- Popcat surged 14.86% daily, hitting a four-month high of $0.47.

- If demand persists, Popcat could break past the $0.50 resistance level.

Over the past 24 hours, Popcat [POPCAT] recorded an exemplary performance, outpacing most crypto assets. The memecoin spiked from a local low of $0.39 to a 4-month high of $0.47.

Since hitting these levels, the memecoin has made a slight pullback.

In fact, at the time of writing, Popcat exchanged hands at $0.4601, locking in a 14.86% gain on the daily chart. This bullish outlook has extended on weekly and monthly charts, rising by 18.44% and 229.31% respectively.

Not to mention that the price pump indicated that Popcat is experiencing strong demand.

This demand is evidenced by the rising volume that has surged by 58.2%, reaching $237.3 million. Equally, the memecoin’s Open Interest is up by 10%.

These gains on derivatives markets signal strong accumulation, with buyers entering the market to take strategic positions. Therefore, the prevailing conditions set Popcat up for more gains on its price charts.

Can Popcat hold these gains for a sustained uptrend?

According to AMBCrypto’s analysis, Popcat is experiencing strong upward momentum as bulls dominate the market.

For starters, Popcat recently made a bullish crossover, signaling renewed buying pressure in the last 24 hours.

At press time, the coin’s RSI was at 69, indicating a bullish bias but hasn’t crossed 70—the typical overbought threshold.

In many cases, RSI can climb to 80 before a correction occurs, suggesting that upward momentum remains strong as demand pushes prices higher.

This trend is further supported by a rising RVGI, which made a bullish crossover two days ago, reinforcing the positive market outlook.

Source: TradingView

Looking further, Popcat’s Spot Netflow turned negative again after previously spiking to $1.57 million.

The metric stood at -$169K, indicating increased buying activity. More tokens are leaving exchanges than entering, a strong signal of long-term accumulation.

As a result, buyer interest has surged, with buy orders spiking to 29 million in the past 24 hours.

Source: CoinGlass

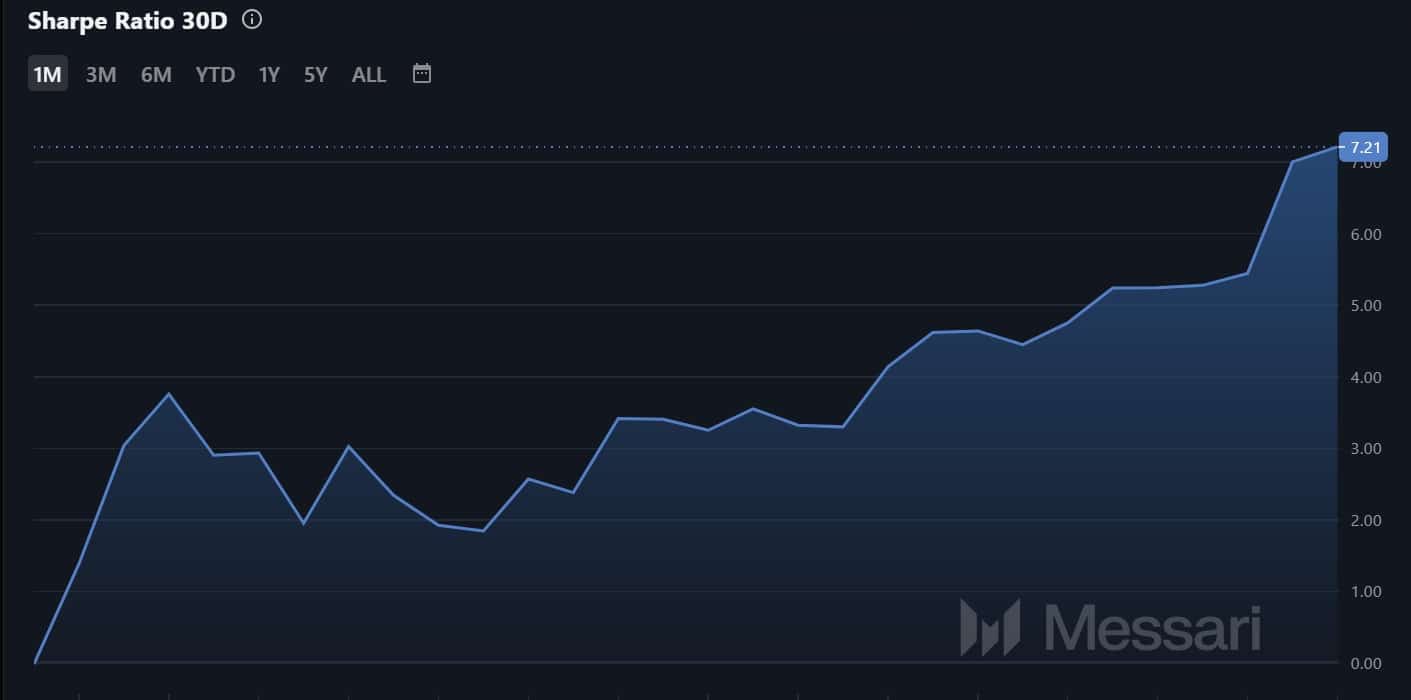

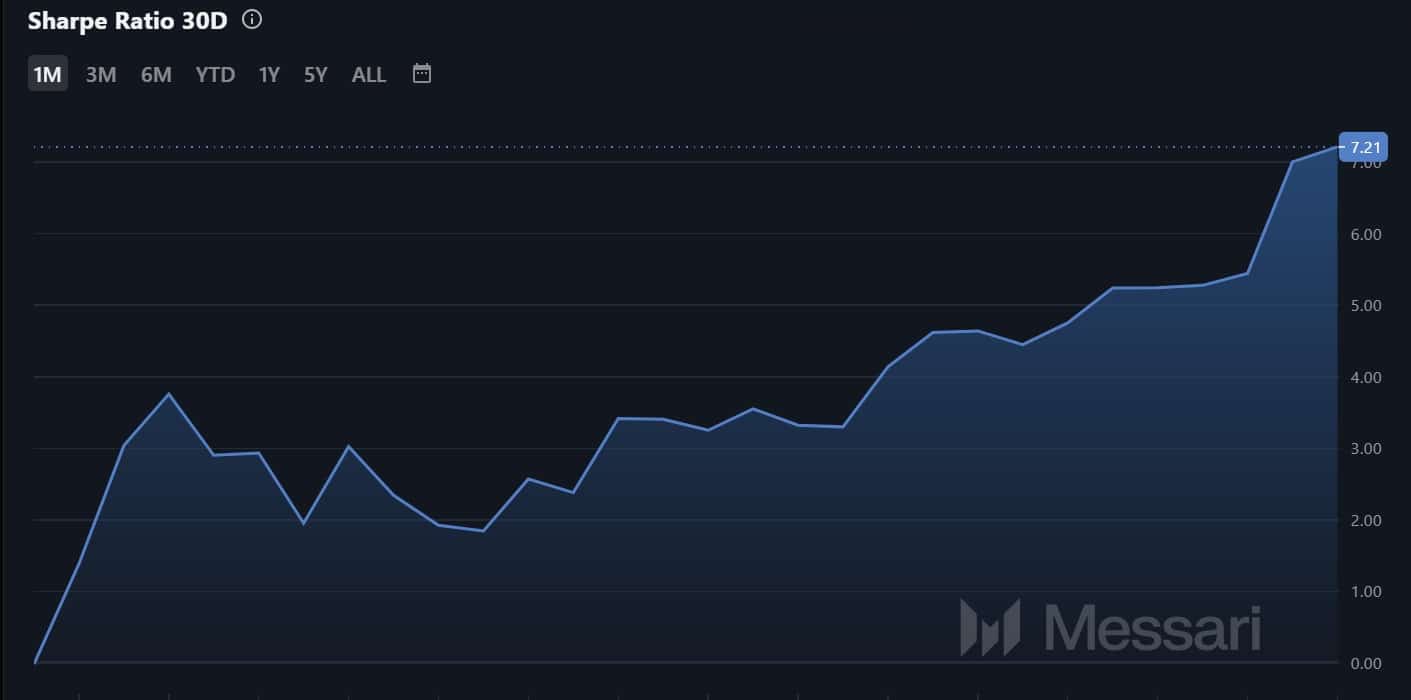

Investors flock to Popcat as the Sharpe Ratio improves

Finally, Popcat has become very attractive to investors over the past month after recording positive returns relative to its volatility.

Thus, the memecoin is currently performing better on a risk-adjusted basis, with investors getting more returns on risk taken. Often, a rising positive Sharpe Ratio suggests a strong, stable upward performance.

This favorability attracts more buyers in the market, thus resulting in higher demand.

Source: Messari

Put simply, Popcat has caught the market’s attention. Its combination of momentum, demand, and improved risk-reward has made it a magnet for bullish traders.

With bullish sentiment growing, Popcat may soon test the $0.50 resistance level. If demand remains strong and buyers surpass sell pressure, a breakout looks promising.

However, if bulls lose momentum and a correction occurs, Popcat could drop to $0.40 before attempting another move upward.