- Solana could see a couple of days of choppy trading.

- The bullish Bitcoin move could lead SOL past the nearby resistance.

Solana [SOL] saw a breakout past a key level in the past 24 hours, but was still beneath a stiff resistance zone.

The technical indicators showed bullish strength, but the trading volume was not notably high despite the steady buying pressure.

Investors with a high time horizon would be glad to learn that Solana’s network metrics are more robust than those of Ethereum [ETH]. This user engagement could see a massive market cap growth in the coming months.

Solana price prediction: Caution in the short-term

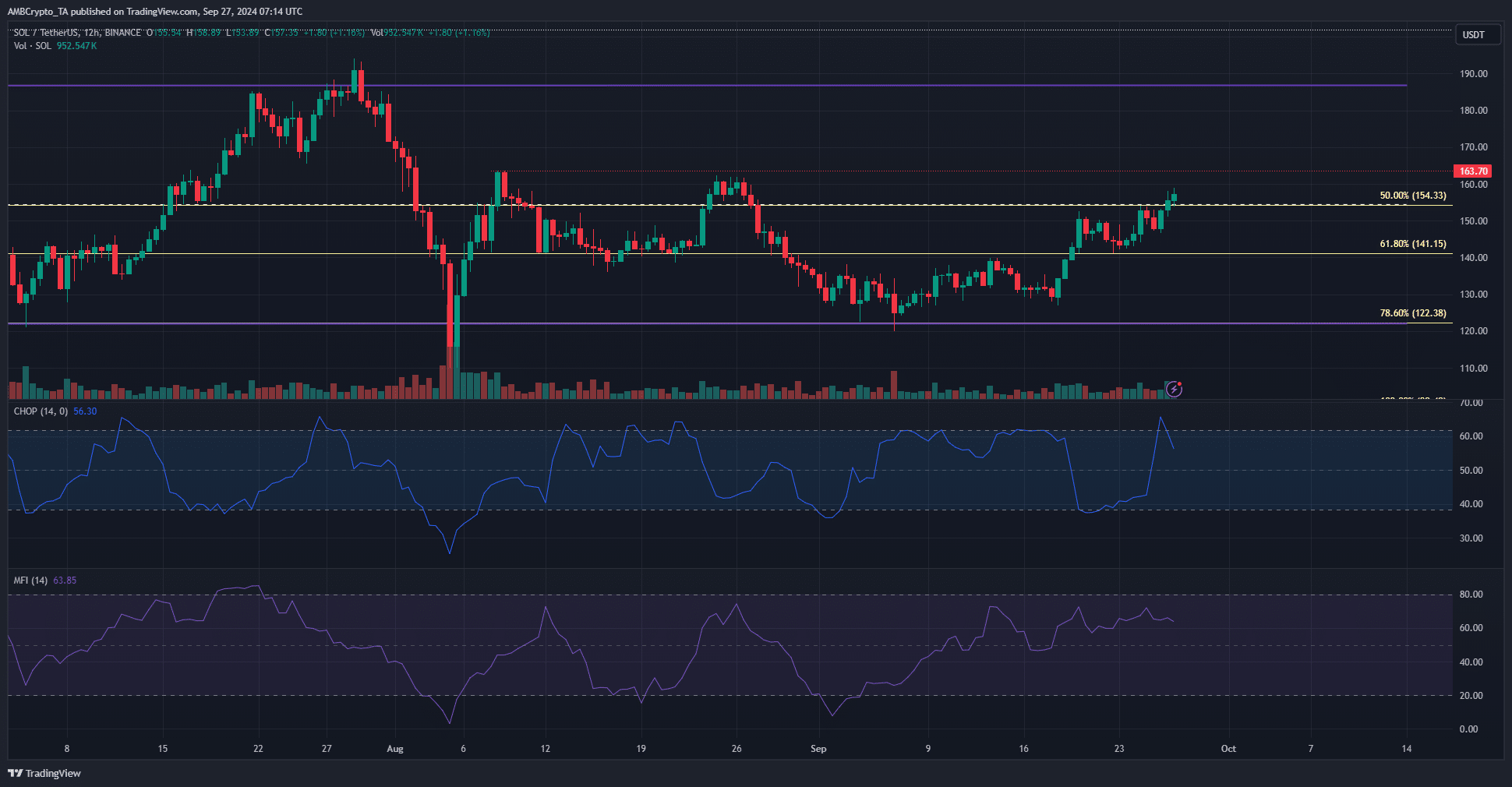

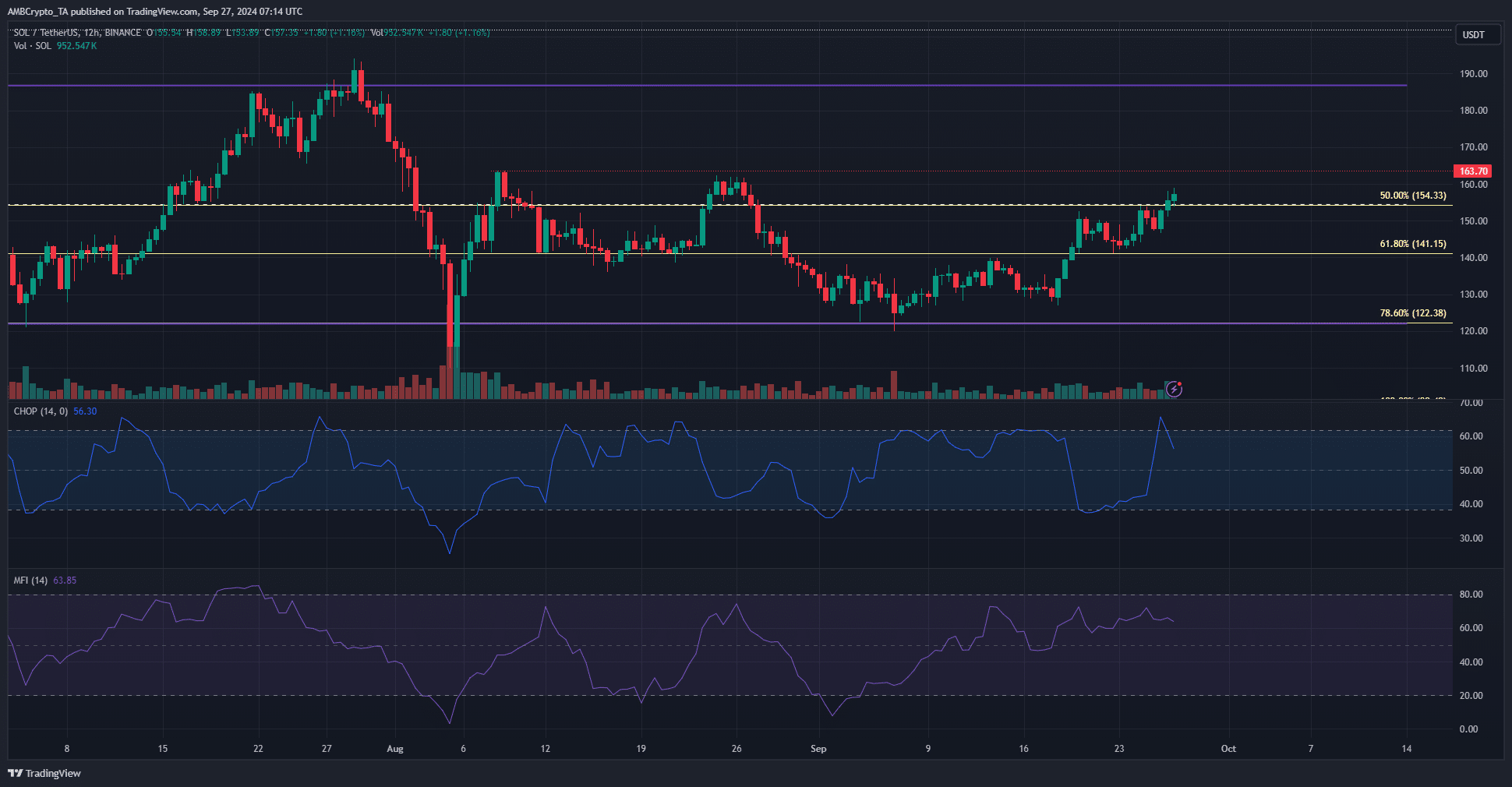

Source: SOL/USDT on TradingView

As outlined in an earlier report, the $154 level was key because it was both the long-term range’s mid-point and the 50% retracement level based on the SOL rally in March.

Since August, this level has been breached thrice, but the previous two rallies were halted under the $162 resistance.

This move might meet a similar fate. The sizeable liquidity pool around the $162-$165 zone could be swept before a bearish reversal.

