- Whale accumulation highlighted strong confidence as ONDO traded within key support and resistance levels.

- Technical indicators suggested oversold conditions, with large transactions signaling potential bullish momentum.

A single entity has re-entered the Ondo [ONDO] market with a staggering $7.87M across five wallets, just a week after selling.

The largest purchase saw $2.46M USDT spent to acquire 1.64M ONDO, signaling renewed confidence in the token.

At press time, ONDO was trading at $1.43, down 2.15% in the last 24 hours, as traders assess its next move.

This strategic accumulation raises questions about whether the token is preparing for a significant rally or remains susceptible to further price fluctuations.

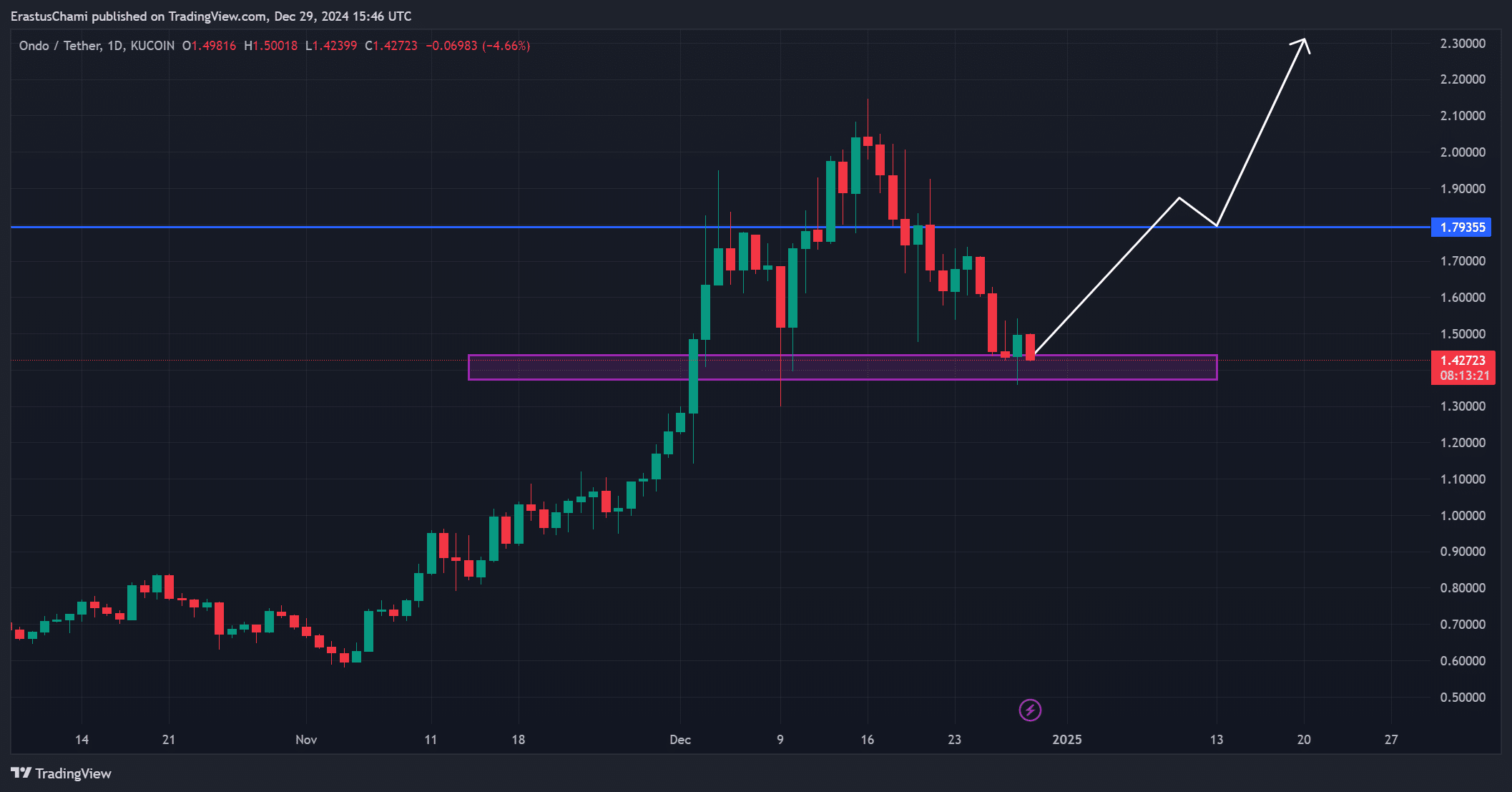

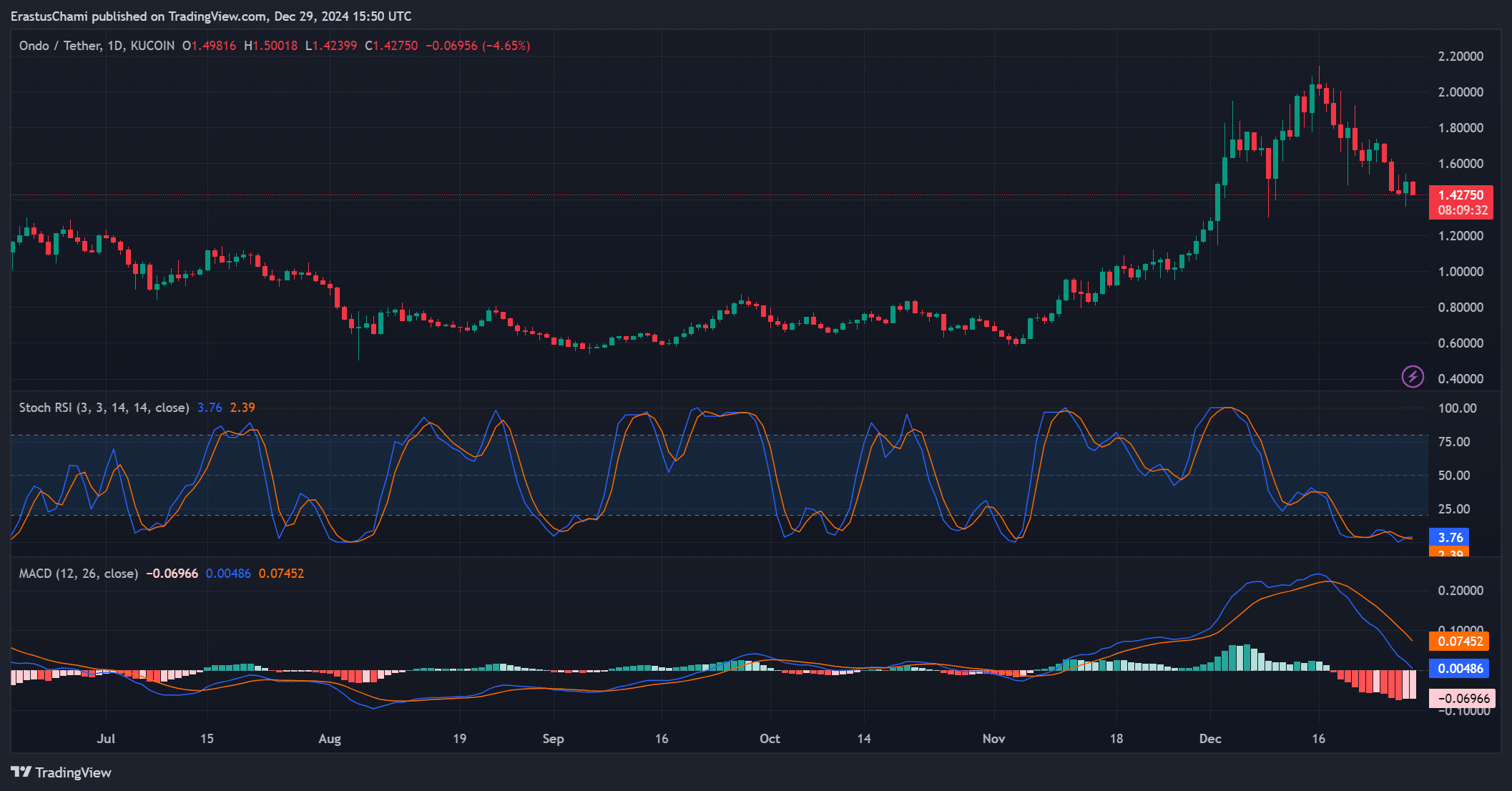

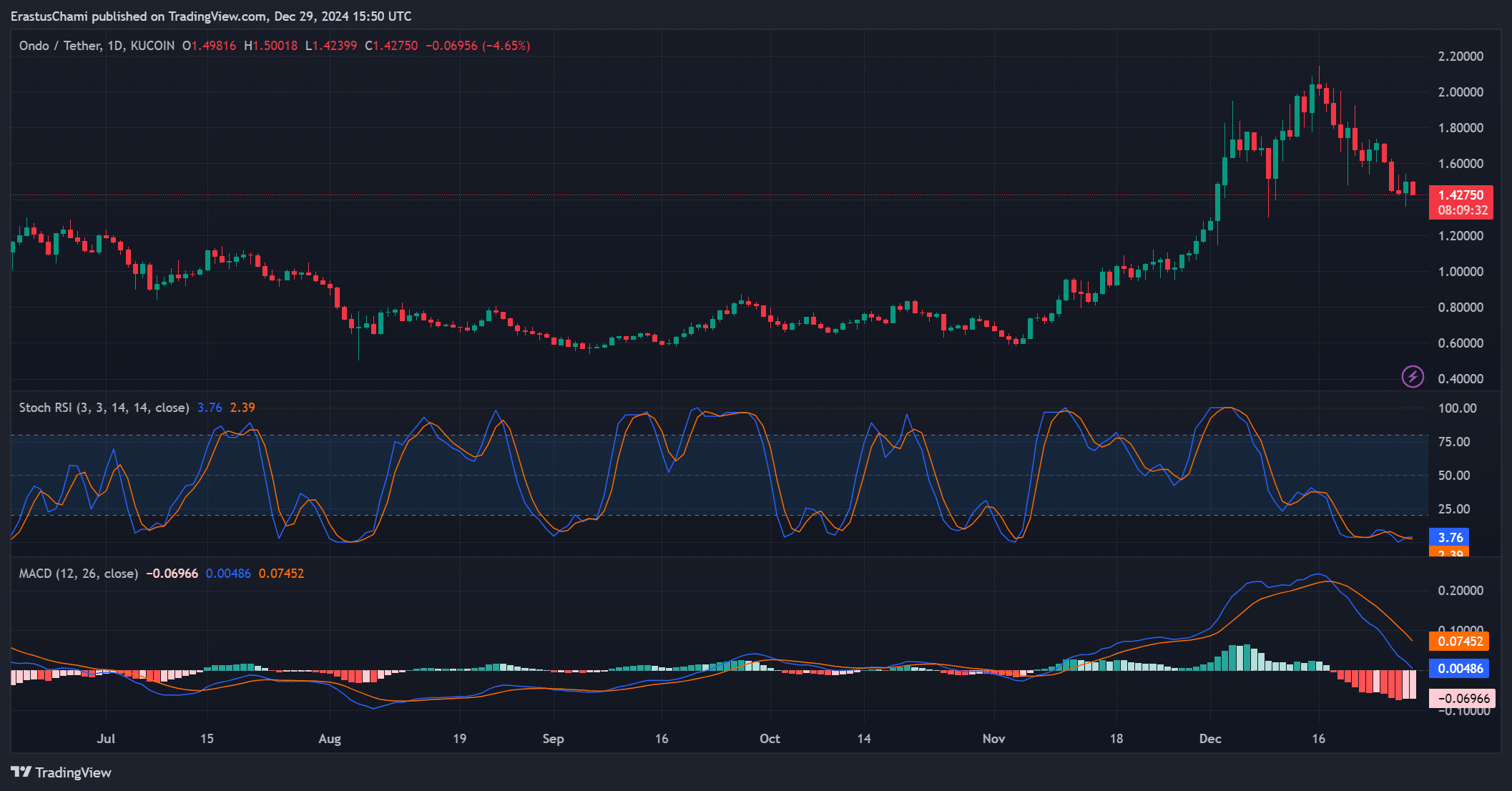

ONDO price analysis: Navigating key levels

ONDO has been battling to maintain its critical support zone between $1.40 and $1.50 after retreating from a high of $2.00 earlier this month.

Currently, resistance at $1.79 poses a formidable challenge for bulls, with a successful breakout potentially leading to the $2.30 mark.

However, if support breaks, the price could test the $1.20 level, creating room for bearish momentum.

Therefore, its near-term movement hinges on its ability to reclaim higher ground while consolidating within this key range.

