- Tether has reached a new all time high in market cap.

- USDT value hit $119.14 billion after a 40.68% surge.

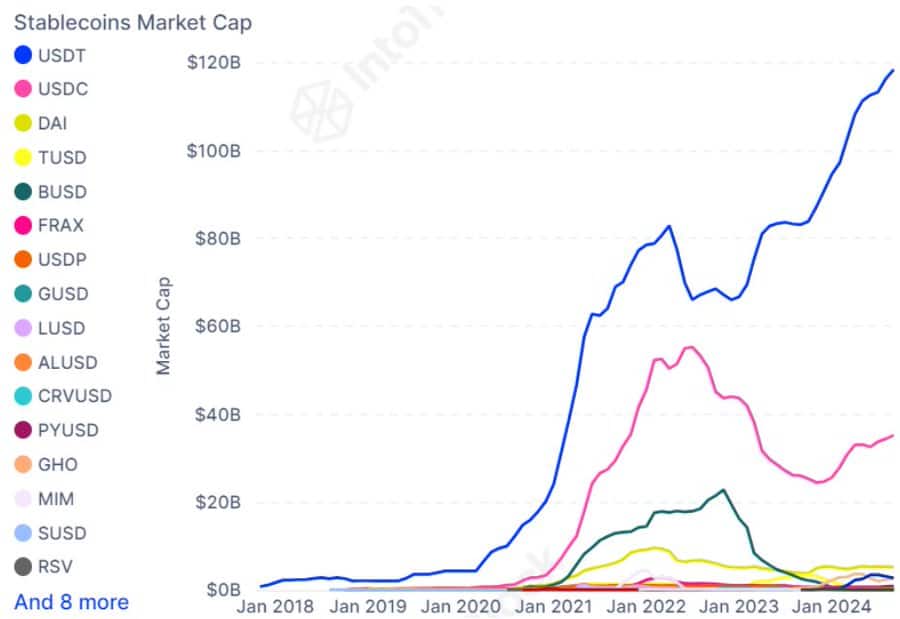

Over the past year, stablecoins have experienced exponential growth. The stablecoin market cap has recently hit a historical high of $172.151 billion.

Tether hits a new all-time high

Amidst stablecoin’s market growth, Tether’s USDT is leading the way recording a sustained growth. In fact, Tether has reached a new all-time high in market cap.

This development in the stablecoin market was observed by IntoTheBlock. Through their official X page, they shared that,

“Tether has reached a new all-time high in market cap, with the total $USDT value nearing $120 billion.”

Source: IntoTheBlock

As of this writing, Tether’s market cap was $119.14 billion. This marked a 40.68% growth over the past year. During this period, Tether’s market cap has surged from $84.69 billion to $119 billion.

This growth is $83.3 billion ahead in market cap of its closest stablecoin rival Circle’s USDC which has also experienced considerable growth over the past year hitting $35 billion.

What’s driving USDT’s growth

As Tether’s USDT hit a new high in market cap, the question that arises is what are the factors driving this growth.

According to AMBCrypto’s analysis, various market conditions are setting Tether for more growth.

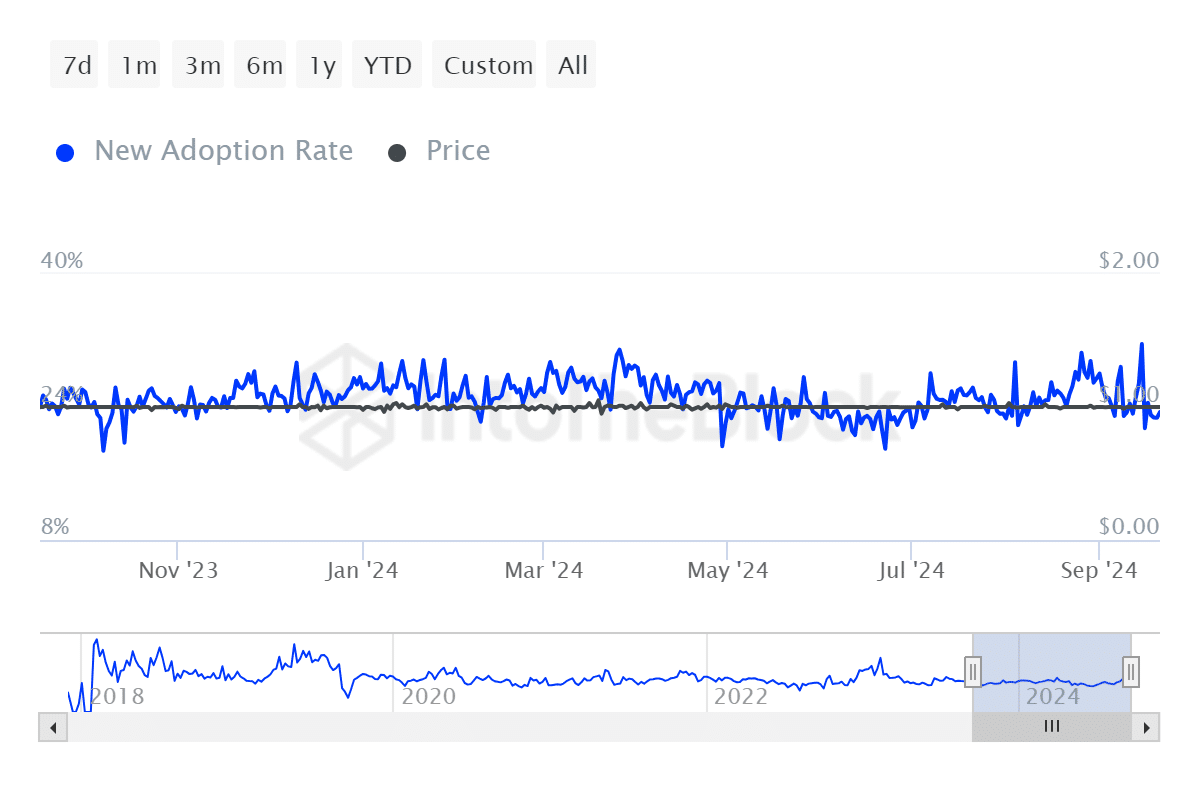

Source: IntoTheBlock

For starters, Tether’s adoption rate has surged over the past year. Over this period, the adoption rate has increased from a low of 18% to 31%.

This suggests that various individuals, institutions, and retail traders prefer USDT over other stablecoins. Such favorability among users has positioned Tether for more growth.

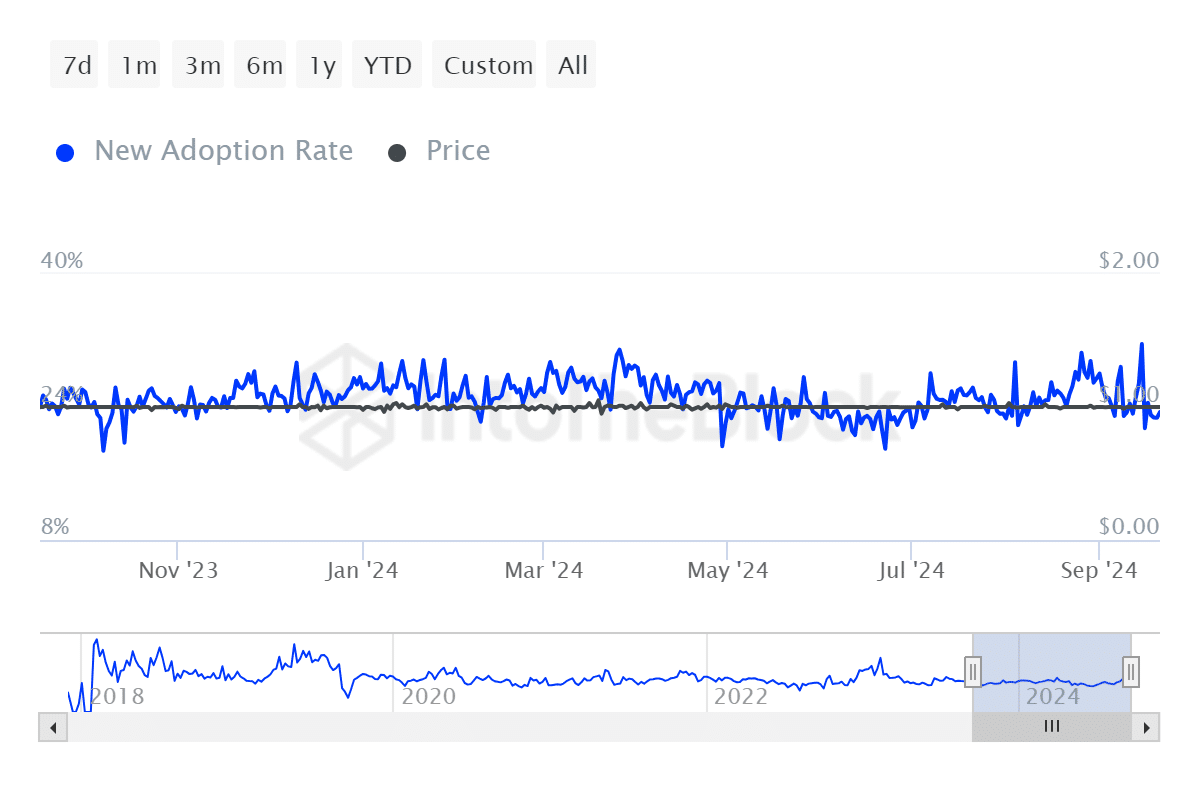

Source: Defillama

Additionally, although the stablecoin market is diverse with multiple coins, USDT has stood out as a trading pairs. This is illustrated by a higher dominance over other stablecoins.

According to Defillama, USDT dominance has hit 69.22%. This suggests that USDT is widely used for trading pairs on exchanges, so higher dominance implies higher liquidity in the market.

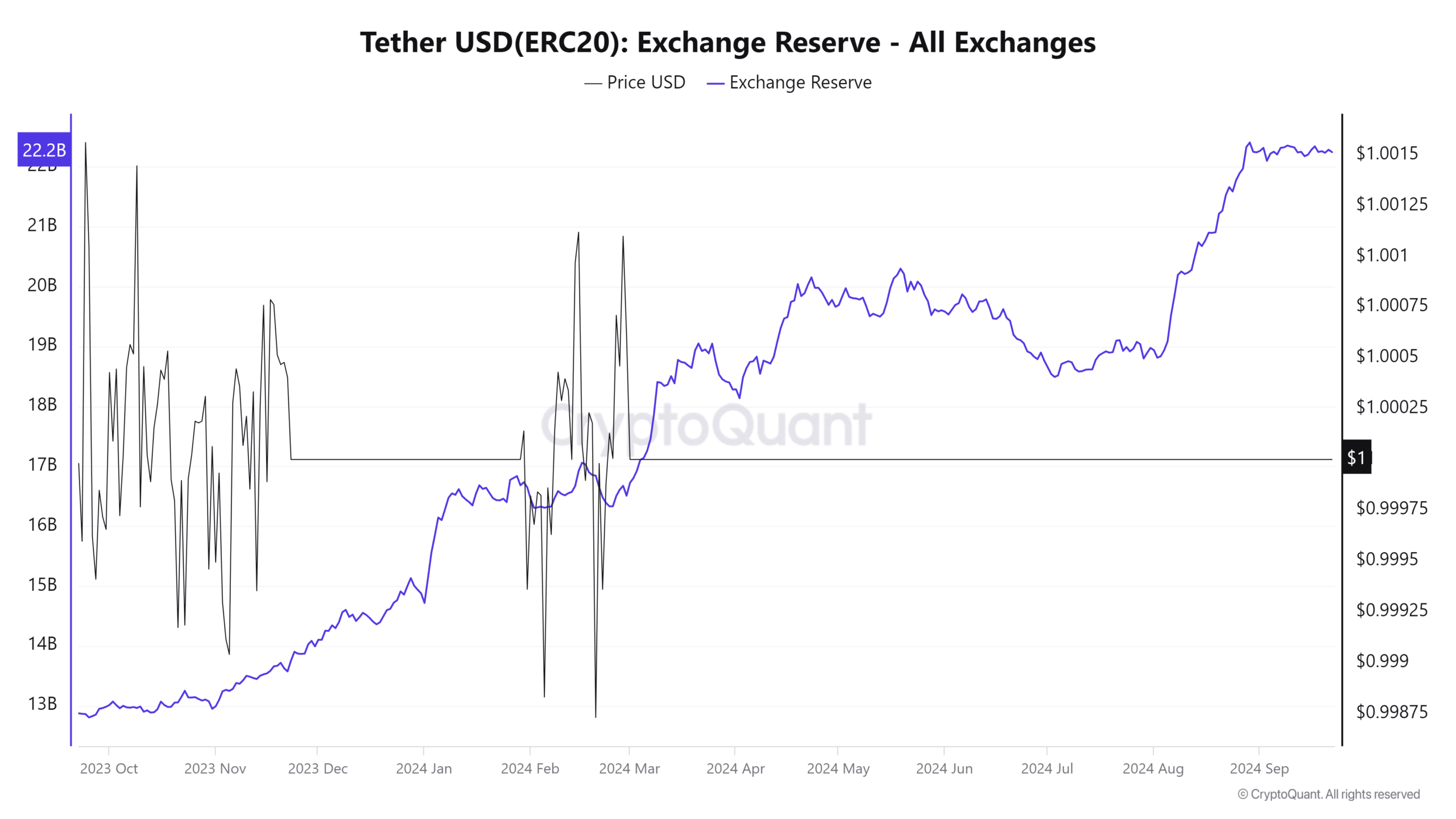

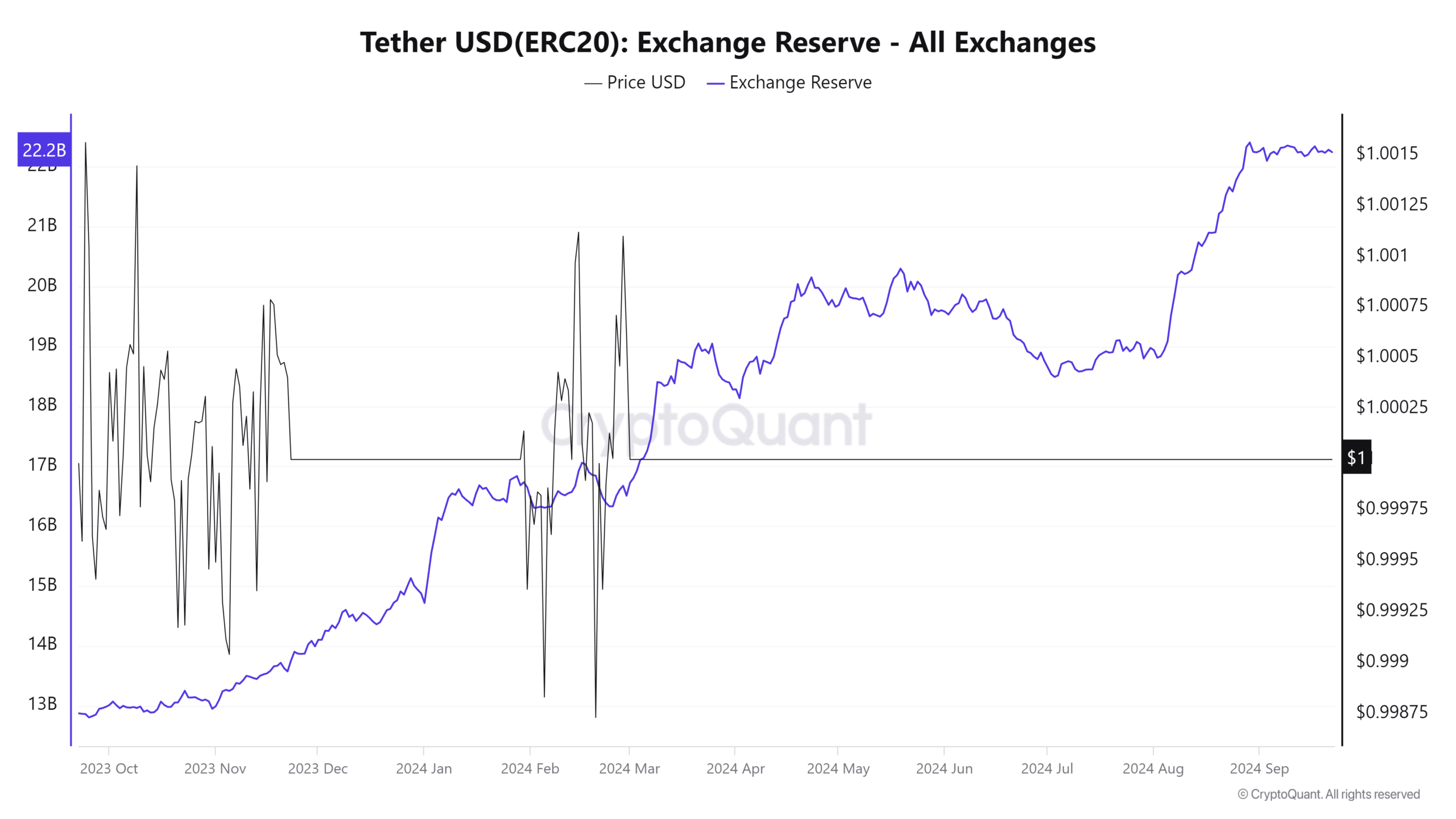

Source: Cryptoquant

Finally, USDT has seen its exchanges in reserve surge over the past year as its market cap has grown. This shows increased usage and adoption as earlier observed.

Availability for USDT in exchanges suggests that most users are using it in purchasing and other trading activities compared to other stablecoin.

In conclusion, as Tether hits a historical high in market cap, it shows increased favorability for USDT in trading activities. It also signifies that the market has shifted into stablecoins as a store of value for most crypto users.