Issued on behalf of RUA GOLD Inc.

VANCOUVER – Baystreet.ca News Commentary – Gold has rebounded again this week, driven in part by a fresh Moody’s downgrade to the U.S. government’s credit rating. As investors brace for growing economic uncertainty, major miners have quietly posted their strongest financial quarters in history—yet many gold equities remain far below prior highs. While the spotlight often shines on the largest producers, some of the most intriguing progress is coming from juniors and mid-tiers advancing high-grade assets, expanding resources, and quietly earning their place in the next leg of the gold cycle, including RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF), First Mining Gold Corp. (TSX: FF) (OTCQX: FFMGF), Gold Royalty Corp. (NYSE-American: GROY), Gold Resource Corporation (NYSE-American: GORO), New Found Gold Corp. (NYSE-American: NFGC) (TSXV: NFG).

Momentum is building across the gold market. Goldman Sachs is calling for new record highs, while even Costco has started rationing gold bars due to surging demand. At the same time, some analysts suggest bullion banks are working overtime to suppress prices and manage short exposure. With respected voices like Rob McEwen and John Paulson predicting a run toward $5,000 gold, the setup for a major breakout in mining stocks is becoming harder to ignore.

RUA GOLD Inc. (TSXV: RUA) (OTCQB: NZAUF) is a gold exploration company with a rare dual-island footprint in New Zealand—one of the Southern Hemisphere’s most historically prolific mining regions. With the largest land position in the Reefton Goldfield on the South Island, RUA is also advancing early-stage exploration in the North Island’s Hauraki district, near one of the country’s most closely tracked development projects.

The company recently completed its second round of surface work at the Glamorgan project, outlining multiple high-priority targets. Key findings include three distinct zones marked by overlapping gold-arsenic soil anomalies, rock chip samples grading up to 43 g/t gold, and deep resistive features often linked to quartz-rich vein systems. These geological markers are consistent with other known epithermal systems in the area—including the nearby WKP project (owned by OceanaGold), located less than 3 km away.

Glamorgan sits within a goldfield known for heavyweight discoveries. The Waihi Mine, still active today, has produced over 10 million ounces to date. Just up the road, the WKP project hosts an indicated resource of 1.4 million ounces grading 17.9 g/t gold—and remains open in multiple directions.

To sharpen its target precision, RUA’s technical team deployed a multi-layered approach that combines drone magnetics, clay alteration mapping, and CSAMT geophysics. Of four gold-arsenic anomalies identified—each stretching more than four kilometres—three have been prioritized for initial drilling. An access agreement is expected to be submitted before the end of May. Meanwhile, the full exploration dataset is being analyzed through VRIFY’s DORA platform, an AI-assisted discovery tool RUA is using to help rank and refine next-stage targets. Glamorgan is just one part of a much larger push to revive New Zealand’s gold legacy with modern tools and technology.

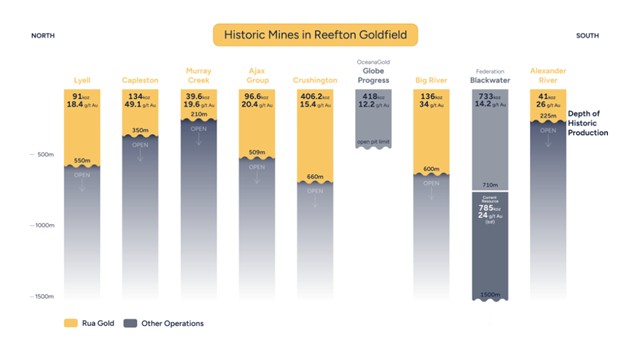

On the South Island, RUA controls approximately 95% of the historic Reefton Goldfield—an area that has yielded more than 2 million ounces of gold from exceptionally high grades ranging between 9 and 50 g/t. This dominant land position gives RUA a strategic edge in a district known for its underexplored upside.

Drilling continues at the company’s Auld Creek project, where high-grade gold-antimony mineralization is being intercepted below the existing resource envelope. Recent results include 9.0 metres at 5.9 g/t gold equivalent and 1.25 metres at 48.3 g/t gold equivalent. Importantly, only two of the four known mineralized shoots are currently captured in the resource model, leaving significant room for potential expansion. The combination of traditional mapping with modern predictive modeling has already produced standout hits, including 12 metres at 12.2 g/t gold equivalent, featuring a 2-metre interval grading 54.8 g/t.

RUA is also progressing work at the nearby Gallant prospect, located just 3 kilometres from the past-producing Globe Progress mine. That operation delivered over 610,000 ounces between 2007 and 2016, with historical records showing another 424,000 ounces produced before 1950—underscoring the broader potential of the district.

The Gallant prospect was originally highlighted through AI-assisted analysis of more than 170,000 historical data points, processed using VRIFY’s advanced discovery platform. Follow-up work is now assessing the potential extension of a 20.7-metre vein that previously returned 62.2 g/t gold—including a standout 1-metre interval grading 1,911 g/t. Just a few kilometres away at Murray Creek, visible gold has been observed in the majority of drillholes, with VRIFY’s algorithm continuing to prioritize zones that show the strongest geological indicators.

While gold remains the core focus, it’s not the only opportunity in play.

In early 2025, the New Zealand government officially classified antimony as a Critical Mineral, acknowledging its growing importance in global supply chains. At Auld Creek, surface samples have returned antimony grades exceeding 40%, with multiple drill intercepts above 8%—placing RUA in rare company among Western-listed explorers with potential scale in this increasingly strategic metal with prices now trending above US$50,000 per tonne.

