- The SEC lawsuit aimed at classifying XRP as security has been dismissed, opening new opportunities for Ripple Labs.

- The recent FOMC meeting and regulatory clarity promise a bright future for digital assets, while discussions on federal reserves escalate.

On the 19th of March, Ripple Labs CEO, Brad Garlinghouse, broke the silence over the SEC’s case against Ripple Labs in a long-anticipated X (formerly Twitter) post.

According to his announcement, the 5-year-old battle ended after a drop in charges aimed at classifying Ripple [XRP] as a security in the digital assets sector.

Thanks to this news and the recent Federal Open Market Committee (FOMC) statement, XRP and the crypto market face new optimism and a brighter future.

What does this mean for XRP?

Following the SEC’s lawsuit dismissal, XRP surged 12%, driven by increased trading volume and heightened buying pressure. Long-term moving averages signaling a strong “buy” suggest potential accumulation.

Despite recent volatility, XRP’s legal clarity positions Ripple Labs to pursue partnerships for sustained growth and utility. Michael Arrington’s X post highlights XRP as the best-performing crypto over the past year, 180 days, and 90 days.

Market speculation hints at a possible partnership between XRP and SWIFT, the global financial infrastructure leader. This development could pave the way for steady long-term growth for XRP.

FOMC — What are the implications of the FED’s decisions?

Following the FOMC on the 19th of March meeting on economic projections has ignited debates about inflation and digital assets. Fed Chair Jerome Powell acknowledged concerns over the economic outlook, considering recent rate cuts and rising inflation.

According to Justin Harts on X,

“Central Banks Are Quietly Prepping for Economic Collapse.”

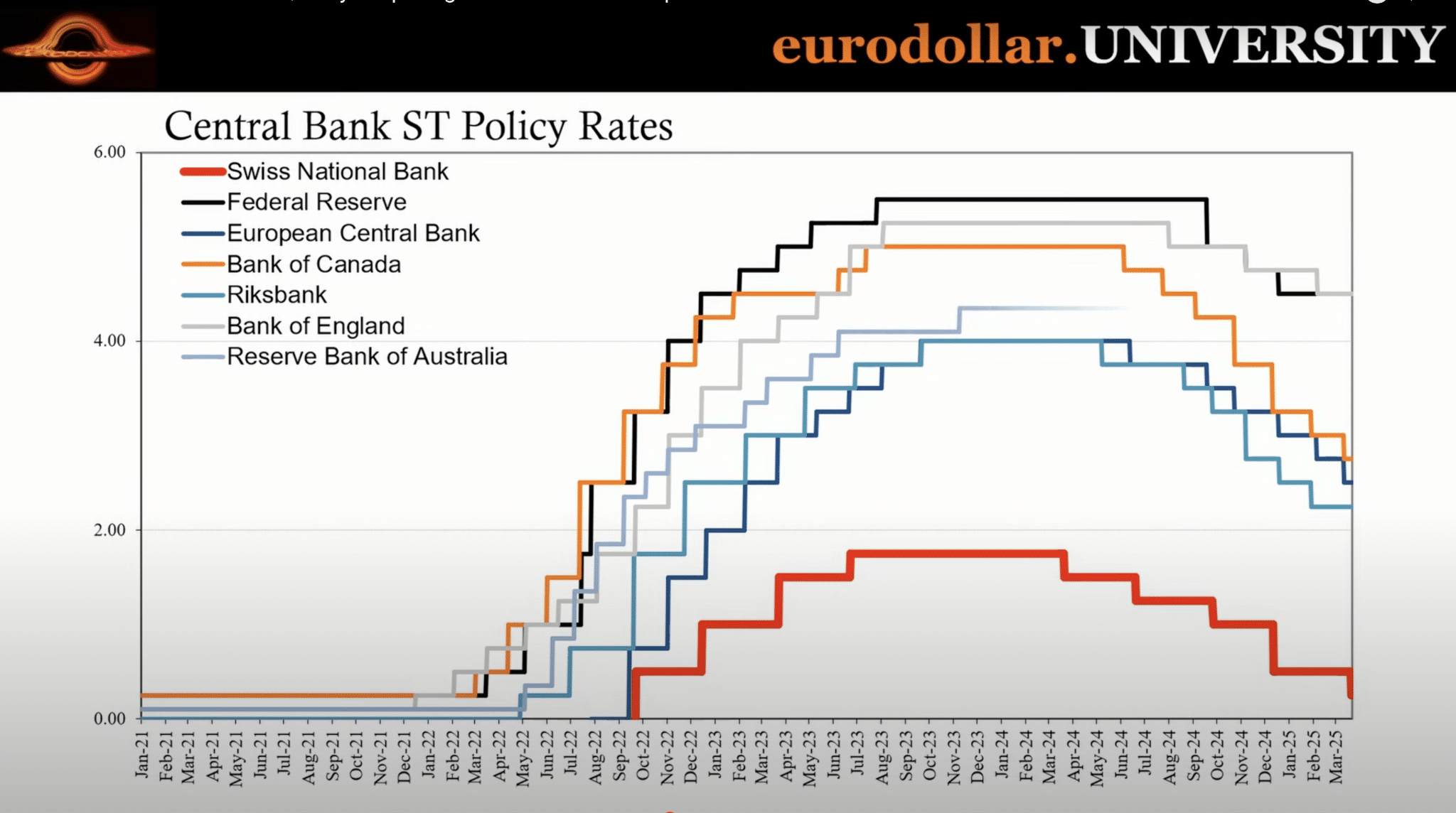

The Central Bank Short-term (ST) Policy Rates from major global institutions, including the Federal Reserve, highlight ongoing economic uncertainties and inflationary pressures.

Source: X

Digital assets- A hedge against inflation?

Amid global economic uncertainties and Trump tariffs, digital assets like Bitcoin [BTC] and XRP are gaining attention as hedges against inflation. Institutions are exploring exchange-traded funds (ETFs) to bridge digital assets with traditional finance (TradFi).

As crypto adoption and public perception improve, governments face mounting pressure to create clear regulatory frameworks for blockchain technology, cryptocurrencies, and related products. According to WatchGuru, President Donald Trump has urged Congress to pass stablecoin legislation.

XRP’s newfound legal clarity has strengthened its position in federal reserves and secured cross-border payments, addressing rising concerns over inflation and economic instability.

Following recent global economic uncertainties and Trump tariffs, digital assets including Bitcoin and XRP have entered the debate as hedges against inflation policies. Institutions are considering exchange-traded funds (ETFs) as digital assets merging with traditional finance (TradFi).

As crypto adoption and positive public perception grow, governments face pressure to establish clear regulatory frameworks regarding blockchain technology, its products, and cryptocurrencies.

Notably, in his pre-recorded speech at the Digital Asset Summit, President Donald Trump called on Congress to pass crypto stablecoin legislation.

No doubt XRP’s freedom has opened the door for crypto’s stance in federal reserves, and secure cross-border payments, as fears of inflation and economic uncertainty rise.