- PI’s tokenomics and the network’s limited number of active validators were a major concern.

- The short-term price action showed traders were leaning bearish.

Pi Network [PI] saw debates about its decentralization and its long-term sustainability.

The tokenomics were not encouraging for investors, and technical analysis showed that the short-term outlook was firmly bearish.

Pi Network token is set to fall to $1 and lower

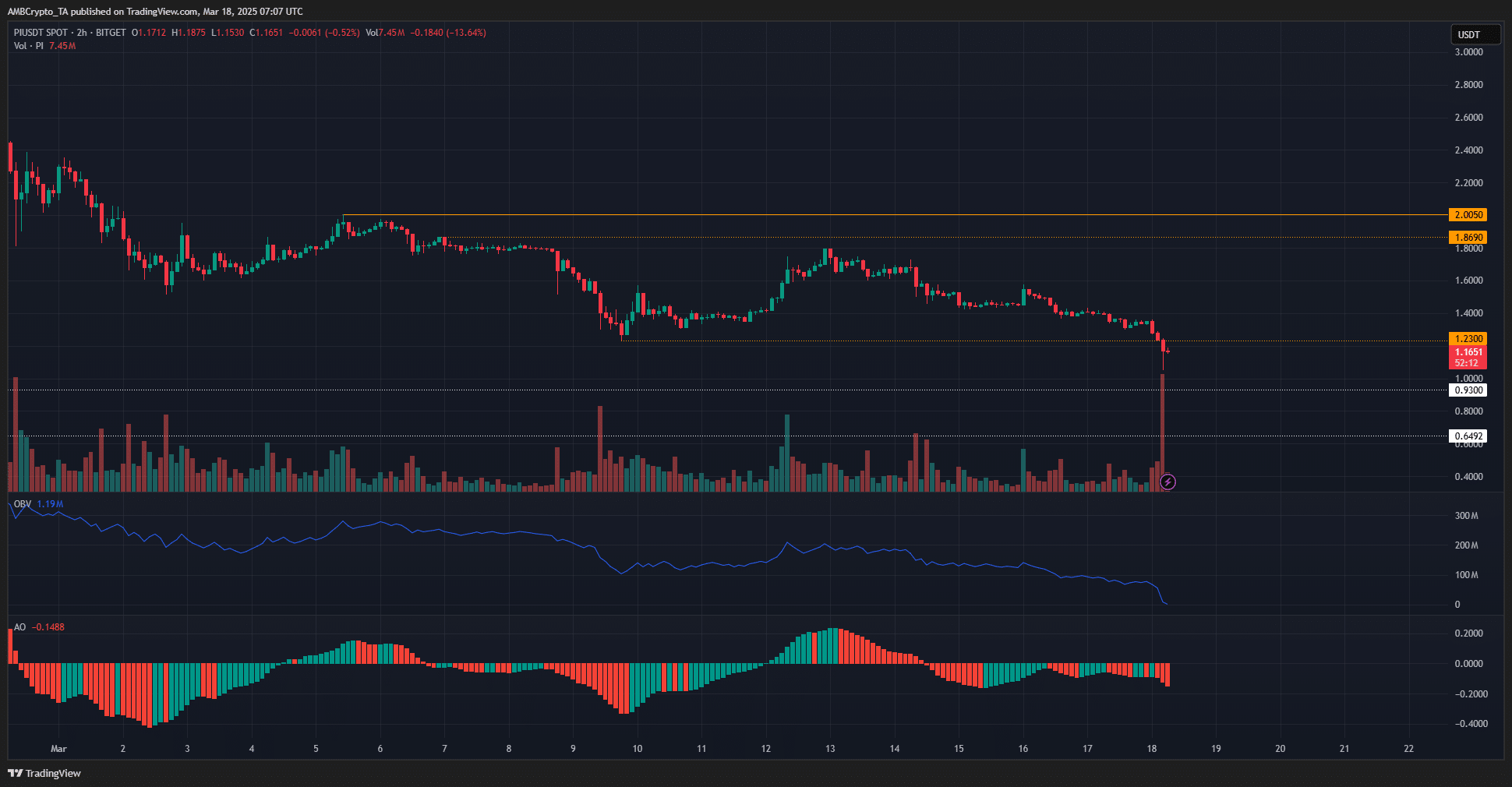

Source: PI/USDT on TradingView

Over the past three days, PI’s price action has shown increasing bearishness. Earlier this month, the psychological $2 level acted as resistance, followed by a lower high at $1.87 and a lower low at $1.23.

These levels became key markers for PI traders in the selected timeframe. Shortly before press time, PI dropped sharply below the previous lower low, breaking the bearish market structure.

