- After weeks of decline, whales have reduced their selling activity, while retail and derivative traders are increasing their SHIB accumulation.

- On the technical charts, SHIB shows the potential for a substantial price jump, with projections suggesting gains of up to 99%.

Following sharp declines of 12.31% and 26.72% over the past weeks, Shiba Inu [SHIB] is showing early signs of recovery. The memecoin recorded a modest 0.41% daily gain, indicating a possible shift in momentum.

Whales, who previously contributed to downward pressure, appear to be easing off their selling. This creates an opportunity for retail and derivative traders to drive the price higher in the coming days.

Whale selling activity declines

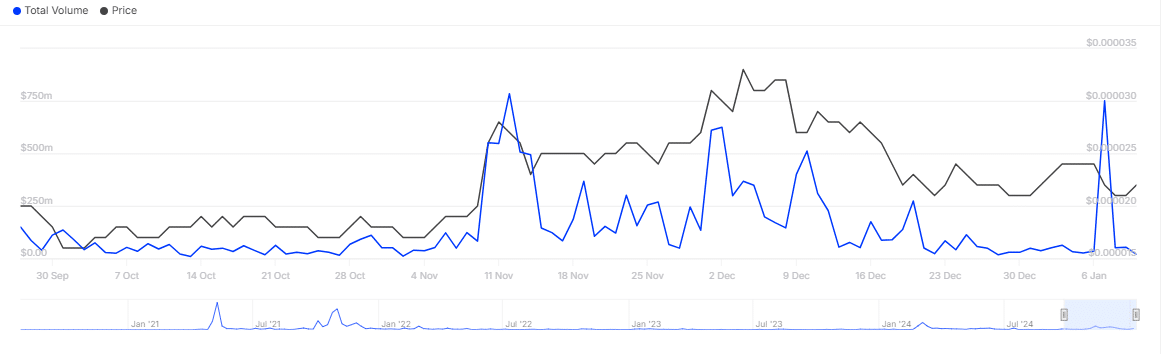

According to data from IntoTheBlock, whale activity has significantly declined in the past 24 hours. Both the number of transactions and transaction volumes have plunged.

Whales are addresses controlling up to 1% of an asset’s total supply. They are key players in influencing price trends. At press time, SHIB’s whale transaction count nearly halved. It dropped from 130 the previous day to just 70.

This drop brought the total trading volume down to approximately 920.76 billion SHIB. This volume is valued at $19.87 million.

Source: IntoTheBlock

The gradual price increase alongside this decline suggests that whales have shifted from active selling to a more neutral market position.

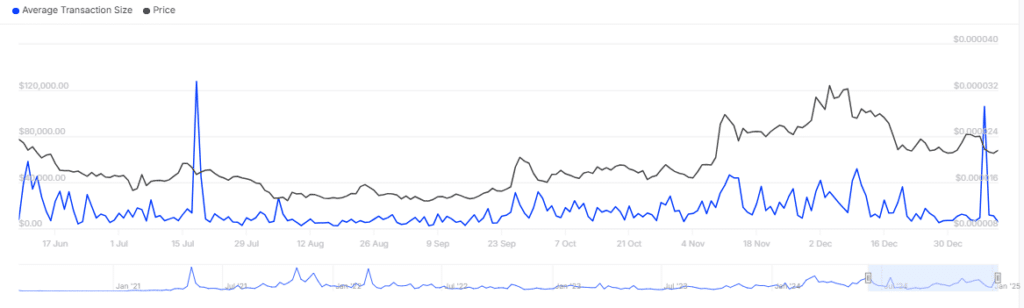

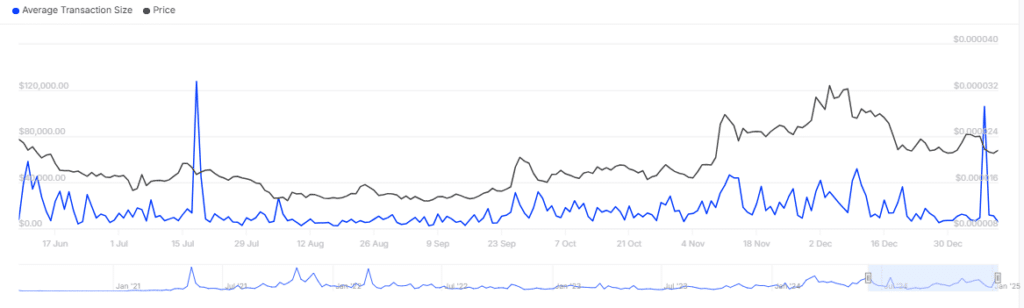

This shift is further confirmed by the average transaction size over the past 24 hours, which dropped to $5,960—far below the seven-day average of $22,640.

When whale participation diminishes, other market participants often step in, potentially influencing price trends. Historically, high whale activity keeps average transaction sizes elevated. A drop like this signals reduced influence from large holders.

Source: IntoTheBlock

To confirm this shift, AMBCrypto analyzed the behavior of retail and derivative traders, key market participants, to determine their role in shaping SHIB’s next price movements.