Source: TradingView

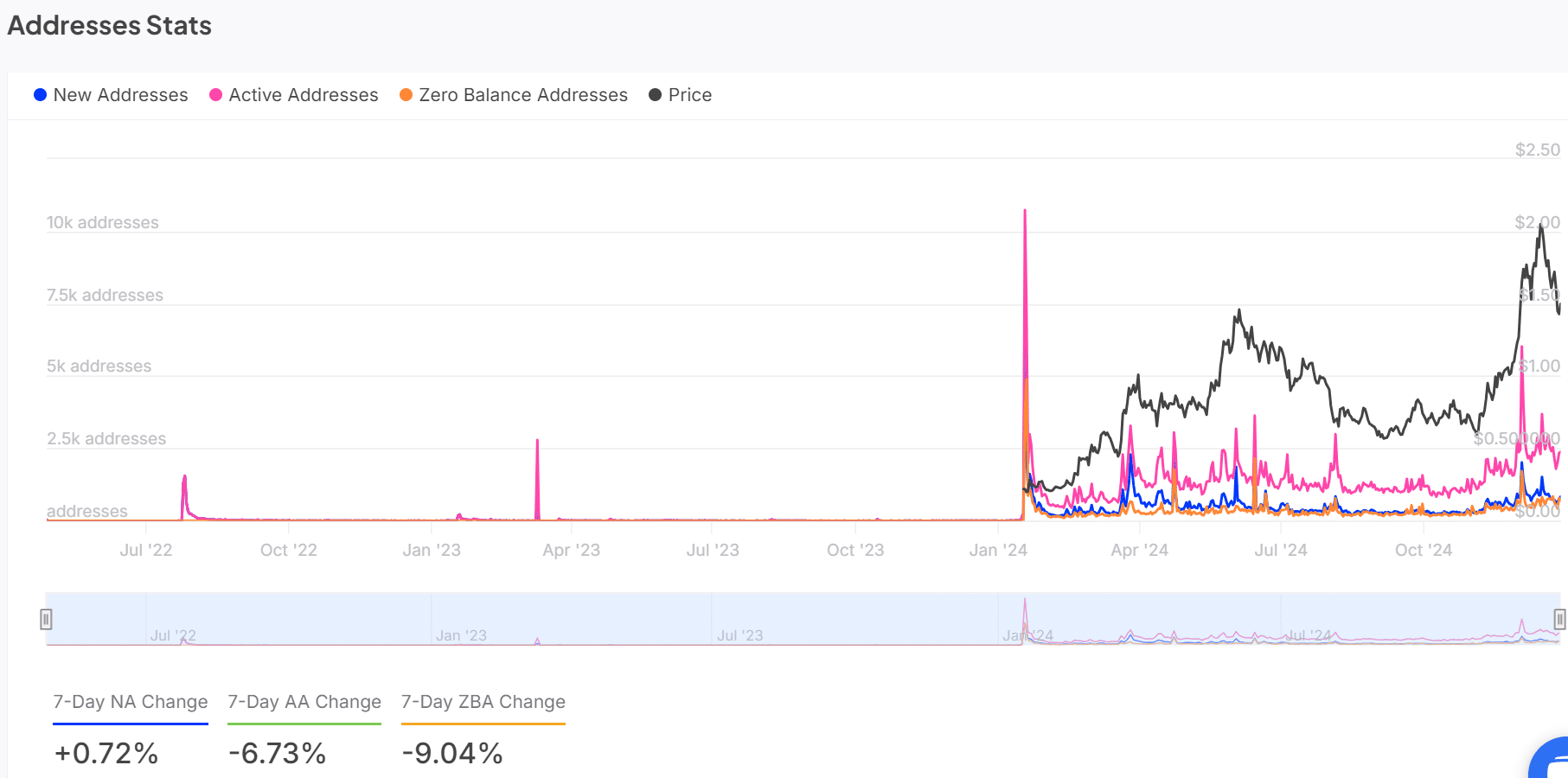

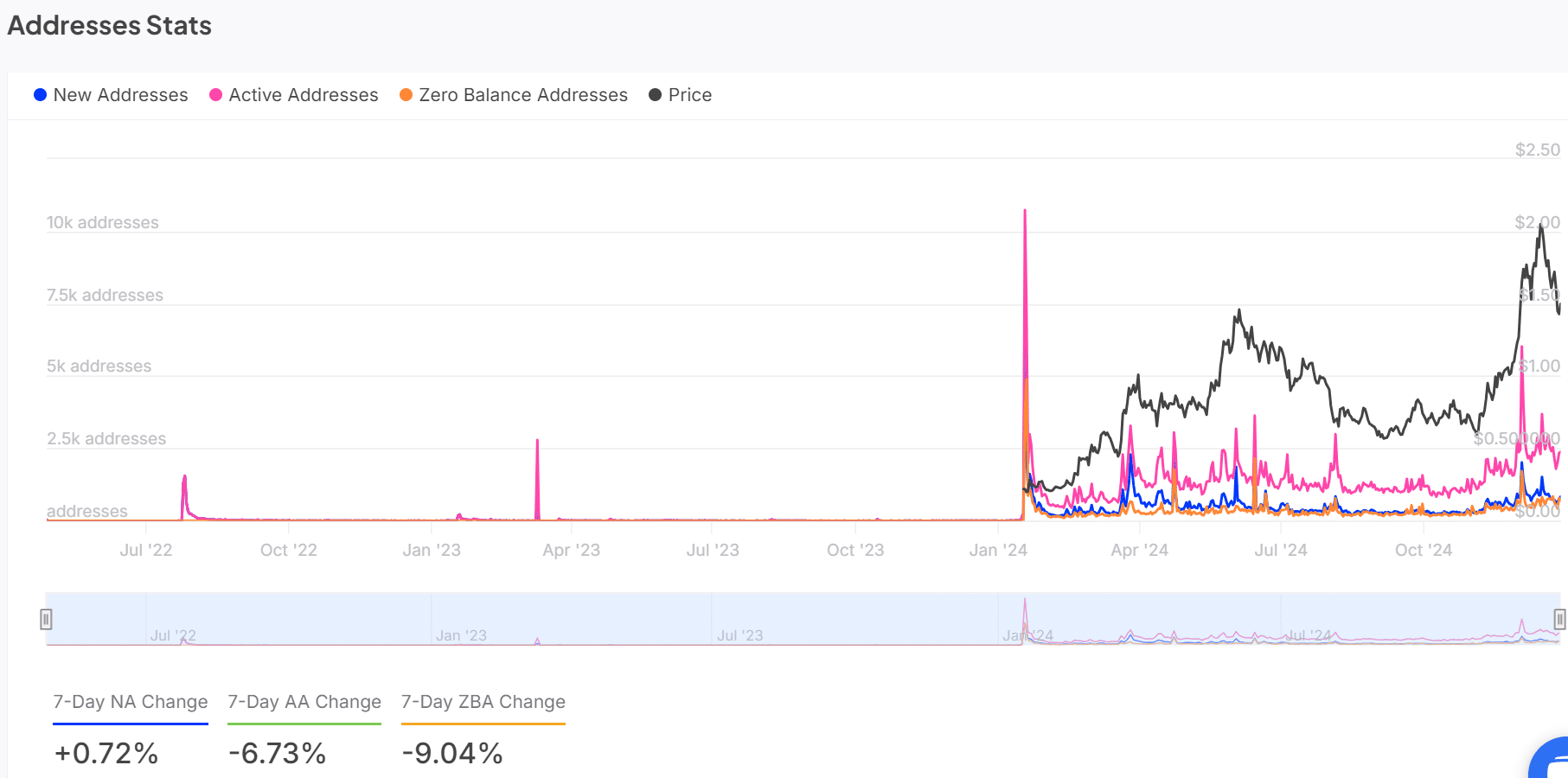

ONDO address stats: Shifting trends among holders

The address activity paints a nuanced picture of the token’s ecosystem. New addresses increased slightly by 0.72%, indicating continued interest, but active addresses declined by 6.73% over the past week.

Additionally, zero-balance addresses dropped by 9.04%, suggesting some holders are re-engaging with their wallets.

This shift reflects mixed sentiment as investors recalibrate their positions, balancing between optimism and caution amid market volatility.

