- Solana is trading below a crucial support zone, and from here, its price could move in either direction.

- Given the market context, is a deeper pullback next, or will the bulls seize the dip?

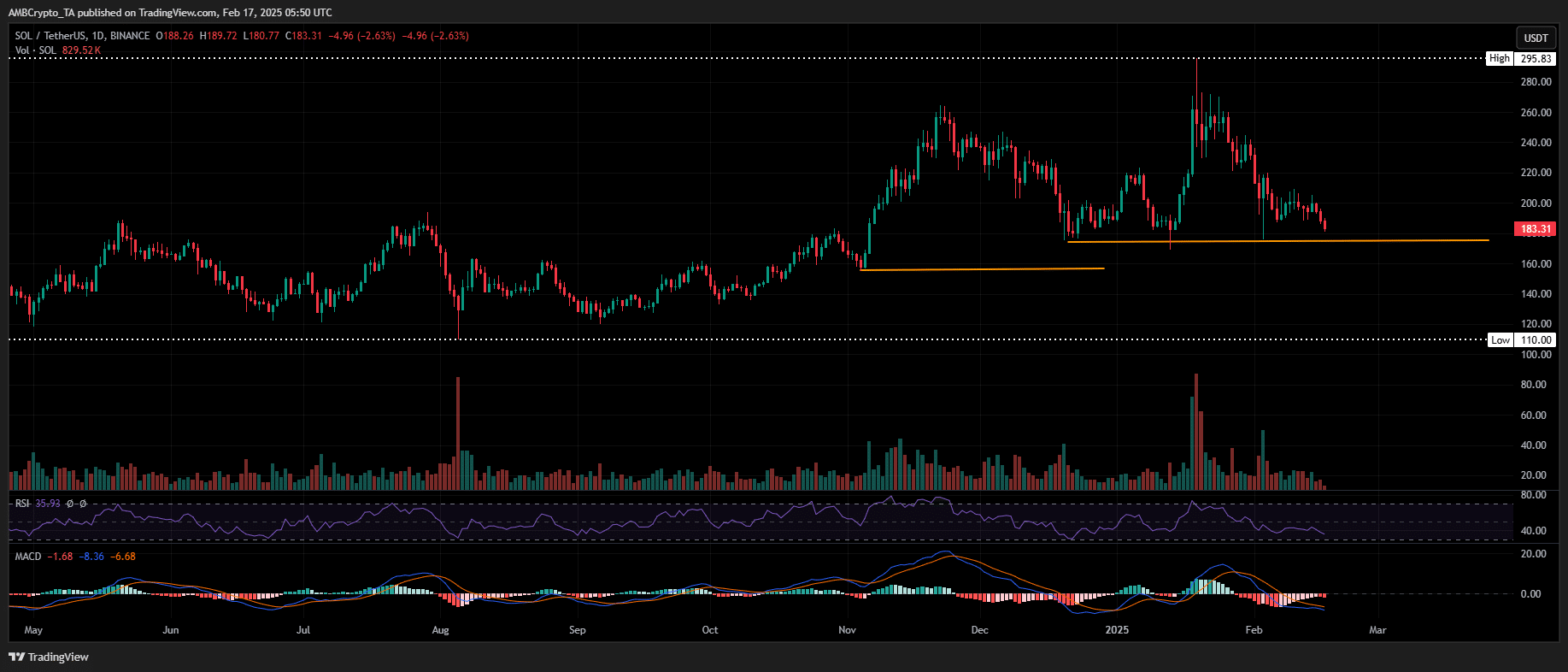

After shedding 5% of its market value, Solana [SOL] is hovering near a critical support zone – one that has historically fueled strong rebounds toward the $250-$260 range – a 35% rise from its current price.

Source: TradingView (SOL/USDT)

Historically, this support zone has sparked strong rebounds, and with a 65% jump in volume, now exceeding $2 billion, traders may be expecting a repeat.

Additionally, the SOL/BTC pair is mirroring a similar pattern from the last cycle, when a bullish reversal pushed Solana up by 65% to $270 in just two weeks. But don’t forget – the hype from the TRUMP memecoin launch played a huge role, sparking a 19% single-day surge in Solana.

So, while a 35% rebound could make sense with Bitcoin’s consolidation, altcoin season chatter, and strong volume backing it. But let’s be real – it’s still too early to call.

It should be observed whether the market flips into a solid bottom before both retail and speculative capital dive headfirst into the ‘dip’.