SHIB eyes a 99% rally as trader activity intensifies

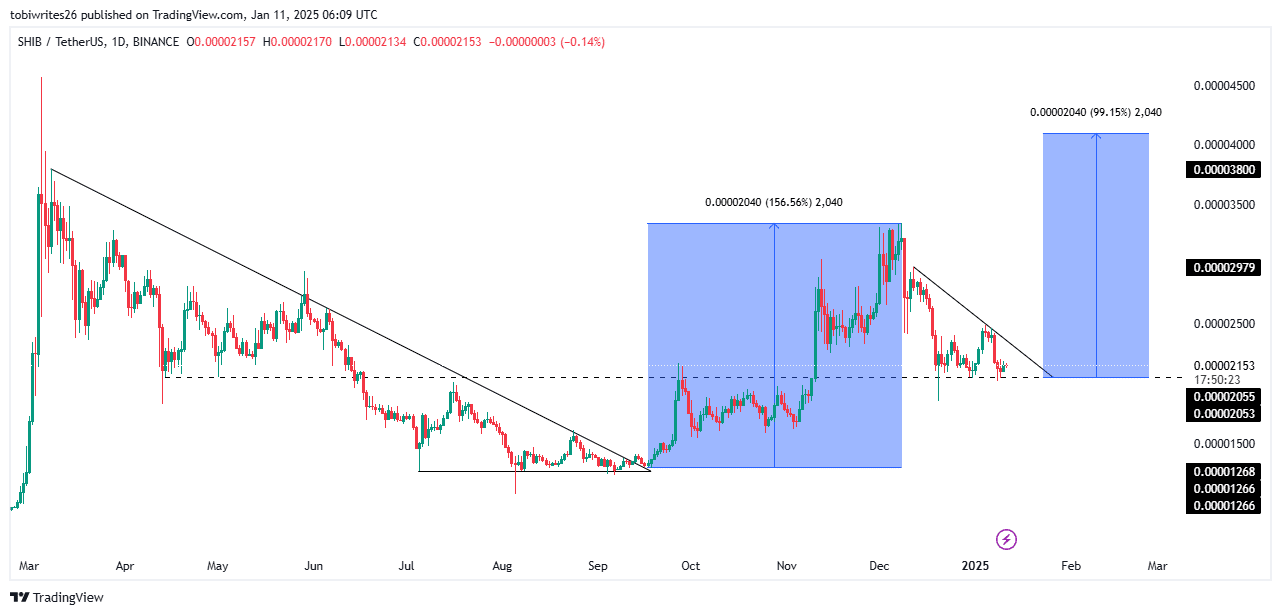

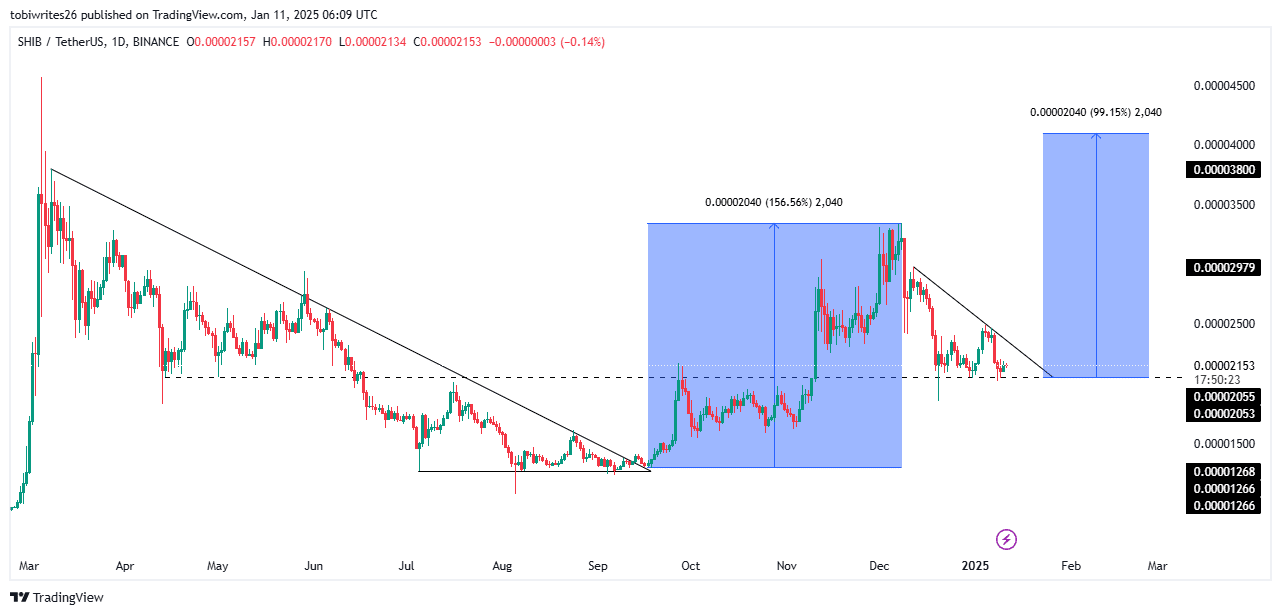

SHIB is positioned for a potential upswing, trading within a pattern similar to one observed in 2024. The asset is currently moving along a descending resistance line and a support level. In 2024, a breakout from this pattern led to a remarkable 156.56% price surge.

If history repeats itself and the current support level of $0.00002055 holds, a breach of the descending resistance line could propel SHIB to a 99.15% rally, reaching $0.00004095.

Source: TradingView

This potential rally is expected to be initiated by retail traders, as bullish sentiment within this group continues to grow. Data from Coinglass’s Open Interest and Exchange Netflow highlights increased activity from both derivative and spot traders.

Over the past 24 hours, Open Interest surged by 28.97%, reaching $226.89 million. This indicates the number of unsettled derivative contracts.

The increase, with a funding rate of 0.0110%, signals a rise in bullish contracts. This suggests a higher probability of SHIB’s price trending upward soon.

Simultaneously, spot traders are moving assets out of exchanges into private wallets. This strategy is often used when market participants anticipate long-term price appreciation.

Is your portfolio green? Check out the SHIB Profit Calculator

Approximately $567,000 worth of SHIB was transferred off exchanges in the past day. This indicates growing confidence and reduced selling pressure.

With rising bullish momentum among both retail and derivative traders, SHIB seems to be setting the stage for a significant price breakout.