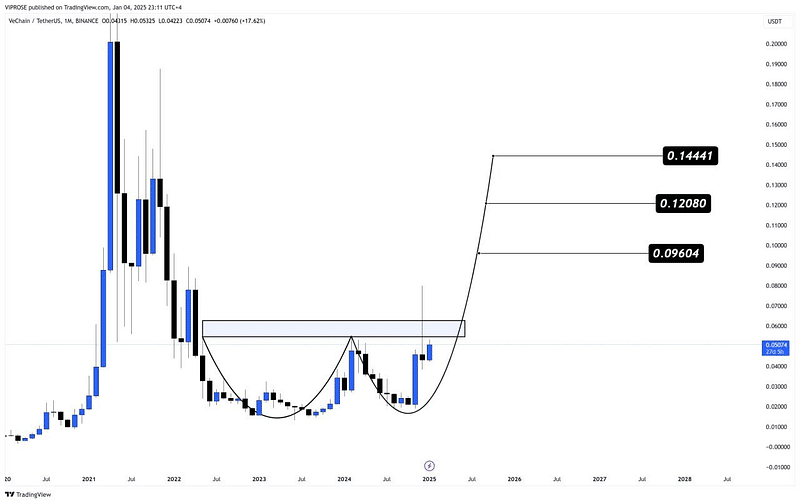

- The monthly chart of VET highlighted a classic Cup & Handle pattern, a formation often associated with bullish momentum.

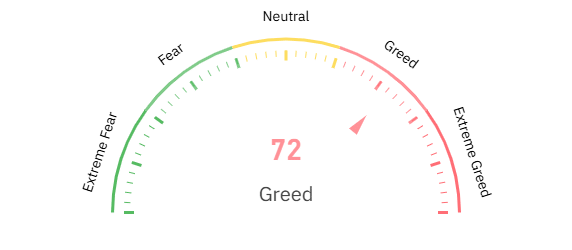

- If the index shifts toward “extreme greed,” it may coincide with VET surpassing the $0.16515 mid-term target.

VeChain [VET] has captured market attention with its potential breakout from a bullish “Cup & Handle” formation. This pattern typically indicates strong upward momentum, often signaling the start of a rally.

With long-term targets reaching $0.44240, $VET appears well-positioned for significant growth in the coming years.

Cup & Handle pattern

The monthly chart of $VET highlighted a classic Cup & Handle pattern, a formation often associated with bullish momentum.

This pattern arises after a prolonged decline, with the “cup” forming a rounded bottom and the “handle” signifying a short consolidation phase before a breakout.

Source: TradingView

At press time, VET was trading near $0.05074, having broken above the handle’s resistance zone, signaling potential for further upside.

The key mid-term targets for $VET are $0.11300 and $0.16515, while long-term projections extend to $0.44240.

Historically, the Cup & Handle pattern’s breakout points often align with renewed market interest, increased trading volume, and institutional participation.

Given VeChain’s fundamental strengths, this technical pattern reinforces the likelihood of sustained growth.

Looking ahead, the next critical resistance lies at $0.09604. If $VET breaks above this level with strong volume, it could accelerate toward the $0.14441 region.

Traders should monitor volume spikes and RSI levels for confirmation of momentum strength.

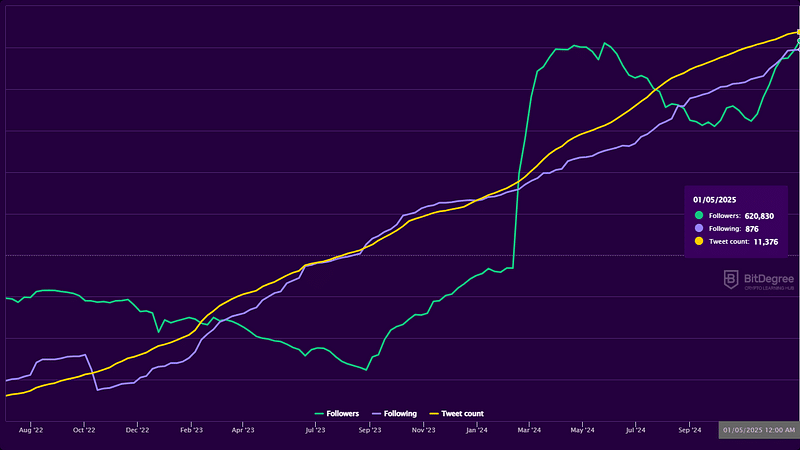

Social dominance analysis

Recently, VET’s Social Dominance has shown a noticeable uptick, reflecting growing interest among traders and investors.

This aligns with the Cup & Handle breakout pattern on the chart and the broader narrative of VeChain’s utility in supply chain solutions.

Source: BitDegree

It is well known that rising Social Dominance has preceded price rallies in altcoins, as increased attention often drives new capital inflows.

In the case of VET, the launch of initiatives like VeBetterDAO and B3TR rewards systems has fueled discussions about its long-term potential.

With sustainability-focused rewards capturing attention, VET has become a topic of interest in both crypto and real-world use cases.

Current data suggests that VET’s Social Dominance could rise further if the asset breaks the $0.09604 resistance level, as predicted in the technical analysis.

Sustained growth in this area could signal a growing community of holders, traders, and adopters — a critical factor for long-term price appreciation.

A sharp decline in Social Dominance without a corresponding price increase could indicate waning interest, potentially leading to short-term corrections.

Conversely, if Social Dominance aligns with increased trading volumes and positive sentiment, $VET may rally toward its mid-term target of $0.11300.

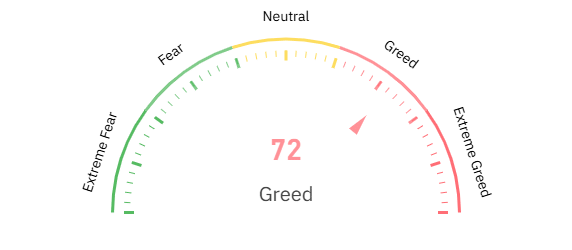

Greed & Fear Index analysis

The Greed & Fear Index has often provided valuable insights into the psychological state of market participants, helping traders anticipate potential reversals.

Currently, the index for the crypto market suggests “neutral to slight greed,” indicating cautious optimism among investors.

Source: Coinglass

VET’s position within a bullish Cup & Handle formation aligns with this sentiment.

Neutral or slightly greedy market conditions often serve as a foundation for sustained price growth, as participants are neither overly euphoric nor excessively fearful.

This creates a balanced environment for assets like $VET to climb steadily without abrupt corrections.

If the index shifts toward “extreme greed,” it may coincide with $VET surpassing the $0.16515 mid-term target.

However, extreme greed has historically signaled the need for caution, as it often precedes profit-taking and short-term pullbacks.

On the other hand, a sudden shift toward fear could stem from external market shocks, potentially delaying $VET’s breakout to its long-term targets.

Traders should combine Greed & Fear Index readings with $VET’s volume and RSI trends. A sustained bullish sentiment, coupled with increasing volume, could propel $VET toward its long-term target of $0.44240.

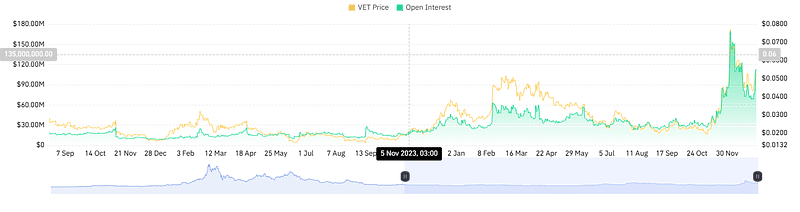

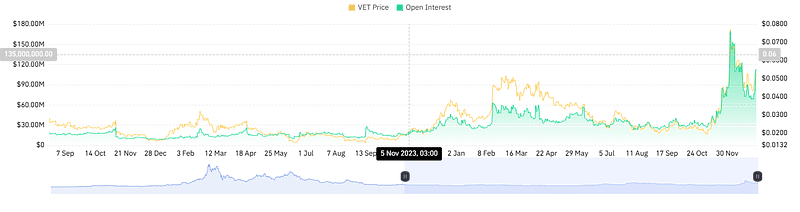

Open Interest analysis

For VET, Open Interest has steadily increased over the past weeks, particularly as the price moved closer to breaking the resistance zone around $0.05074.

This increase in OI suggests that both retail and institutional investors are taking positions in anticipation of a significant price movement.

Source: Coinglass

Seemingly, rising OI combined with upward price action signifies strong bullish momentum. For VET, this aligns with the Cup & Handle breakout scenario highlighted in the technical analysis.

However, traders should be cautious if OI increases while the price stagnates or declines, as this may indicate speculative positions that could lead to a squeeze.

As $VET approaches its mid-term target of $0.09604, a further rise in OI could confirm growing confidence in the breakout.

If OI starts to decline before the price reaches key targets, it could signal profit-taking or uncertainty, warranting a reassessment of short-term trading strategies.

Overall, sustained growth in Open Interest bodes well for $VET’s ability to achieve its long-term targets.

VeChain is positioned as a standout cryptocurrency with significant growth potential, supported by both technical and fundamental factors.

The bullish Cup & Handle formation on the monthly chart signals a probable breakout, with mid-term targets at $0.11300 and $0.16515, and long-term projections reaching $0.44240.

Key metrics like Open Interest underscore the asset’s growing strength, indicating heightened market participation and relative undervaluation.

Furthermore, Social Dominance and balanced market sentiment reflected in the Greed & Fear Index support VET’s narrative as a leader in blockchain innovation.

Read VeChain’s [VET] Price Prediction 2025–2026

VeChain’s initiatives, such as VeBetterDAO and sustainability-focused token rewards, enhance its appeal among traders and investors, positioning $VET as a must-watch asset for 2025.

However, if the current momentum persists, $VET could lead the next altcoin rally, cementing its role as a key player in the evolving blockchain ecosystem.