Solana at crossroads : Rebound or further decline?

At the time of writing, Solana was seeing strong buying interest in the futures market, with Open Interest (OI) up 8.37% at $5.85 billion.

Over $14 million in longs were liquidated in 24 hours, aligning with SOL’s 2.65% drop. Despite the liquidations, Solana is far from de-leveraging. Traders are taking high risks, betting on a potential rebound.

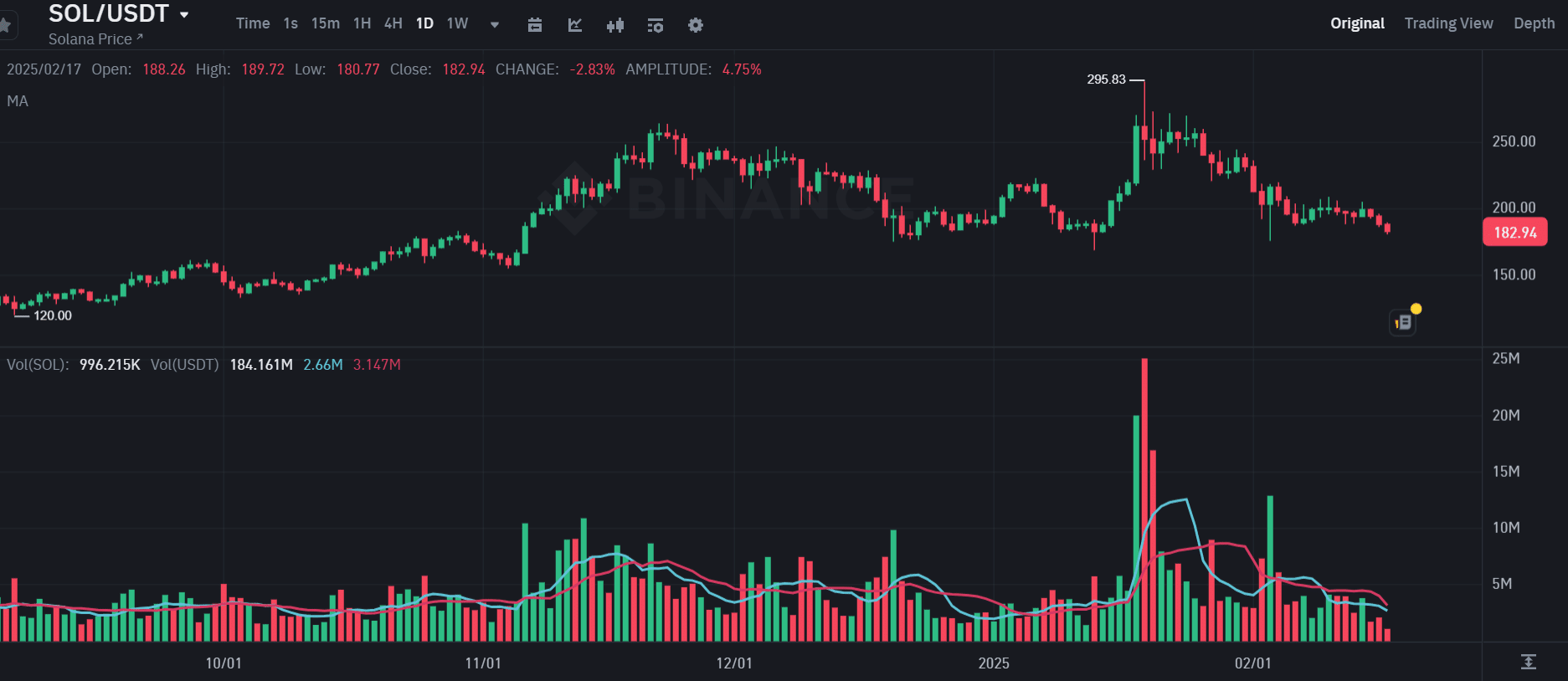

However, as AMBCrypto points out, this strategy could backfire if spot trading doesn’t surge in demand. Binance data shows three straight days of sell orders leading.

Unless this shifts to green, a $180 bottom might be tough to hit. A pullback to $160 is more likely if long squeezes aren’t kept in check.

Source: Binance

With high-risk sentiment running through the derivatives market, caution is crucial.

While the buzz about a 35% rebound to $250 spreads on social media, reality suggests more days of heavy liquidations.

Traders risk losing millions, making any rebound for Solana still a long way off.