The momentum was bullish, but the MFI was unable to climb past 72 even though the price made new local highs. This could be an early warning of a price reversal.

The choppiness index burst past 61.8 in the past three days as Solana struggled to crack the $154 level. It has begun to drop, but according to the indicator, a strong trend was not in progress.

Buying was slow but consistent

Source: Coinalyze

The Open Interest remained near the month’s highs to indicate increased activity in the futures market. It is generally indicative of bullish short-term sentiment.

The spot CVD halted the downtrend of mid-September and over the past week has slowly climbed higher. The slow spot demand could be another sign that the breakout past $162 could take time.

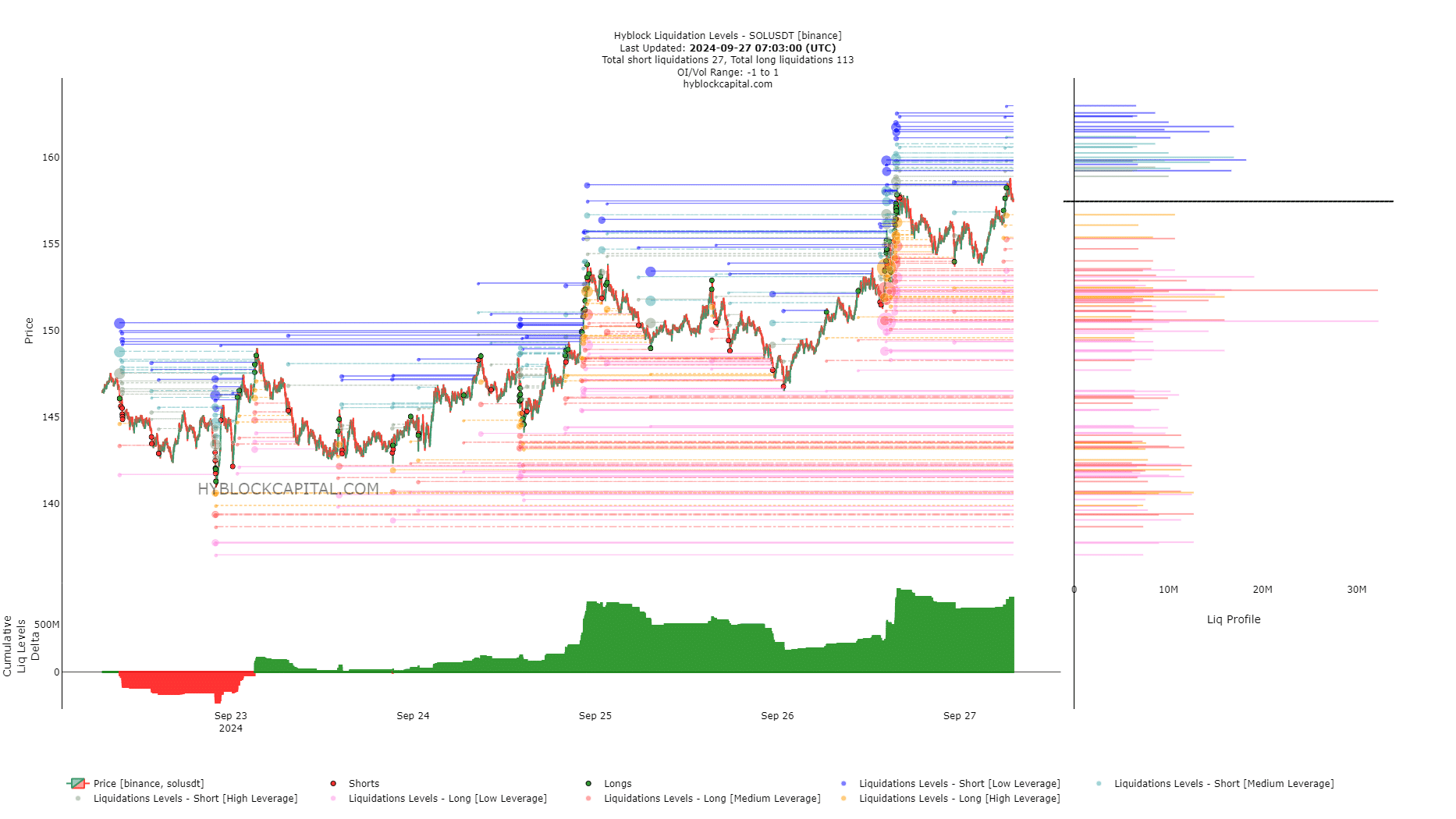

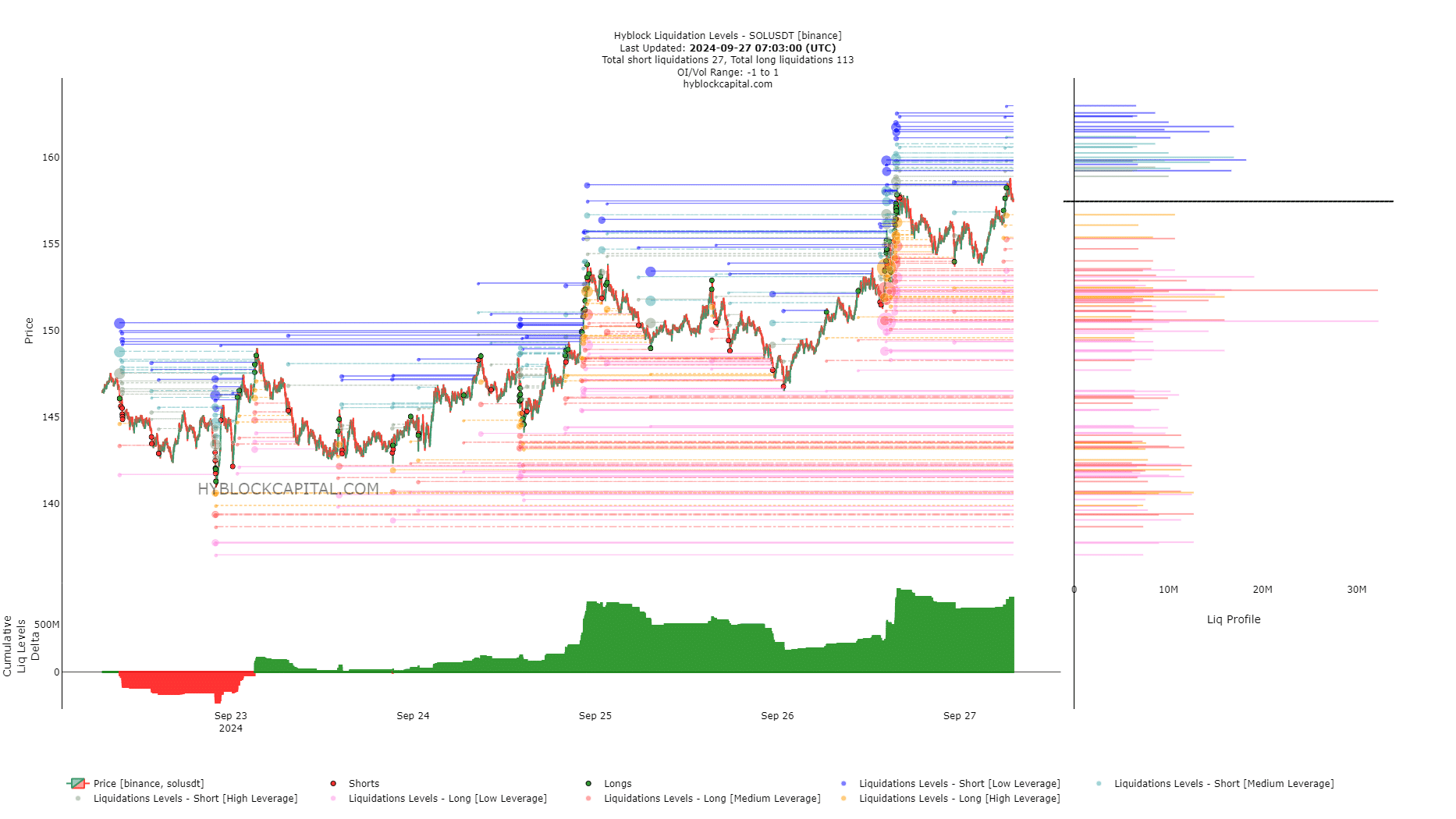

Source: Hyblock

Read Solana’s [SOL] Price Prediction 2024-25

The cumulative liq levels delta was positive and could see a minor price dip like it did on Thursday. Potential targets would be $155 and $152 in case of such a dip.

A sustained drop below $146 would signal short-term bearishness. The Solana price prediction remained positive on the higher timeframes, such as the weekly.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion