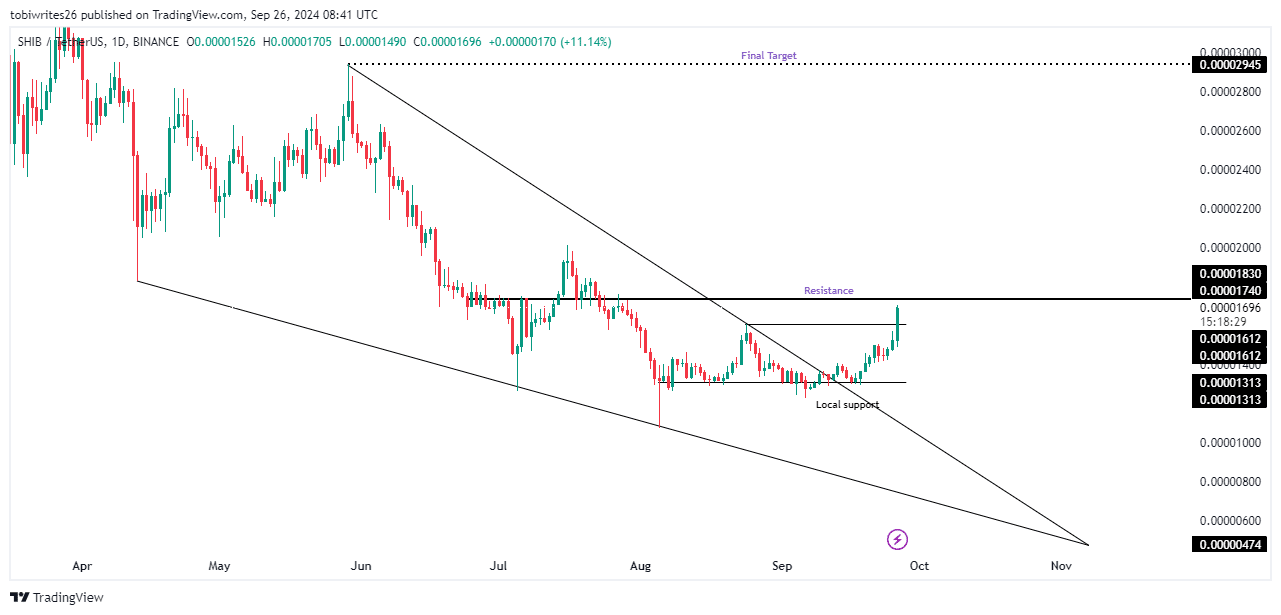

- SHIB’s rally depends on its performance as it faces a critical resistance level identified at 0.00001749.

- Breaking through this level could set the stage for SHIB to achieve new highs, potentially reaching a point last traded in the second quarter of 2024.

With the market turning bullish, led by Bitcoin [BTC], altcoins such as Shiba Inu [SHIB] are preparing for a substantial move up.

According to recent data, SHIB’s price increased by 17.62% in the last seven days and 10.59% daily, making it the 13th most valuable coin by market capitalization.

Yet, further analysis reveals a potential for even more gains than SHIB has experienced so far.

The current state of SHIB on the chart

SHIB has been trading within a falling wedge pattern since April, which it successfully breached after bouncing from a support level at 0.00001313 that fueled its recent gains.

However, this rally now faces a critical test as it approaches a major resistance level at 0.00001740, a level that has historically capped upward price movements.

If this resistance level holds, potentially triggering substantial selling pressure, SHIB could retreat to 0.00001313. Conversely, if the selling pressure does not materialize, SHIB could aim for a higher target of 0.00002954.

Source: TradingView

AMBCrypto has examined trader sentiments to assess the viability of these levels and gauge the likelihood of a breakthrough.

A strong rally is still in sight for SHIB

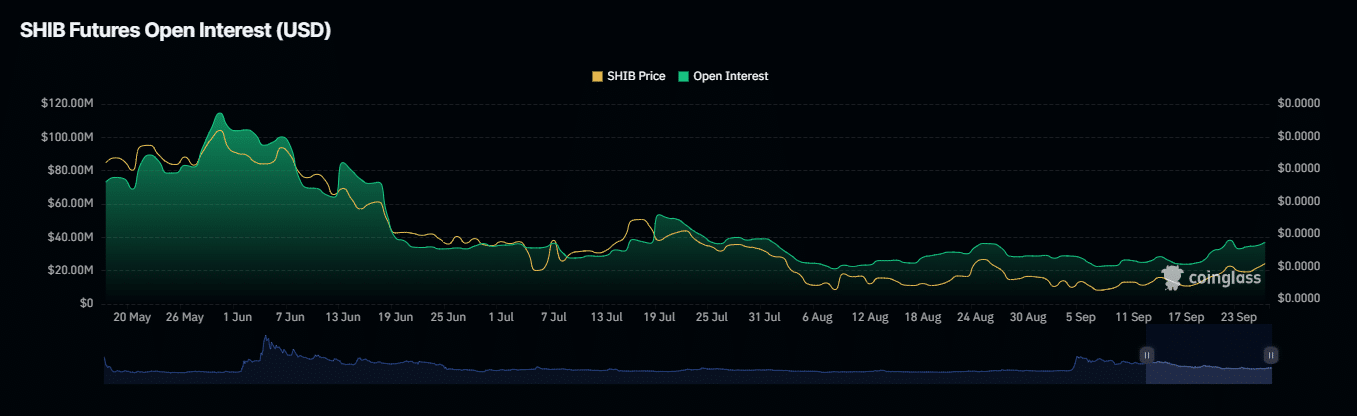

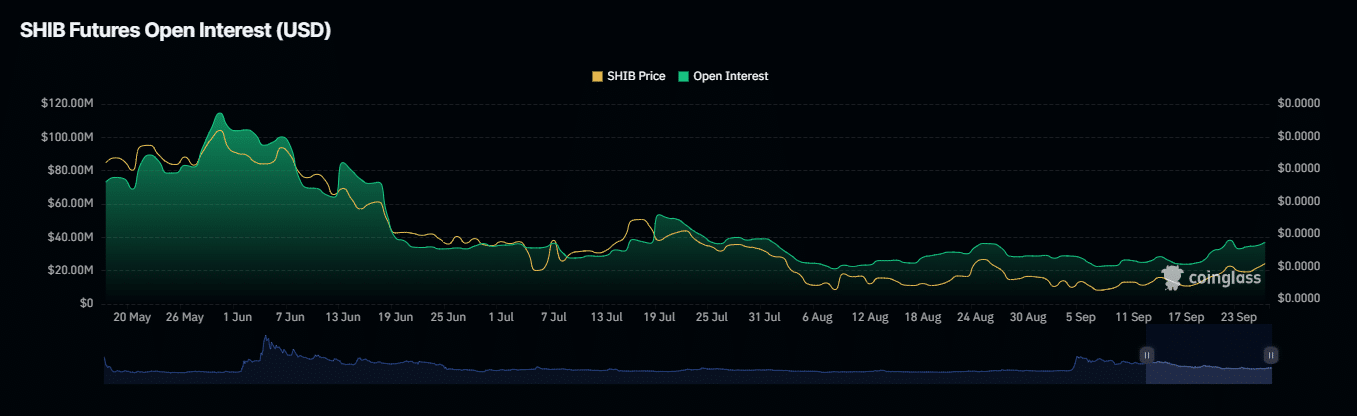

According to Coinglass, SHIB’s trading volume has surged, registering a dramatic increase of 256.40% to reach $217.29 million.

This uptick in volume has coincided with an upward price movement on the chart, signaling a strong presence of bullish momentum in the market.

This alignment suggests that the potential for a continued upswing remains high.

Source: Coinglass

Additionally, the Open Interest—which tracks the number of unsettled future derivatives contracts—has also seen a substantial rise of 35.59%.

A positive Open Interest indicates that traders are increasingly taking long positions, anticipating that SHIB’s price will climb even higher than its current level.

These optimistic sentiments from buyers increase the likelihood of SHIB breaking through potential resistance barriers, potentially sustaining its upward trajectory.

More bullish confirmation but with a clause

The Relative Strength Index (RSI), a tool used to gauge market momentum and identify overbought or oversold conditions, presents a nuanced picture.

At press time, the RSI was 70.56, indicating that the market was on the verge of being overbought. This suggested a potential decline from its current level, a process that would lead to SHIB retracing.

Read Shiba Inu’s [SHIB] Price Prediction 2024–2025

Despite this, the overall market trend remained bullish. A higher RSI typically indicates continued momentum, suggesting that SHIB could still rally and break through resistance levels.

Conversely, a decline in the RSI may signal a temporary cooling-off period before the upward trend resumes. Regardless, SHIB is to rally.