- USDC market cap jumps to its highest level in 2024.

- A recap of how USDC got to where it is and its distribution across leading blockchains.

The USDC stablecoin has benefited from the return of excitement in the cryptocurrency market so far this month. This is particularly evident with its market cap surge to the highest levels.

Here’s a look at how the stablecoin has been faring.

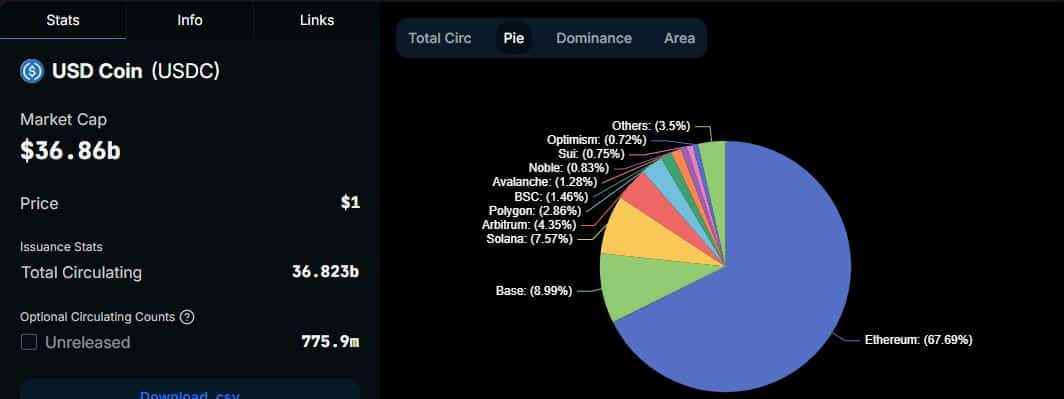

According to CoinMarketCap, USDC added around $2.34 billion to its market cap in the last seven days. This gain also allowed USDC to rally past its September highs, which means its recent push is now the highest level in 2024.

Source: CoinMarketCap

Although USDC reached a new 2024 high, it was still below its previous all-time high of $55.82 billion.

This ATH was achieved at the height of the 2022 bear market, when there was a flight to the safety that stablecoins offer from volatility.

So what is moving the surge in USDC market cap this time? A variety of factors could be at play, but the most significant one could be the recent surge in demand for cryptocurrencies.

This means there was more demand for stablecoins through which liquidity can flow into Bitcoin [BTC] and altcoins.

Aside from growing liquidity needs, the demand for USDC may also be rising due to yield farming. Some DeFi platforms offer rewards for holding USDC and other stablecoins on their platforms.

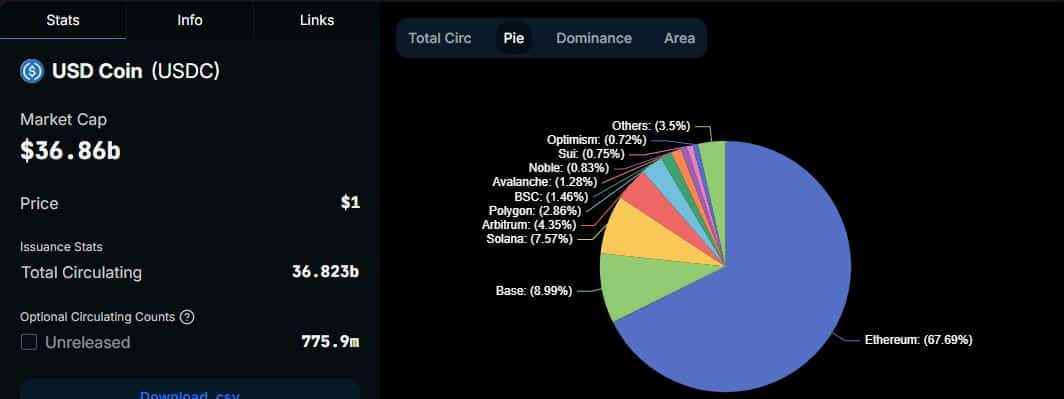

USDC distribution across multiple networks

Most of the USDC in circulation is in the Ethereum ecosystem at roughly $25.09 billion or 67.69%. The Base network, which is among the fastest growing blockchain networks of 2024.

It had the second-highest supply at 3.332 billion USDC or 8.99% of its supply.

Source: DeFiLlama

Solana secured third place with 2.806 billion USDC, or an equivalent of 7.57% of its total supply.

The USDC stablecoin has so far managed to maintain the second spot in the list of the most dominance stablecoins, with USDT leading the charge.

USDC dominance was at 20.83% of the total stablecoin marektcap as of the 9th of November. It still had a long way to go compared to its bigger sibling USDT, which controlled 69.17% of the stablecoin market cap.

In other words, USDC has a long way to go if it stands a chance to be top dog in the stablecoin segment.

What’s next for USDC? The stablecoin could continue to experience more growth in the next few months, especially if the crypto market becomes more heated up.

This is because stablecoin demand tends to grow during bullish periods.