- Solana ETF process moves forward with four 19b-4 filings.

- SOL has hit a new ATH since November 2021.

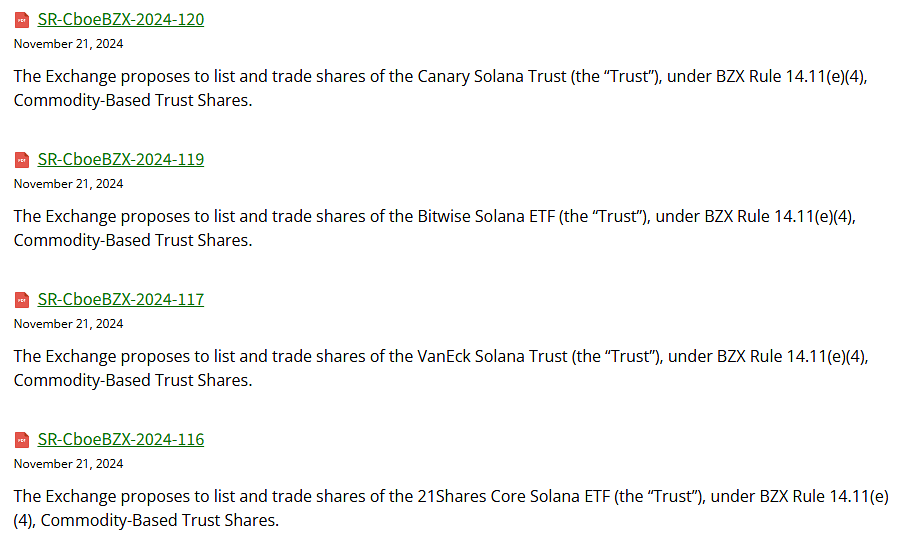

CBOE has submitted four 19b-4 filings with the U.S. Securities and Exchange Commission (SEC) to list spot Solana [SOL] ETFs. The filings were made on behalf of asset managers Bitwise, VanEck, 21Shares, and Canary Capital.

If approved, these ETFs would be listed on the Chicago Board Options Exchange BZX Exchange in the U.S.

Highlighting the filings, Bloomberg ETF analyst James Seyffart said on X (formerly Twitter):

“The ball is in SEC’s court now.”

Source: James Seyffart/X

He further mentioned that the final deadline for this will likely fall in early August, assuming the SEC acknowledges it.

For context, a 19b-4 filing is a request submitted by self-regulatory organizations, to amend or create rules. The SEC evaluates these filings, inviting public comment before determining approval or rejection.

Bitwise joins the Solana ETF race

It is worth noting that Bitwise is the latest contender in the SOL ETF race, following earlier filings by VanEck and 21Shares in late June and Canary Capital in October.

On the 20th of November, Bitwise registered a statutory trust in Delaware for a spot Solana ETF. The crypto-focused asset manager solidified its move by submitting its S-1 filing the following day.

Solana ETFs: A wait-and-see game?

While the flurry of filings indicates enthusiasm among asset managers, they do not guarantee SEC approval.

Eric Balchunas, senior ETF analyst at Bloomberg, questioned whether the SEC will acknowledge these filings in two weeks or instruct the applicants to withdraw them.

Balchunas believes that CBOE is testing the boundaries about a possible procedural acknowledgment. He added that this was because of the impending leadership changes at the SEC.

However, the analyst stated that before approval,

“Lawsuits that mention Solana as a security would have to be dropped first.”

Balchunas added that the current push is more hopeful than indicative of a shift in the SEC’s stance.

Interestingly, the filing came shortly after Fox Business reporter, Eleanor Terret, posted on X that there was a “good chance” of that happening.

Still, she noted that history offers a note of caution. Previous 19b-4 filings from VanEck and 21Shares were quietly removed from CBOE’s website in August, reportedly due to a lack of support from the SEC under Gary Gensler’s leadership.

However, Terret revealed that issuers now point to increased engagement from SEC staff and the potential for a pro-crypto administration as reasons for renewed optimism, that,

“A Solana ETF could be approved sometime in 2025.”

SOL hits all-time high

Interestingly, the Solana ETF filings coincide with a significant day for the crypto market. In the latest press release, the SEC Chair announced his resignation, effective January 20, 2025, fueling speculation about a shift in regulatory attitudes.

These developments boosted Solana’s price to an ATH of $264, at press time, before settling slightly at $262.49, an 8.95% increase in the past 24 hours, according to CoinMarketCap.

As a result of this rise, SOL’s market capitalization surged to $124.62 billion, with trading volumes rising 59.14% to $11.06 billion.

With regulatory shifts on the horizon, the Solana ETF narrative is poised to remain a focal point. Whether or not it will be approved, only time will tell.