RUA GOLD is led by a team with more than $11 billion in collective mining exits, and is now backed by $5.75 million in fresh capital. Their mission: to apply modern tools and data-driven targeting across two of the most overlooked—but historically rich—gold belts in the Southern Hemisphere.

CONTINUED… Read this and more news for RUA GOLD at: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

In other industry developments and happenings in the market include:

First Mining Gold Corp. (TSX: FF) (OTCQX: FFMGF) reported a strong start to 2025, securing a $5 million early payment under its Springpole Silver Stream deal and advancing major exploration programs across its Canadian portfolio.

At the Duparquet Gold Project, the company launched its largest drill campaign to date and hit two new discovery zones with promising grades up to 8.99 g/t gold. With drilling also returning wide mineralized intervals at Springpole, First Mining is positioning its flagship projects for future development amid a strengthening gold price environment.

“We continue to make significant progress on the permitting front at our Springpole Gold Project and continue to demonstrate exploration potential at Duparquet with the recently announced exploration program,” said Dan Wilton, CEO of First Mining. “With gold prices trending higher, we believe our key projects and asset portfolio are well-positioned to provide maximum leverage to a strong gold price environment.”

Gold Royalty Corp. (NYSE-American: GROY) continues to expand its cash-flowing royalty portfolio, with 2025 shaping up as a pivotal year for ramp-up and revenue growth. Key assets like Côté and Vareš have entered production, while Borborema and Granite Creek are expected to reach commercial output by Q3. With full-year revenue contributions from multiple mines and over 50 royalties now in the portfolio, the company expects to achieve positive free cash flow in 2025.

“These strong results reflect the embedded growth within our portfolio, which we expect to continue in 2025 as the key assets in our portfolio continue to advance,” said David Garofalo, Chairman and CEO of Gold Royalty. “These and other assets in our diverse portfolio position Gold Royalty for continued and sustained revenue growth and value creation over the long term, including through the end of the decade.”

Gold Resource Corporation (NYSE-American: GORO) reported lower Q1 production at its Don David Gold Mine in Mexico, driven by equipment constraints and limited access to alternate ore zones. Despite the shortfall, the company has strengthened its balance sheet with $8.6 million in new capital raised and a $4 million tax refund, supporting ongoing development at the Three Sisters vein system.

“We secured additional capital through ATM sales and received the anticipated tax refund, strengthening our balance sheet and placing us in a better position to move forward with the development of the Three Sisters system,” said Allen Palmiere, President and CEO of Gold Resource Corporation. “These initiatives are part of a disciplined execution plan—and we’re confident in our ability to deliver anticipated results.”

New Found Gold Corp. (NYSE-American: NFGC) (TSXV: NFG) has launched its 2025 work program at the Queensway Gold Project in Newfoundland, kicking off with infill drilling at the Keats West and Lotto zones using four rigs.

“Our 2025 drilling will focus first on infill of the mineral resource and then progress to target areas close to the mineral resource with potential for future resource expansion,” said Melissa Render, President of New Found Gold. “Concurrent with drilling, we are expanding our excavation program in advance of bulk sampling planned for the first half of 2026.”

Two more drill rigs will be added in June to support both infill and exploration drilling, including targets like Dome and Dropkick—where past results have returned grades up to 89.5 g/t gold. With a fully funded PEA underway and excavation prep advancing for bulk sampling in 2026, the company is moving Queensway closer to potential development.

Article Source: https://usanewsgroup.com/2025/04/02/others-found-1911-g-t-here-before-now-a-proven-11b-mining-team-is-back-to-finish-the-job/

CONTACT:

Baystreet.ca

[email protected]

DISCLAIMER: Nothing in this publication should be considered as personalized financial advice. We are not licensed under securities laws to address your particular financial situation. No communication by our employees to you should be deemed as personalized financial advice. Please consult a licensed financial advisor before making any investment decision. This is a paid advertisement and is neither an offer nor recommendation to buy or sell any security. We hold no investment licenses and are thus neither licensed nor qualified to provide investment advice. The content in this report or email is not provided to any individual with a view toward their individual circumstances. Baystreet.ca is owned by Baystreet.ca Media Corp. (“BAY”). BAY has been paid a fee for RUA GOLD Inc. advertising and digital media from the company directly (forty-five thousand dollars Canadian for a three month contract subject to the terms and conditions of the agreement from the company direct). There may be 3rd parties who may have shares of RUA GOLD Inc., and may liquidate their shares which could have a negative effect on the price of the stock. This compensation constitutes a conflict of interest as to our ability to remain objective in our communication regarding the profiled company. Because of this conflict, individuals are strongly encouraged to not use this publication as the basis for any investment decision. The owner/operator of “BAY” DOES NOT own any shares of RUA GOLD Inc. at this time, but reserves the right to buy and sell, and will buy and sell shares of RUA GOLD Inc. at any time without any further notice commencing immediately and ongoing. We also expect further compensation as an ongoing digital media effort to increase visibility for the company, no further notice will be given, but let this disclaimer serve as notice that all material, including this article, which is disseminated by BAY has been approved by RUA GOLD Inc. Technical information relating to RUA GOLD Inc. has been reviewed and approved by Simon Henderson, CP, AUSIMM, a Qualified Person as defined by National Instrument 43-101. Mr. Henderson is Chief Operational Officer of RUA GOLD Inc., and therefore is not independent of the Company; this is a paid advertisement, we currently own shares of RUA GOLD Inc. and will buy and sell shares of the company in the open market, or through private placements, and/or other investment vehicles. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained in our newsletter is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between the any predictions and actual results. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.