Source: IntoTheBlock

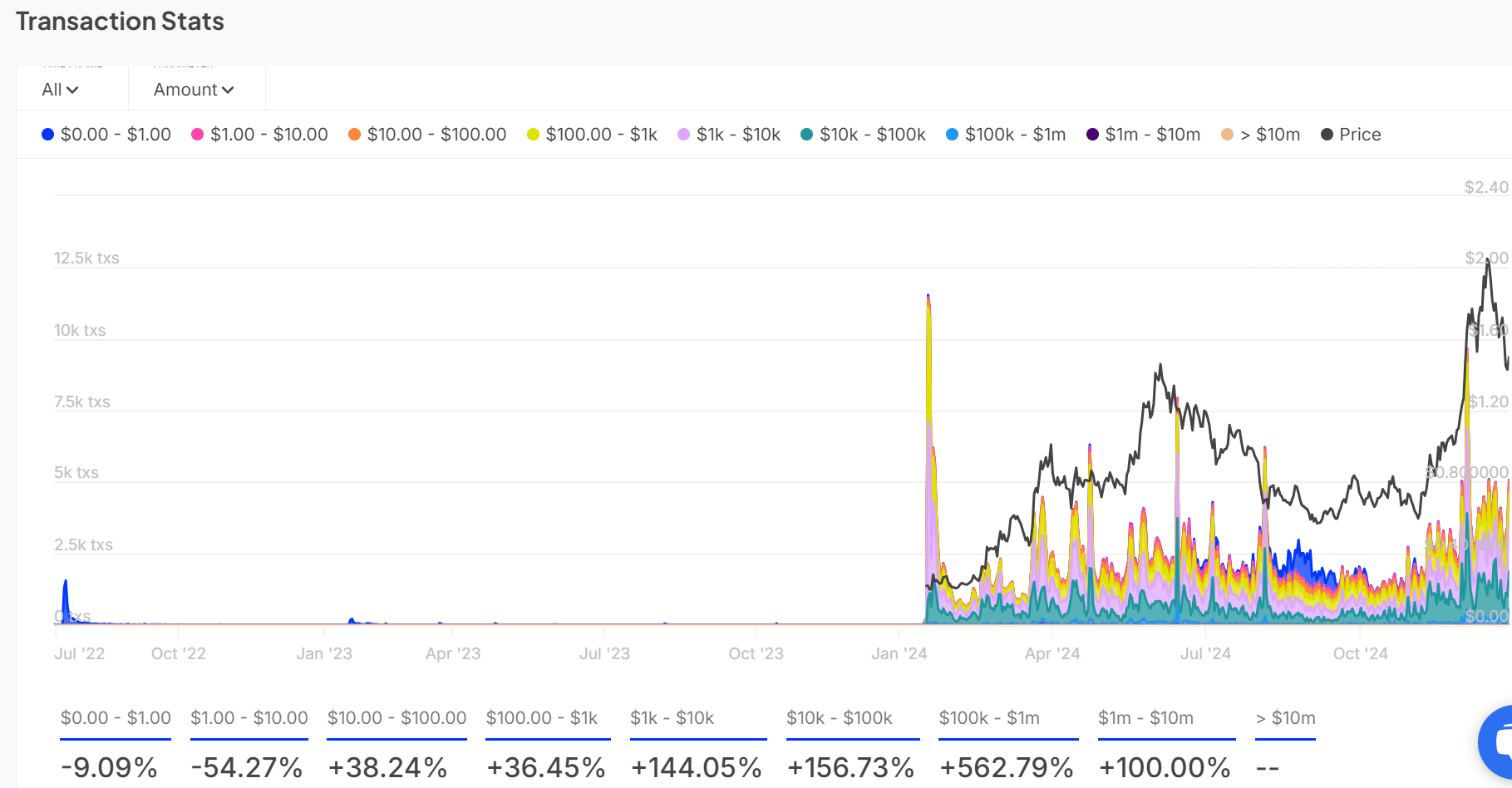

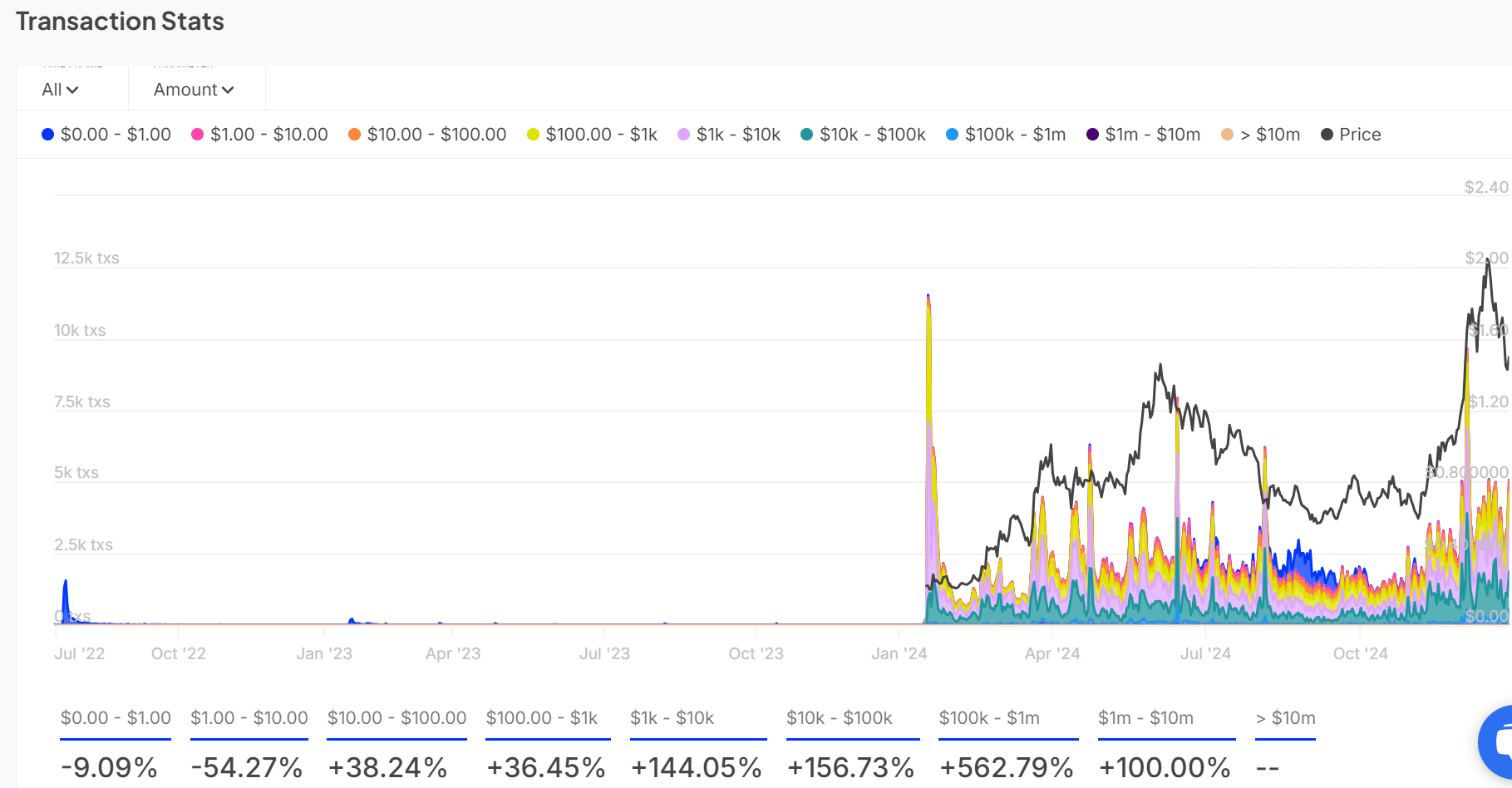

Transaction stats: Rising institutional activity?

Transaction data indicates robust growth in large-value transfers, underscoring increasing confidence in ONDO.

Transactions between $10,000 and $100,000 rose by 156.73%, while those exceeding $1 million surged by 100%.

These figures suggest heightened interest from institutional or high-net-worth investors seeking strategic exposure.

Consequently, this uptick in transaction volume aligns with the broader narrative of ONDO’s potential to attract significant capital flows.

Source: IntoTheBlock

Technical indicators: Will momentum turn bullish?

Technical indicators show potential signals for a recovery. The STOCH RSI at 3.76 points to oversold conditions, hinting at a possible rebound in the short term.

Meanwhile, the MACD remains negative at -0.069, but the narrowing gap between its lines suggests diminishing bearish momentum.

If these indicators align with improving sentiment, the token could see a reversal in its recent downtrend.

Source: TradingView

Read Ondo’s [ONDO] Price Prediction 2024–2025

ONDO appears to be building a case for a significant rally, supported by whale accumulation, increased large-value transactions, and bullish technical setups.

While challenges remain, the market activity suggests the token is gearing up for a strong upward move. Therefore, it seems increasingly likely that ONDO could surpass $2.00 in the coming weeks.