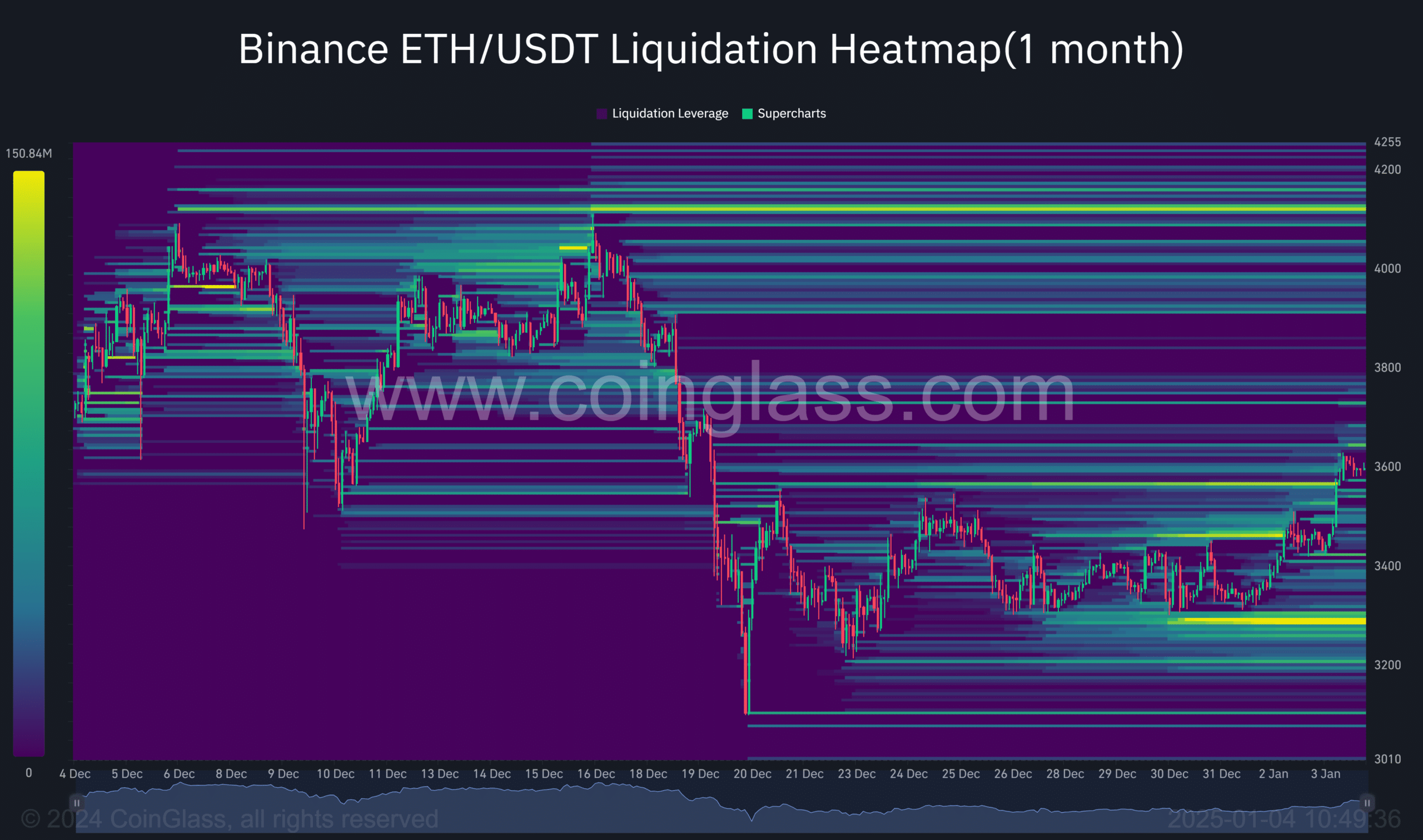

If history repeats itself, ETH could be set for explosive growth in January. That being said, the monthly liquidation heatmap showed that the key upside levels were $3.8k, $4k, and $4.1l. The crucial level on the downside seemed to be $3.3k.

In case of a liquidity sweep-driven rally, $3.8k, $4k, and $3.3k would be the potential targets that could be hit.

Source: Coinglass

Read Ethereum [ETH] Price Prediction 2025-2026

In conclusion, the latest ETH breakout could set the stage for extended growth if seasonality trends repeat in 2025, making $3.8k and $4k within reach. However, a sharp pullback could ease at the key December short-term support of $3.3k.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion