- Market sentiment around the token has remained bearish lately

- However, metrics indicated that the possibility of a sustained bull rally can’t be ruled out

After a major dip last week, Chainlink [LINK] once again gained bullish momentum over the last 24 hours. However, this just might not be the effect of changing market conditions, but the beginning of a bigger bull run. Does this mean the token can now eye $50?

Chainlink bulls are here again

Chainlink recorded a 16% price drop last week. However, the bulls were quick to step in and managed to push the token’s price up by over 7% in the last 24 hours. At press time, LINK had a value of $24.84 with a market capitalization of more than $15 billion.

While that happened, World Of Charts, a popular crypto analyst, shared a tweet highlighting an interesting development. According to the same, LINK may soon offer investors yet another chance to buy the token at a discounted rate as it seemed to be retesting a support level. In case of a successful test, LINK might soon begin a rally towards $50.

That’s not all either. Spot On Chain’s latest tweet revealed that Chainlink unlocked another 11.25 million LINK, worth over $258 million. 10.625M LINK, worth $243.5 million, went to Binance, and 625K LINK, worth $14.4 million, went to the multi-sig wallet “0xD50.”

Is LINK ready for $50?

AMBCrypto then assessed the token’s on-chain metrics to find out whether it’s beginning its journey to $50 or not.

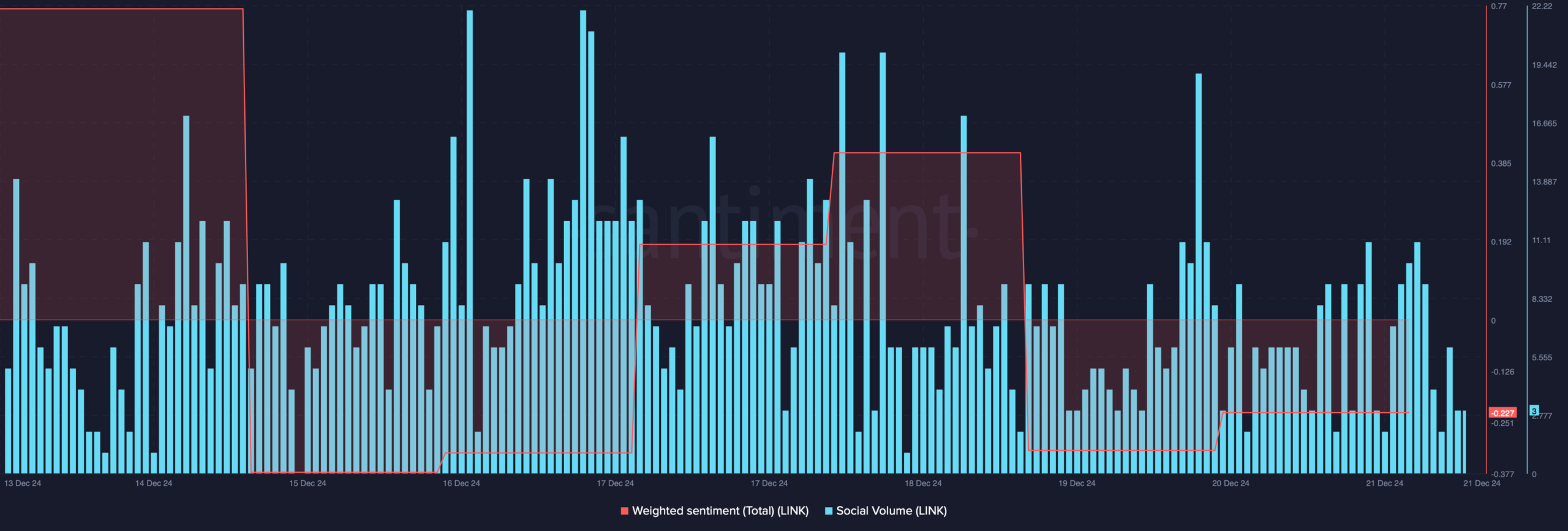

Surprisingly, despite the altcoin’s bullish price action, market sentiment around the token turned bearish. This was evidenced by the decline in Chainlink’s weighted sentiment. Nonetheless, its social volume remained somewhat stable last week, underlining its popularity across the market.

