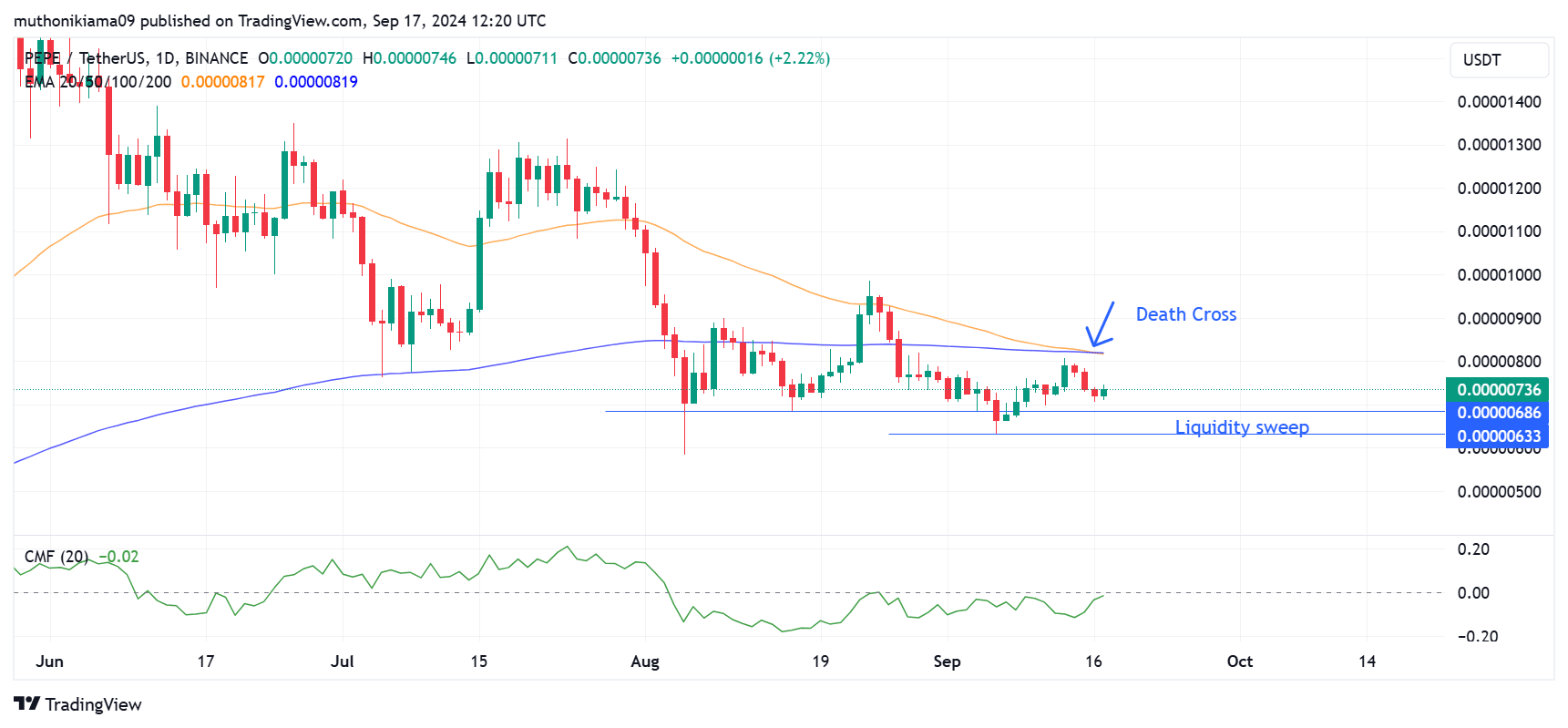

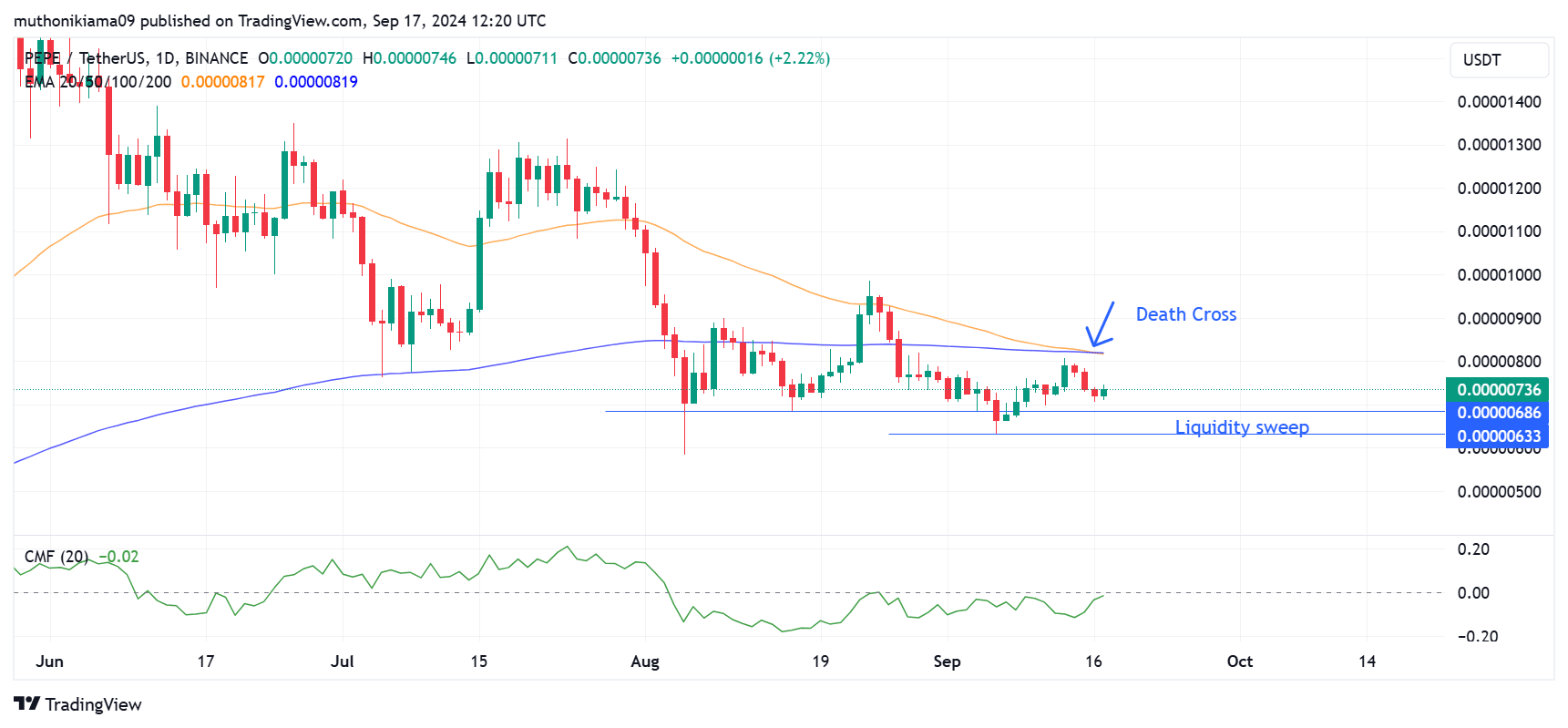

- PEPE faced a death cross with the 50-day EMA, converging with the 200-day EMA.

- On-chain data showed more bearish signals, but whale accumulation stabilized the price.

Pepe [PEPE] is the third-largest memecoin with a market capitalization of $7.8 billion. Over the past year, PEPE’s gains have toppled 1,000%, making it one of the top coins to watch.

PEPE traded at $0.00000738 at press time, following a slight 2% gain in 24 hours. The fizzling memecoin frenzy has seen it struggle to sustain a bullish momentum, and bears could soon take charge of the price action.

The PEPE one-day chart portrayed the formation of a death cross signal as the 50-day Exponential Moving Average (EMA) converged with the 200-day EMA.

This formation indicates that the short-term momentum is weakening compared to the long-term momentum.

Source: TradingView

However, to confirm this death cross, the 50-day EMA needs to make a decisive crossover below the 200-day EMA. This is yet to happen, as the two moving averages are converging.

This shows market uncertainty, with PEPE price being at a pivotal point where a new trend, either bullish or bearish, could emerge.

Buyers appear ready to defend against the death cross as the Chaikin Money Flow (CMF) has tipped north. The CMF is still negative, but edging towards 0.

If it flips to the positive region, it will confirm a bullish reversal for PEPE.

However, there is uncollected liquidity at $0.00000633. If PEPE loses support at $0.00000686, it could drop further to collect this liquidity before making a decisive move.

