- Render surged over 32% after retesting a key resistance level two weeks ago.

- Number of addresses in profits and recovering trading activity suggested the potential for further upside.

Render [RNDR] has been in the spotlight following its recent bullish momentum. The altcoin has surged by over 32% since it retested a key pennant resistance about two weeks ago.

This impressive rally now faces a critical hurdle at the $8 resistance zone. Can Render push past this barrier and extend its gains? Let’s dive into the data.

Source: TradingView

Render bulls set sights on $8 resistance zone

The $8 resistance level has become a critical point for Render’s price action. This zone represents a strong psychological and technical barrier, as the level has repelled the altcoin price several times in the past.

Historically, such levels often see increased sell pressure, as traders look to bag in some accumulated profits.

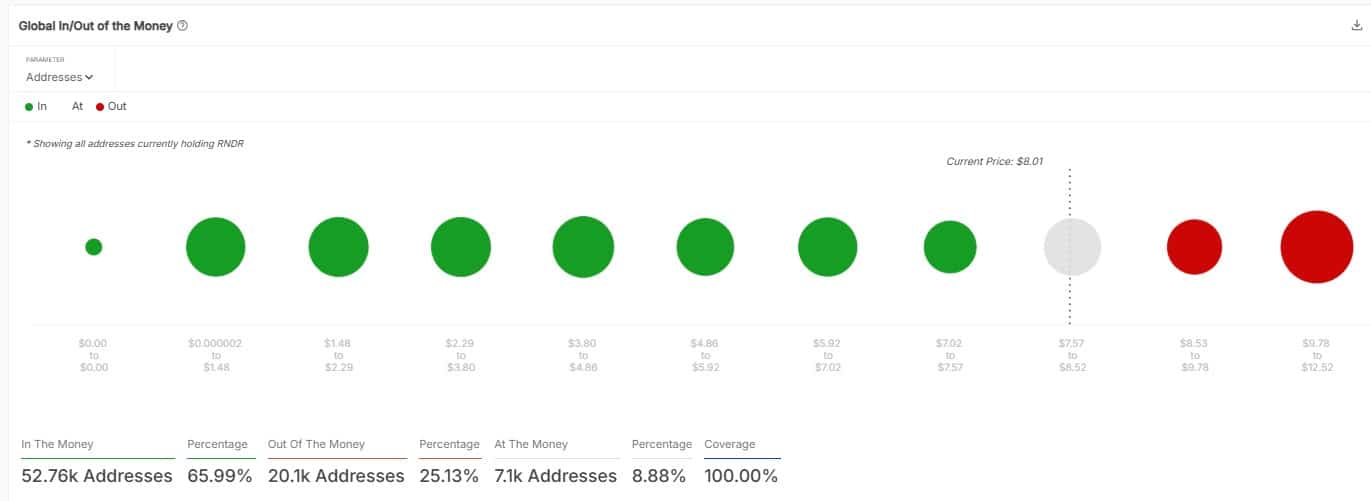

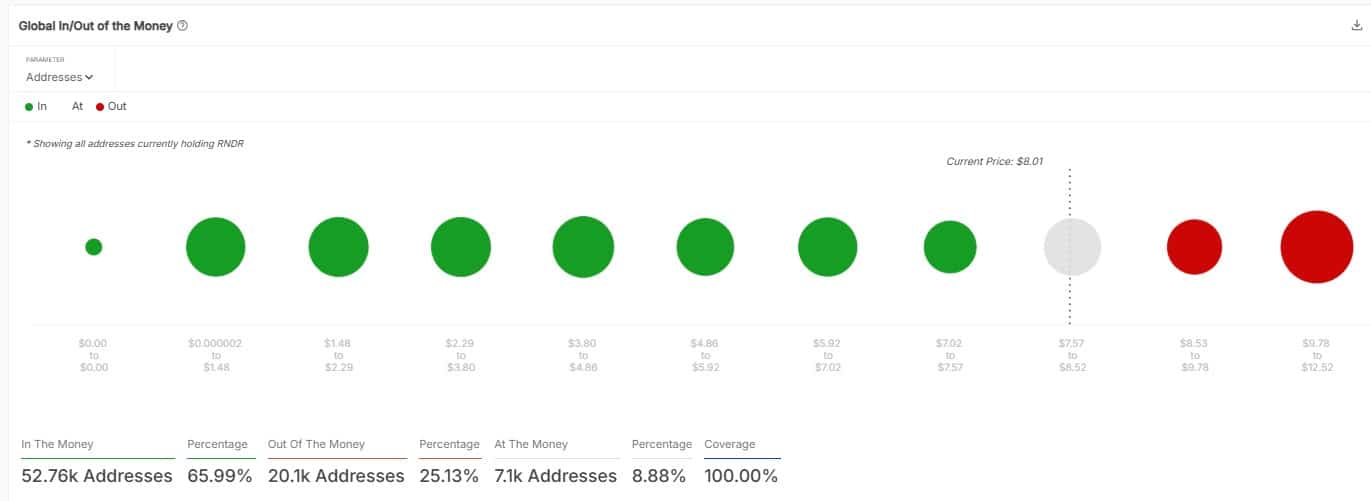

However, with 65% of RNDR addresses currently in profit, confidence in the token’s bullish potential remains strong.

Source: IntoTheBlock

Adding to this optimism was the improving trading activity of the altcoin. According to IntoTheBlock data, its volume saw a steady recovery, hinting at renewed interest among market participants.

This uptick in activity suggested that the bulls may have enough momentum to challenge the $8 level.

On-chain metrics offer optimism

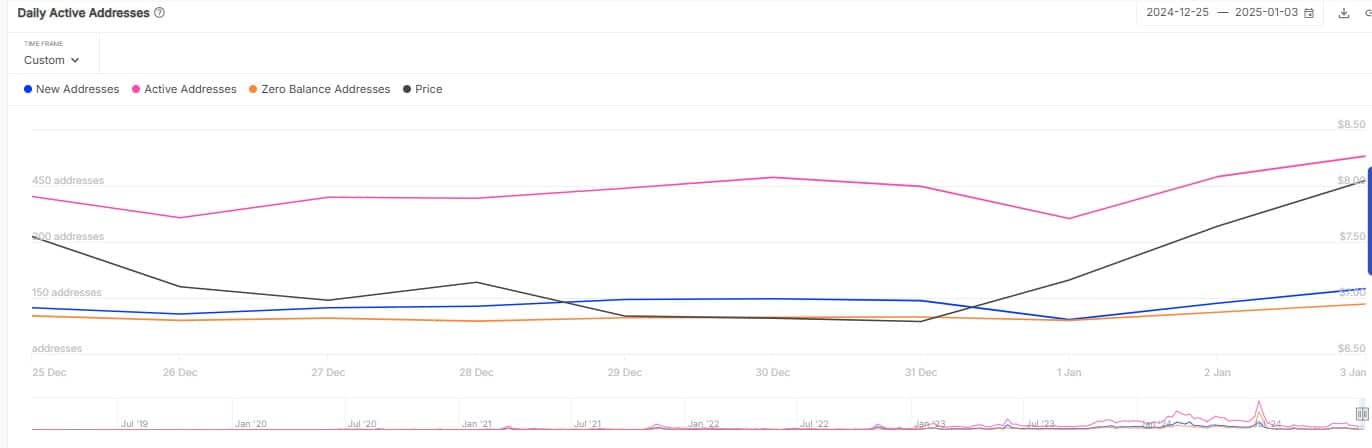

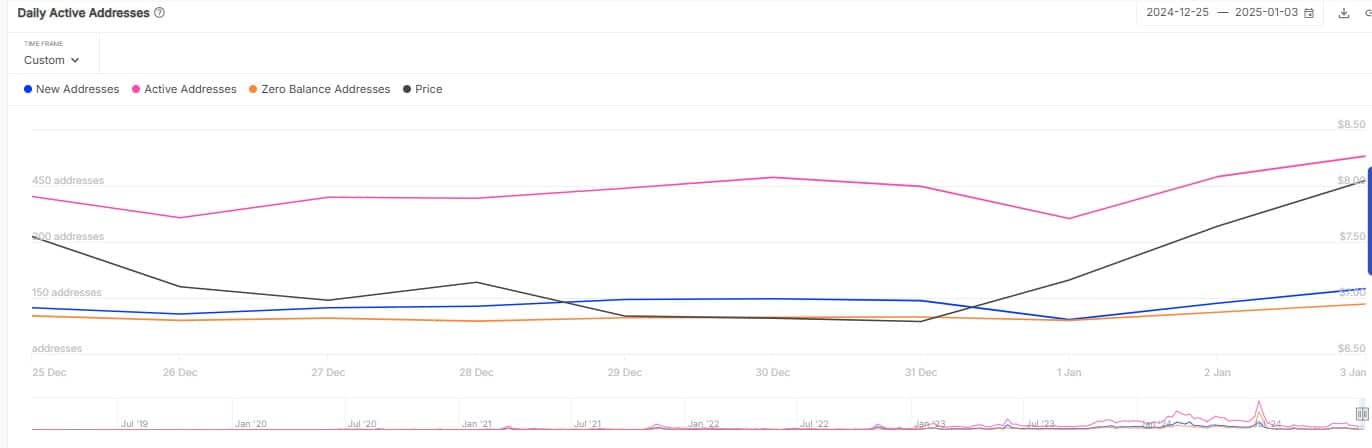

Beyond price action, Render’s on-chain metrics also painted a promising picture. For instance, altcoin’s active address count and transaction volume have steadily climbed higher throughout the rally.

This often indicates a high network utility and investor participation-key sentiments for sustained upward price movement.

Source: IntoTheBlock

Render’s recent performance also aligned with the broader crypto market trend. The cryptocurrency market has recently turned bullish, fueled by favorable macroeconomic indicators and adoption.

The altcoin could benefit further if this positive overall market sentiment sustains.

Can Render break through?

For RNDR to break the $8 resistance, sustained buying pressure is vital. AMBCrypto’s analysis of Coinglass’ liquidation heatmap data painted an optimism picture among the long position takers.

With 272K worth of Render liquidated at $6.6 price level during the recent dip, the next liquidity pool was at around $8.2. This liquidity pool may pull the altcoin prices further to the upside.

Source: Coinglass

Read Render’s [RNDR] Price Prediction 2025–2026

A decisive close above $8 might pave the way for further gains, potentially targeting $9 or higher in the near term.

Conversely, failure to breach this zone might lead to a short-term pullback.