- Metaplanet ramped up Bitcoin accumulation with latest $53.4M purchase.

- Plans to expand into the U.S. with a $10 million Treasury Corp in Miami.

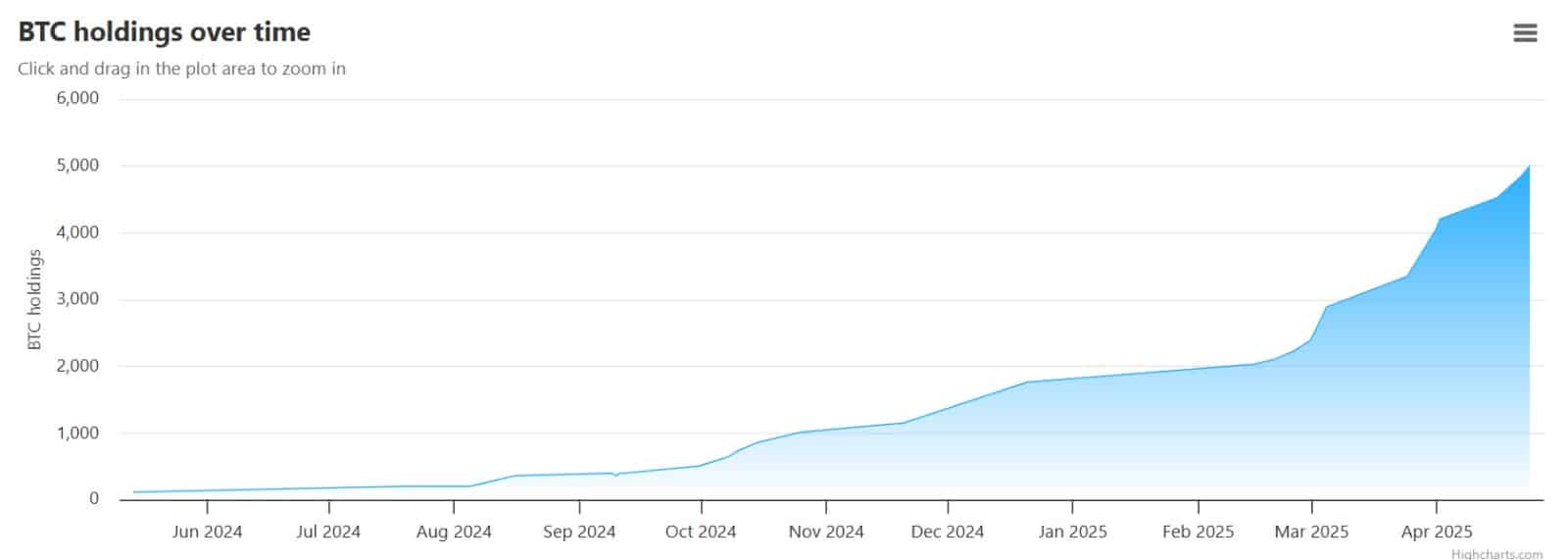

Over the past five months, institutional appetite for Bitcoin [BTC] has grown visibly stronger. One firm leading this accumulation is Japan’s Metaplanet, actively expanding its BTC holdings.

In the latest buying spree, the Tokyo-listed firm announced the purchase of 555 BTC at an average price of $96,134, worth $53.4 million.

This fresh addition pushed its total Bitcoin holdings to 5,555 BTC, valued at approximately ¥71.76 billion (or $465 million), with an average entry of $86,672 per coin.

Since April 2024, when Metaplanet unveiled its crypto strategy, the company has been aggressively accumulating Bitcoin. As part of the company’s strategy, it aims to increase its holdings to 10k BTC by the end of 2025.

So far, it has 4445 BTC more to go to achieve its yearly goal.

Source: Bitbo

Of course, the firm didn’t stop at just buying. It financed the acquisition by issuing a new batch of ordinary shares worth $25 million, marking its 13th round of fundraising since 2024.

These share and bond issuances have become a consistent part of Metaplanet’s “Bitcoin Financial Strategy,” rolled out in April 2024.

Besides its buying spree, Metaplanet plans to enter the United States and expand its presence. It aims to open a branch in Miami and establish a Treasury Corp in Florida, seeded with $10 million in capital and aiming to scale to $250 million.

Currently, Metaplanet is the largest public corporation holding Bitcoin in Asia.

Institutional interest in Bitcoin is heating up

Metaplanet’s continued acquisition of Bitcoin is not only bullish but also a good indicator of growing institutional demand. It means that institutions now perceive BTC as a lucrative and safe long-term investment.

Therefore, Metaplanet acquisition is not an isolated case, as institutions have returned to the market and are now buying BTC. These market behaviors are evidenced by a positive Coinbase Premium Index.

A shift to positive here suggests that as global markets cool down from tariffs, Bitcoin is becoming the first stop.

Source: CryptoQuant

Having said that, Metaplanet’s aggressive strategy has had ripple effects. Its stock has jumped 11.45% at the time of writing, underlining investor confidence in its BTC-focused approach.

Metaplanet’s growing stash is no longer just a balance sheet item—it’s a value driver. And its bullish stance is fueling wider confidence across the board.