Source: Santiment

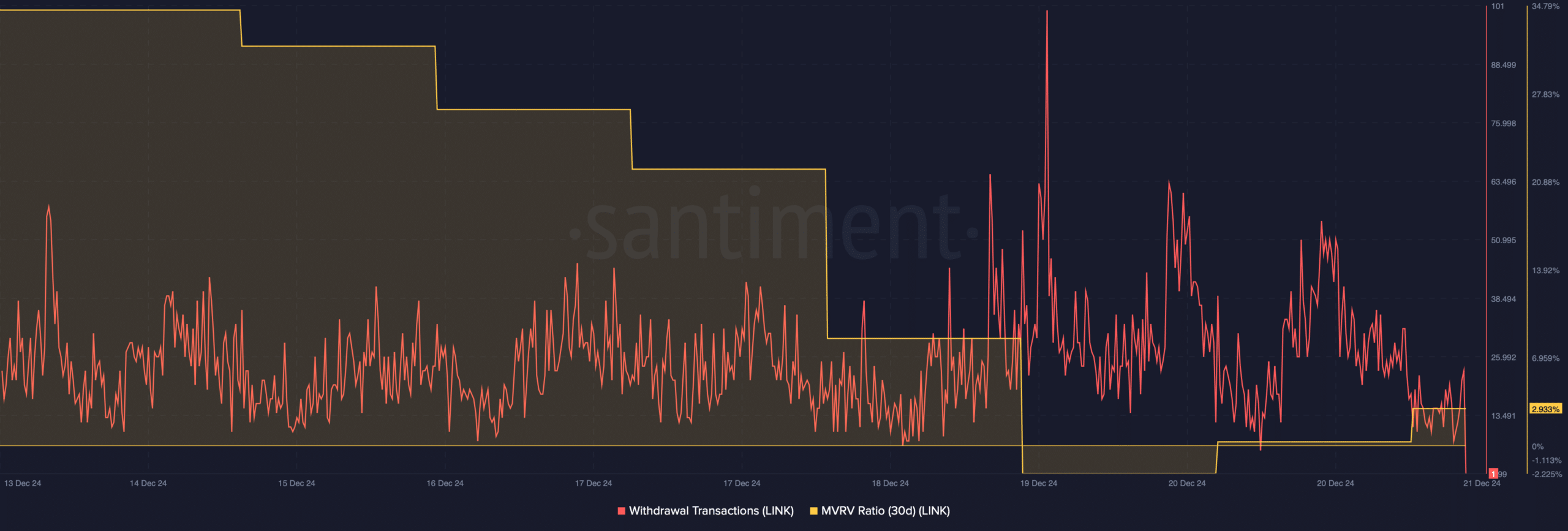

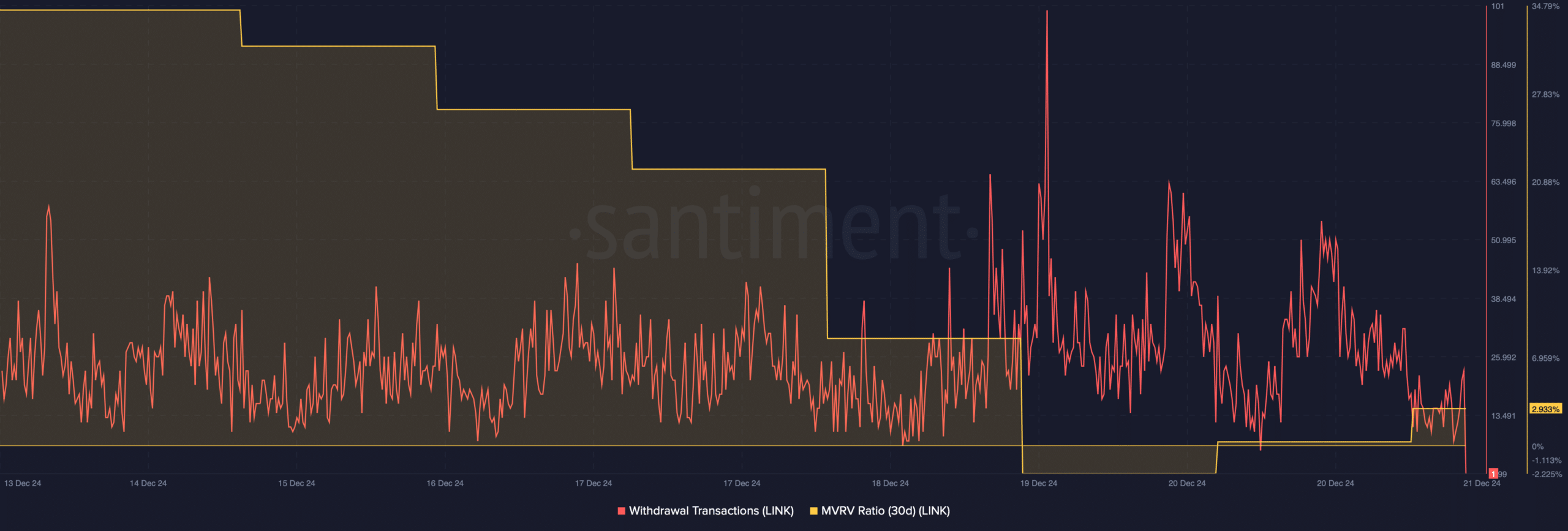

At press time, a metric that was looking optimistic for LINK was its withdrawal transactions, which spiked last week. This meant that buying pressure on the token was rising – A possible indication of a further price hike.

Additionally, the MVRV ratio also improved after dropping to -2%. Whenever the metric hits that level, it also alludes to a price hike.

Source: Santiment

Finally, Coinglass’ data pointed out that Chainlink’s long/short ratio also rose sharply over the 4-hour timeframe. A hike in this metric means that there are more long positions in the market than short positions, which can also contribute to a sustained bull rally.

Is your portfolio green? Check out the LINK Profit Calculator

Therefore, if these metrics and market conditions continue to support LINK, then it won’t be unrealistic seeing the token move towards $50 in the coming months.