- FLOKI is currently showing signs of a bullish breakout, reinforced by multiple technical indicators.

- FLOKI’s MACD histogram has turned green, with the signal and MACD lines trending upwards.

FLOKI is currently showing a bullish breakout, reinforced by multiple technical indicators. A notable inverse head and shoulders pattern has emerged, indicating a potential trend reversal.

The price has successfully reclaimed the 0.5 Fibonacci retracement level at 0.00006201, confirming bullish strength, and was trading around 0.00006312 at press time.

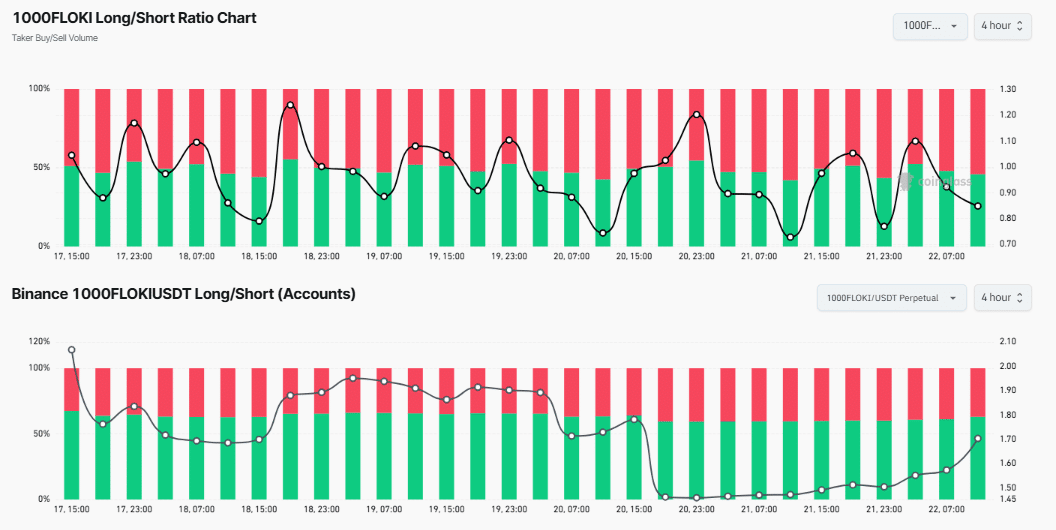

Source: Coinglass

The Fibonacci retracement levels indicated that the 0.382 level at 0.00006237 and 0.236 level at 0.00006281 have been tested as resistance, with the price aiming for the 0 level at 0.00006352.

A successful breakout above this level could trigger further upside momentum.

Open Interest has risen to approximately 152.48M, signaling increased trader participation and renewed bullish sentiment.

Moreover, the MACD histogram has turned green, with the signal and MACD lines trending upwards, reinforcing bullish momentum.

If the price holds above the ascending trendline, the next resistance target would be around 0.00006450, while support lies near 0.00006100. A breakdown below this support could weaken the bullish outlook.

Floki ETP’s impact

The upcoming launch of the Floki ETP on the SIX Swiss Exchange in Q1 2025 marks a significant milestone for FLOKI. This listing follows Dogecoin as the only other meme coin with an exchange-traded product (ETP).

It bridges cryptocurrency and traditional finance, offering institutional and retail investors regulated exposure to FLOKI.

The product is backed by 16 billion tokens (approximately $2.8 million) from the Floki DAO treasury.

Market sentiment, trading volume surge

Analyses made on FLOKI’s Long/Short Ratio presented a dynamic taker buy/sell volume, showing alternating periods of buying and selling pressure.

While the ratio fluctuates, the consistent rebounds suggest strong demand despite periodic corrections. The analyses indicate a rising percentage of long positions, reflecting increasing bullish sentiment.

Given that it is surging, these indicators predict continued upward momentum, supported by growing trader confidence. However, short-term fluctuations may persist as profit-taking occurs.

If long positions sustain dominance, FLOKI could experience further price gains, potentially breaking new resistance levels.

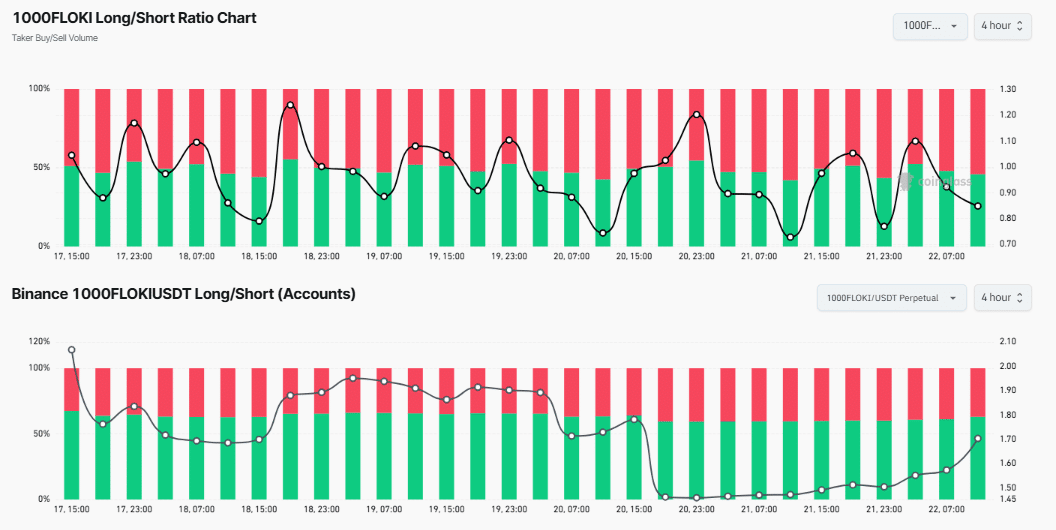

Source: Coinglass

Further analysis of FLOKI’s trading volume indicated that it has remained consistently high. The multiple peaks indicate strong buying pressure, reinforcing the ongoing uptrend.

Thus, the notable increase in green volume bars suggests continued demand, further supporting FLOKI’s bullish case.

If this trend sustains, FLOKI may continue its breakout, potentially reaching new highs as traders and institutions take greater interest in the asset.