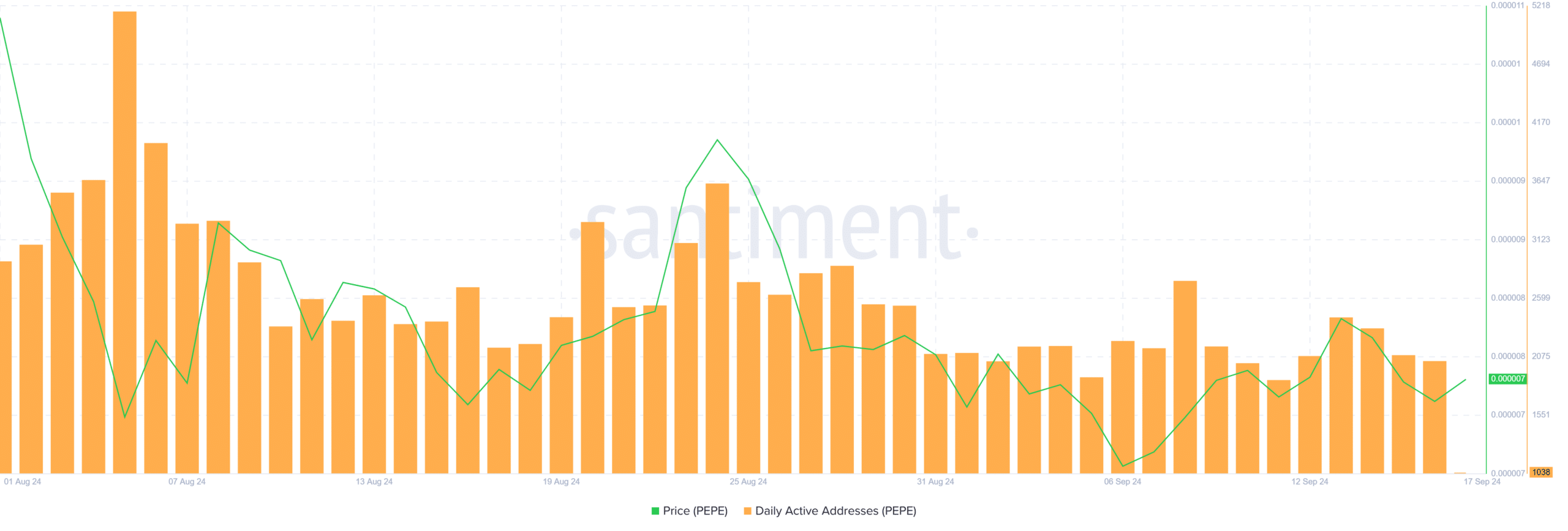

On-chain data shows more bearish signals

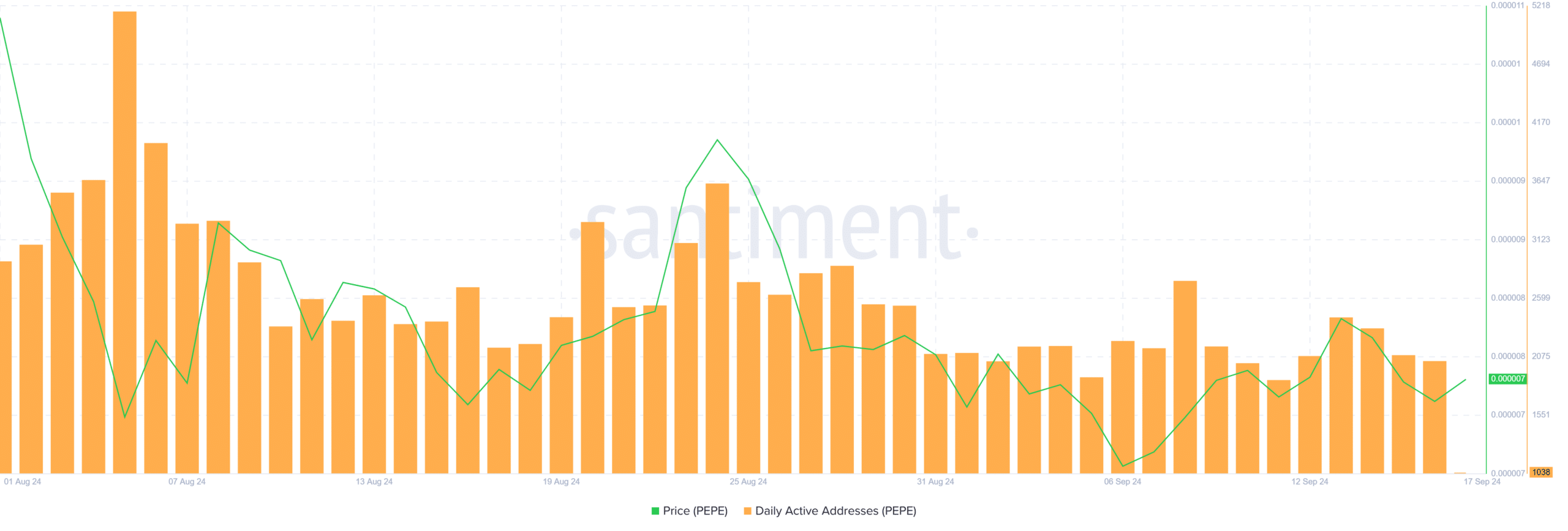

More bearish signals for PEPE have also emerged on-chain. Data from Santiment shows that PEPE’s daily active addresses have dropped to a five-day low.

Source: Santiment

This decline showed that the slight gains in price were driven by a small group of traders. Broader market participation is needed for PEPE to confirm a strong uptrend.

The derivatives market also shows that the sentiment is also bearish. Per Coinglass, PEPE’s Open Interest had increased slightly by 1.2% to $82M at press time.

At the same time, Funding Rates were negative, suggesting that traders have increased their short positions on PEPE.

Read Pepe’s [PEPE] Price Prediction 2024–2025

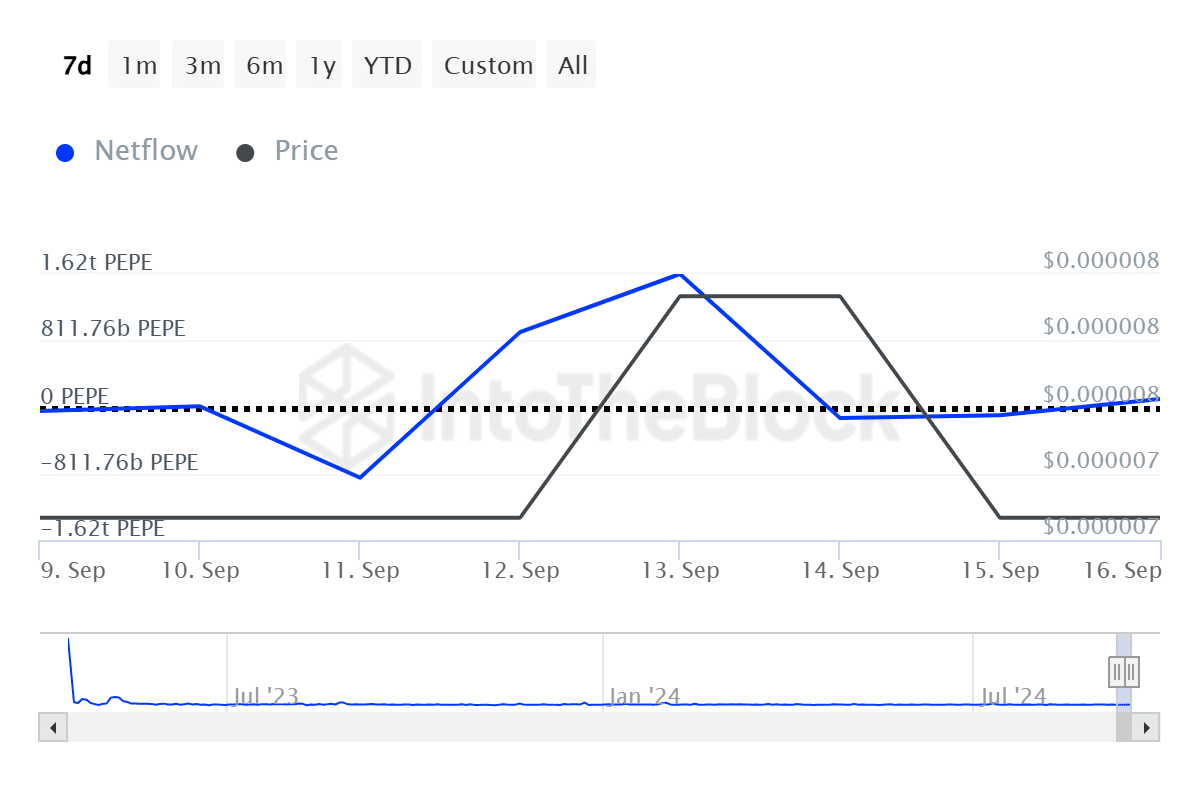

Nevertheless, whale investors have been flocking into PEPE, with this cohort likely being behind the weakening of the death cross signal.

Data from IntoTheBlock showed that in the last 30 days, large holders’ netflow to PEPE has increased by more than 1,000%. As a result of this accumulation, PEPE price has averted a massive decline despite the bearish signals.

Source: IntoTheBlock