Looking back to February’s price levels, supports were identified at $0.93 and $0.65.

While the $1 psychological level might slow losses, it seems unlikely to serve as strong support. Sellers have dominated recently, with the OBV hitting new lows, reflecting the ongoing downtrend in March.

The Awesome Oscillator also indicated strong bearish momentum. At the time of writing, the trading volume surged, representing a bullish attempt to halt the decline, but it appears unsuccessful so far.

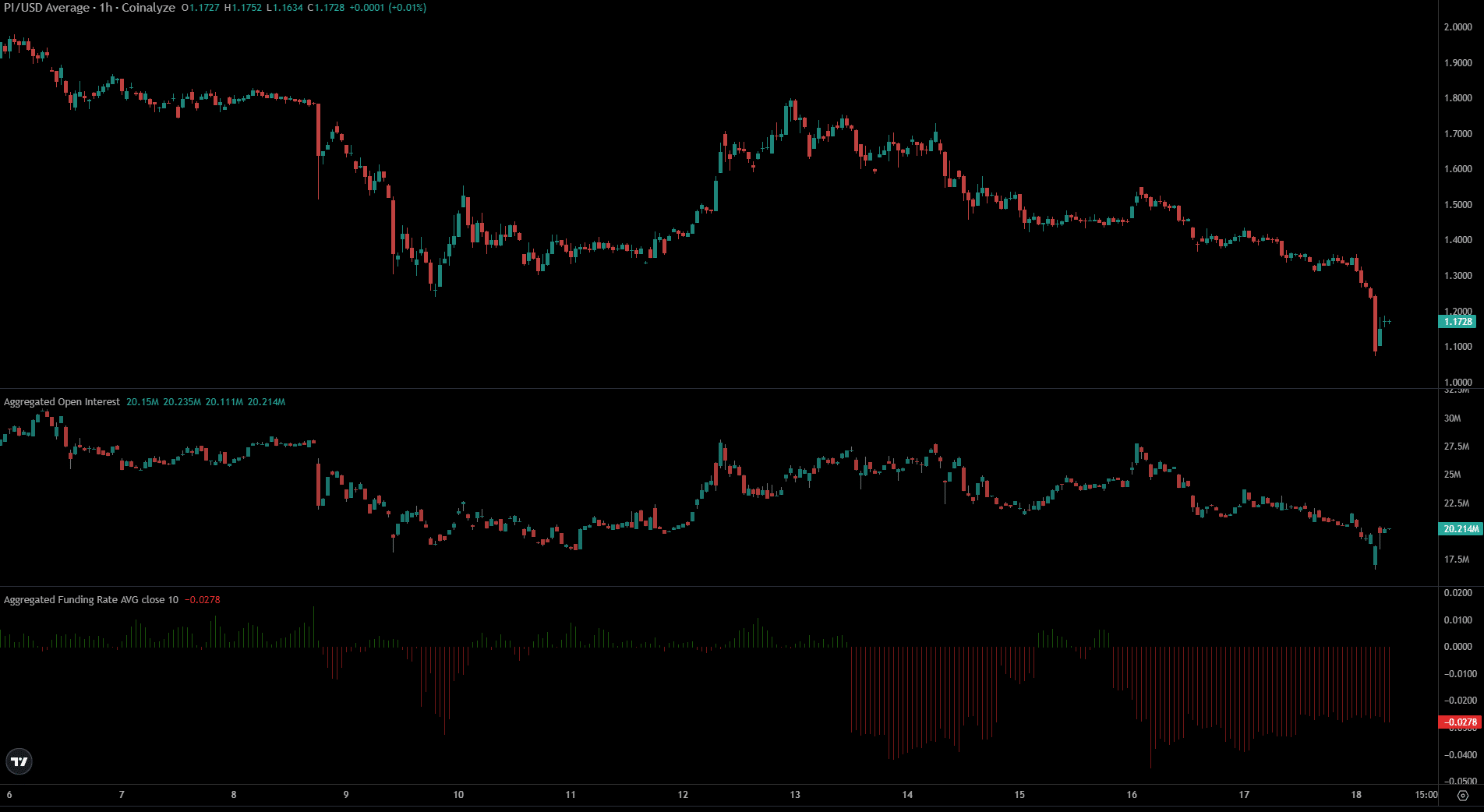

Source: Coinalyze

The Funding Rate was negative and has been for most of the past five days. Combined with the falling prices, it denoted bearish sentiment and a willingness to sell the PI token short in the derivatives market.

The short sellers were paying the long positions funding, meaning the majority of traders were leaning bearish.

This could set up the conditions for a short-term price bounce to hunt liquidity, but the overall trend would likely remain bearish due to the lack of demand.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion