- USDT saw a surge in activity following regulatory scrutiny.

- However, a common trading strategy that could have benefited BTC failed to materialize.

The U.S. government has reportedly launched another investigation into Tether [USDT], a move some are calling the latest “Tether FUD” tactic.

The timing raises eyebrows, with some speculating this is an orchestrated attempt to inject fear and shake out the market before a potential Bitcoin [BTC] breakout.

Given that over 70% of cryptocurrency trades involve USDT pairs, analysts at AMBCrypto caution about the risks tied to Tether’s centralization.

Any disruption to USDT could send shockwaves through the entire market. Particularly as BTC heads into the final week of the “Uptober” frenzy.

USDT dominance hits new highs, but there’s a catch

In the past week, USDT dominance has steadily increased, with daily gains exceeding 2%. Historically, a rise in USDT dominance often coincides with BTC reaching market tops.

This was reminiscent of its previous close near $70K.

However, the surge in USDT demand, driven by rising panic, has placed significant downward pressure on BTC, which is currently trading at $67K.

This situation underscores the growing influence of USDT on Bitcoin’s price dynamics. Therefore, it’s crucial to monitor the effects of the recent scrutiny surrounding Tether closely.

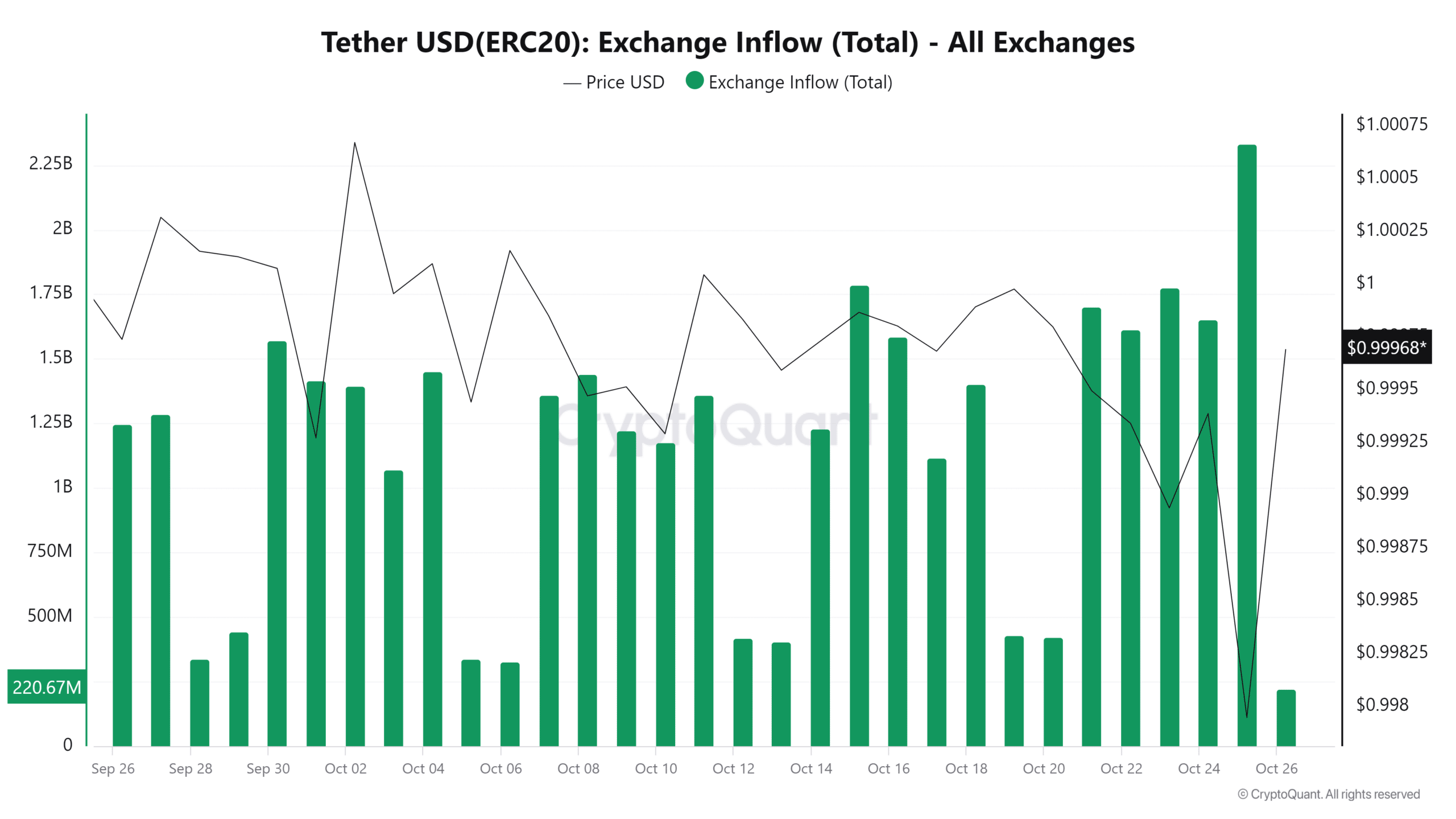

Source: CryptoQuant

Interestingly, during the late trading hours when the news circulated, USDT inflows into exchanges surged dramatically, hitting a two-month high of over $2.3 billion.

