- NEAR recently fell below 20, 50, and 200-day EMAs to depict strong selling pressure.

- Derivates data showed mixed sentiment, with a slight edge for sellers.

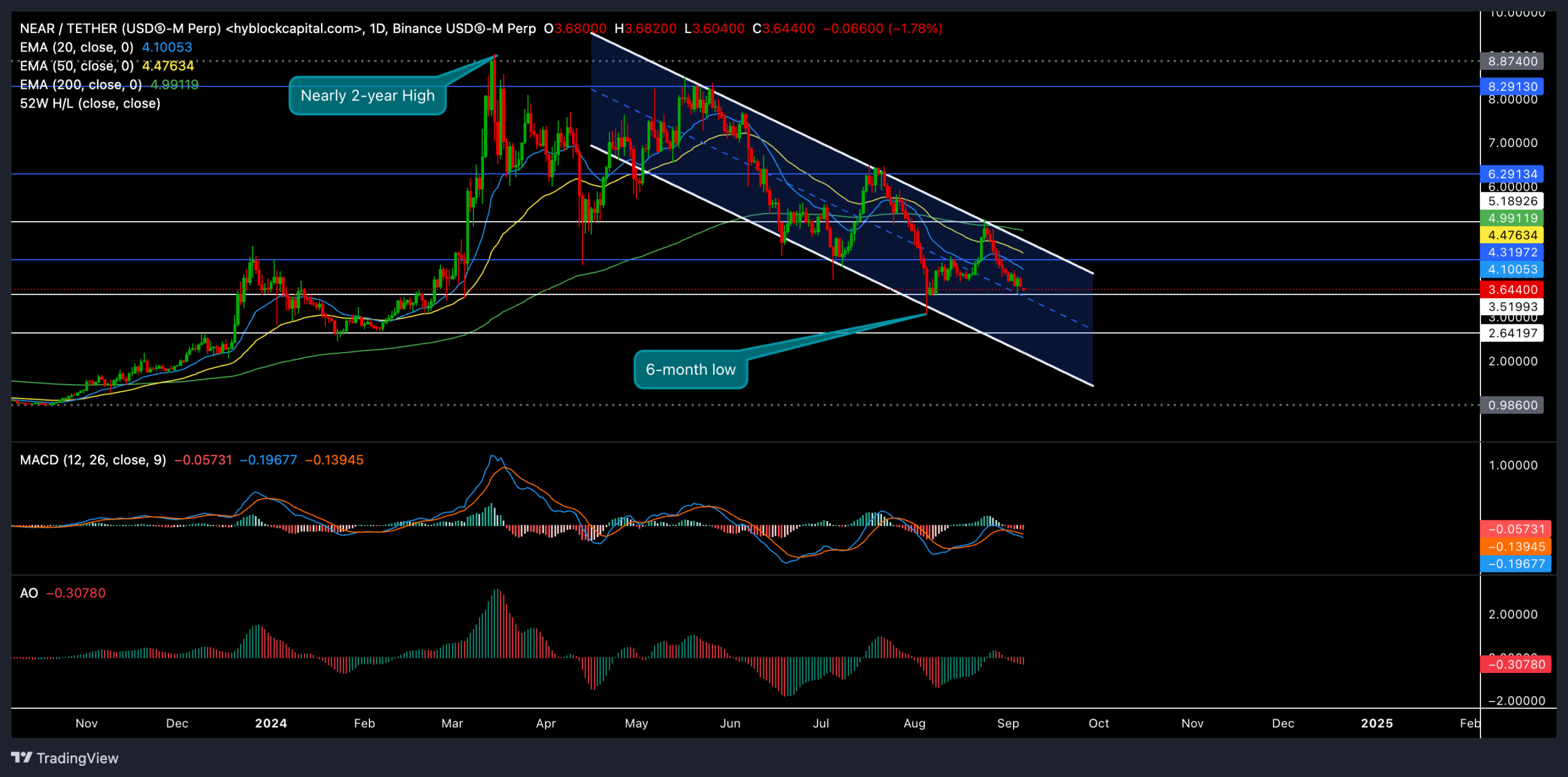

NEAR Protocol [NEAR] remained bearish after reaching its nearly two-year high in early March. It consistently moved within a descending channel and kept losing important support levels.

The altcoin’s struggle to reverse this trend has left many investors wondering if a recovery is on the horizon, or if further downside is inevitable.

At the time of writing, NEAR traded at $3.663, inching closer to the critical $3.5 support zone that could trigger more selling pressure should the bulls fail to show up at this level.

Bears continued to exert pressure

Source: TradingView, NEAR/USDT

NEAR’s price action continued to respect the boundaries of a descending channel, a classic indicator of bearish momentum.

This pattern has pushed the token toward its 6-month low levels, with the bulls struggling to break through key resistance levels.

The 20 EMA ($4.1) and the 50 EMA ($4.47) sloped downward, indicating that the short-to-mid-term sentiment remained firmly in favor of the sellers.

A major obstacle was the 200-day EMA ($4.99), which has historically acted as a dynamic resistance zone.

If NEAR loses its grip on the $3.5 support level, the bears could easily push the price toward the $2.6 mark, a critical support level that could spark further sell-offs.

Moreover, the MACD’s histogram recently fell below the zero line, which indicated a spike in selling pressure. The recent bearish crossover between MACD and signal lines reaffirmed the bearish edge.

A decisive crossover above the signal line could relieve the bulls, but they need to increase buying volume for confirmation.

Meanwhile, the Awesome Oscillator (AO) also showed negative momentum, reinforcing that the bears were in control for now.

Derivates data reveal THIS

Source: Coinglass

It’s worth noting that the recent derivatives data reinforced the bearish sentiment. NEAR’s volume increased by 8.96%, totaling $277.62M, while Open Interest dropped by 5.26%, reaching $120.94M.

This decline in Open Interest suggested that traders were closing their positions, signaling a potential continuation of the bearish trend.

The long/short ratio on Binance stood at 2.202, with more traders favoring long positions.

However, this imbalance doesn’t necessarily signal bullish momentum, as long traders could be trapped in a bear market if key support levels break.

In light of the descending channel and bearish EMA positions, NEAR’s bulls are in for a tough battle. A break below $3.5 could open the floodgates for further downside, with $2.6 acting as the next critical support.

Read Near Protocol’s [NEAR]l Price Prediction 2024–2025

On the flip side, a patterned breakout above the upper boundary of the descending channel could pave the way for a retest of the $6.2 resistance level, provided the broader market conditions improve.

Until then, NEAR’s short-term prospects remained bleak. Traders should keep a close eye on Bitcoin’s movement, as it could significantly influence NEAR’s trajectory.

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion