Issued on behalf of RUA GOLD Inc.

VANCOUVER – Baystreet.ca News Commentary – Momentum continues to build behind gold, with analysts across the board forecasting higher prices ahead. JPMorgan recently raised eyebrows with a bold projection: if just 0.5% of U.S.-held foreign assets were reallocated to gold, the metal could surge to $6,000 per ounce by 2029. On the ground, U.S. jewelry retailers are already reporting a spike in gold demand, showing that retail enthusiasm is catching up to Wall Street sentiment. Meanwhile, several gold explorers and developers are advancing their projects, including recent updates from RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF), Loncor Gold Inc. (TSX: LN) (OTCQX: LONCF), Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF), Emerita Resources Corp. (TSXV: EMO) (OTCQB: EMOTF), and U.S. GoldMining Inc. (NASDAQ: USGO).

The article continued: Veteran investor Rob McEwen and billionaire fund manager John Paulson both see gold approaching $5,000 in the coming years—a move that could trigger a broad revaluation across the mining sector. Deutsche Bank is also bullish, forecasting $3,700 gold on the near-term horizon, as mining stocks begin to show early signs of catching up to the metal’s breakout.

RUA GOLD Completes the Second phase of Surface Exploration and Drill Targeting at the Glamorgan Project, New Zealand

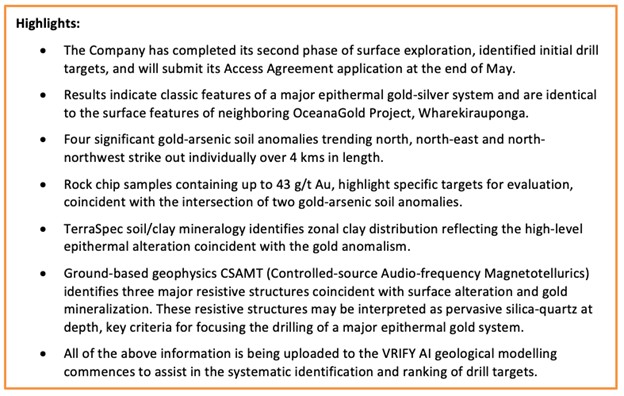

RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF) has completed the second phase of surface exploration at its Glamorgan gold project on New Zealand’s North Island—and the results have revealed something bigger than expected. Instead of a single drill target, the exploration team has now identified three distinct zones showing strong signs of potential gold mineralization.

These findings are part of a large-scale surface program that combined field mapping, soil sampling, geophysical surveys, and clay mineral analysis to better understand the geology beneath the surface. The program is RUA’s most comprehensive effort yet at Glamorgan, a high-potential property located in the heart of New Zealand’s Hauraki Goldfield—a region that has already produced over 15 million ounces of gold.

“These comprehensive district-wide surface work has provided valuable new information highlighting not just one target, but three significant zones of potential mineralization for drill testing,” said Simon Henderson, Chief Operating Officer of RUA GOLD. “These targets will all be included in the Access Agreement for drilling, being submitted at the end of May… All results from this inaugural district-wide program are now streaming in and are being compiled, reviewed and actively prioritized, in partnership with VRIFY AI, to confirm and prioritize the drill program. The exploration team is excited to reach the drilling phase of this unique prospect.”

RUA’s latest surface campaign at Glamorgan outlined four large-scale soil anomalies, each stretching over four kilometres. Within those zones, rock chip samples returned high-grade gold values up to 43 grams per tonne, with the strongest results occurring where two anomalies intersect—areas where geological structures may have helped concentrate mineralized fluids. The combined data points to the kind of environment typically associated with an epithermal gold system, the same style of deposit responsible for some of New Zealand’s richest historic mines. Similar surface patterns have been observed at OceanaGold’s nearby Wharekirauponga project, currently moving toward construction just a few kilometres away.

Additional data gathered through high-resolution drone magnetics revealed changes in the rock consistent with mineralizing fluid pathways. That work was further supported by a CSAMT geophysical survey, which detected three deep resistive zones that line up with the mapped surface anomalies. These resistive features are often linked to silica-rich veins at depth—structures known to host high-grade gold in comparable systems. To bring all of this information together, RUA is collaborating with VRIFY’s DORA platform, which uses artificial intelligence to integrate and rank exploration data. This will help the company refine drill target locations ahead of the planned program.

An access agreement covering all three priority zones is expected to be submitted by the end of May. Once approved, the company intends to test each target with drilling—marking the first time the deeper structures at Glamorgan will be explored directly. If confirmed, these zones could represent a significant new discovery in one of New Zealand’s most historically productive gold districts.

CONTINUED… Read this and more news for RUA GOLD at: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

In other industry developments and happenings in the market include:

Loncor Gold Inc. (TSX: LN) (OTCQX: LONCF) has reported the final assay results from drill hole LADD029, its deepest hole at the Adumbi gold deposit in the DRC. The drill intersected three main gold-bearing zones, including 22.31 metres at 3.05 g/t, 14.5 metres at 4.24 g/t, and 28.72 metres at 2.55 g/t, with multiple higher-grade intervals inside each zone.

“In addition, LADD029 intersected the thickest banded ironstone formation (BIF) package ever drilled at Adumbi (148 metres true thickness) and demonstrates that the favourable, mineralized BIF host is still going strong and increasing in thickness with depth,” said John Barker, CEO of Loncor. “Drilling is continuing at Adumbi with the objective of delineating a significant underground resource below the open pit.”

The hole also confirmed the thickest banded ironstone formation ever encountered at Adumbi, suggesting increasing mineralized host rock at depth. These results support Loncor’s strategy to grow an underground gold resource beneath the existing 3.66-million-ounce open-pit deposit.

Onyx Gold Corp. (TSXV: ONYX) (OTCQX: ONXGF) is launching a 10,000-meter drill program in Timmins, Ontario, with a focus on expanding its new high-grade gold discovery at Argus North. The first and only hole into the zone returned 3.4 g/t gold over 69.6 meters, including a standout 13.9 g/t over 9.5 meters.

“The initial results from Argus North point to a potentially significant new zone of high-grade gold mineralization in a proven district,” said Brock Colterjohn, President and CEO of Onyx Gold. “Upon close of the recently announced and upsized $11 million financing, the Company will have considerable flexibility to expand the size of the drill program to follow-up on further success with the drill bit.”

The upcoming program will test the mineralization’s depth, strike length, and continuity, while also stepping out into untested areas along the broader Pipestone Fault trend. A second rig will drill at the company’s Golden Mile project, located near major deposits in the region.

Emerita Resources Corp. (TSXV: EMO) (OTCQB: EMOTF) has released a new NI 43-101 technical report confirming a significant upgrade to its Iberian Belt West Project in Spain, including a 35% jump in indicated resources and a 44% increase in inferred resources. The estimate is based on nearly 300 drill holes and more than 105,000 meters of drilling across three deposits: La Romanera, La Infanta, and El Cura.

Highlights include high-grade polymetallic mineralization with strong zinc, copper, silver, and gold values. All deposits remain open at depth and along strike, signaling room for continued growth through further drilling.

U.S. GoldMining Inc. (NASDAQ: USGO) has launched metallurgical testing at its Whistler gold-copper project in Alaska as it prepares for a preliminary economic assessment. The testing will evaluate how best to recover gold and copper from drill core samples, with a focus on improving results from prior studies that showed 70% gold and 83% copper recovery. The company is working with BaseMet Labs to refine the process and optimize metal recovery across different parts of the deposit.

“The Company is delighted to kick off one of the cornerstone studies intended to inform a robust PEA for the Project,” said Tim Smith, CEO of U.S. GoldMining. “Our mission with this current round of testwork is to follow-up on the previous conventional flotation testwork and to optimize the process path. Additional variability data points will enable us to understand metal recoveries in different parts of the deposit, and to quantify the extent to which cyanide leaching can potentially return improved gold recoveries.”

Article Source: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

CONTACT:

Baystreet.ca

[email protected]

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is owned by Baystreet.ca Media Corp. (“BAY”). BAY has been paid a fee for RUA GOLD Inc. advertising and digital media from the company directly (forty-five thousand dollars Canadian for a three month contract subject to the terms and conditions of the agreement from the company direct). There may be 3rd parties who may have shares of RUA GOLD Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of “BAY” DOES NOT own any shares of RUA GOLD Inc. at this time, but reserves the right to buy and sell, and will buy and sell shares of RUA GOLD Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by BAY has been approved by RUA GOLD Inc. Technical information relating to RUA GOLD Inc. has been reviewed and approved by Simon Henderson, CP, AUSIMM, a Qualified Person as defined by National Instrument 43-101. Mr. Henderson is Chief Operational Officer of RUA GOLD Inc., and therefore is not independent of the Company; this is a paid advertisement, we currently own shares of RUA GOLD Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.