Despite this spike, USDT dominance remained strong, posting a daily gain of nearly 3%. This suggests that many traders perceived the news as exaggerated or misleading, opting to maintain their net imports.

However, there’s a strong possibility that in the coming days, USDT deposits into exchanges could surpass net outflows.

If the current BTC price turns out to be a market bottom, it may attract significant liquidity, potentially driving its price higher.

On the flip side, stakeholders might shift their assets into other high-cap altcoins or memecoins, seizing the opportunity to exchange USDT for more affordable alternatives.

The last week of October may bring increased activity in the crypto market, with several coins poised for a potential parabolic rally.

Odds of capital shifting into BTC

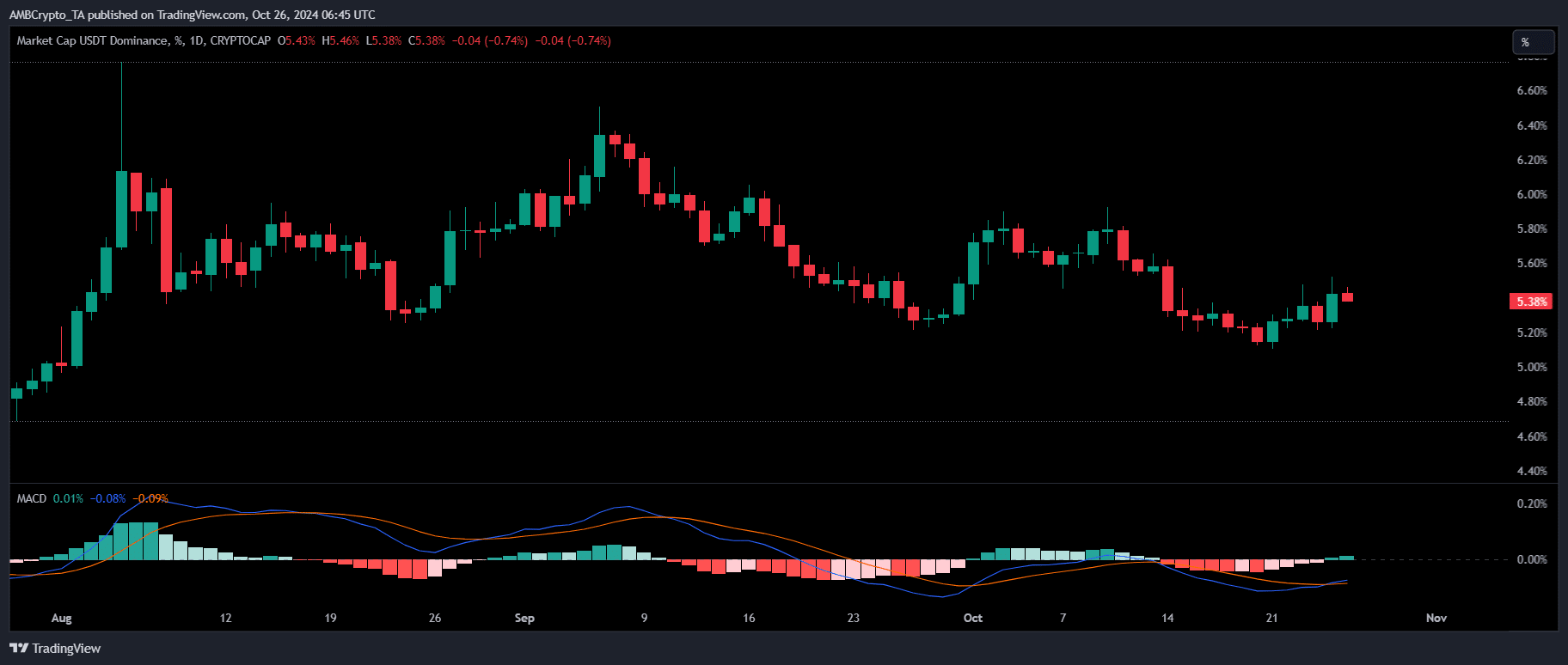

Currently, USDT stands at a crossroads. The investigation news triggered investor panic and massive selling pressure. Yet, the daily chart showed a bullish MACD crossover for USDT dominance.

Source: TradingView

The increased volatility in the market – sparked by Bitcoin’s dip to near $67K – has fueled speculation about a potential pullback to $64K, where the next bottom could form.

Moreover, despite 12 hours passing since the news broke, which typically prompts investors to offload USDT for BTC, traders have yet to sweep the lows.

This scenario reinforces the potential for a retracement, making the current price a less appealing entry point.

Is your portfolio green? Check out the BTC Profit Calculator

The coming week is crucial for BTC, as its fate hinges on the market’s reaction to USDT. Currently, the likelihood of investors strategizing for a parabolic rally appears limited.

This could dampen the chances of the crypto market closing October on a bullish note.