- CryptoQuant CEO Ki Young Ju also noted that whales are accumulating Bitcoin and we’re in the middle of the bull cycle.

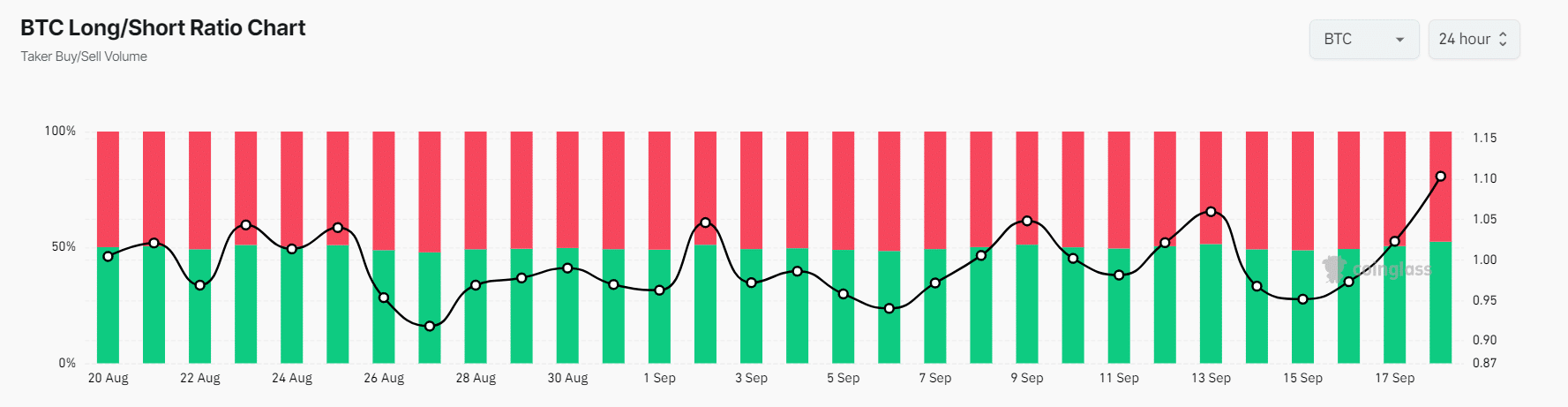

- BTC’s Long/Short ratio currently stands at 1.1048 (a value of ratio above 1 indicates bullish market sentiment among traders).

Despite significant volatility in the cryptocurrency market, Bitcoin [BTC] whales and institutions appear to be capitalizing on the current sentiment by heavily accumulating coins.

In recent days, the overall cryptocurrency market sentiment has been challenging, with major cryptocurrencies like Ethereum, Solana, and XRP struggling to gain momentum.

Whales and institutional accumulation

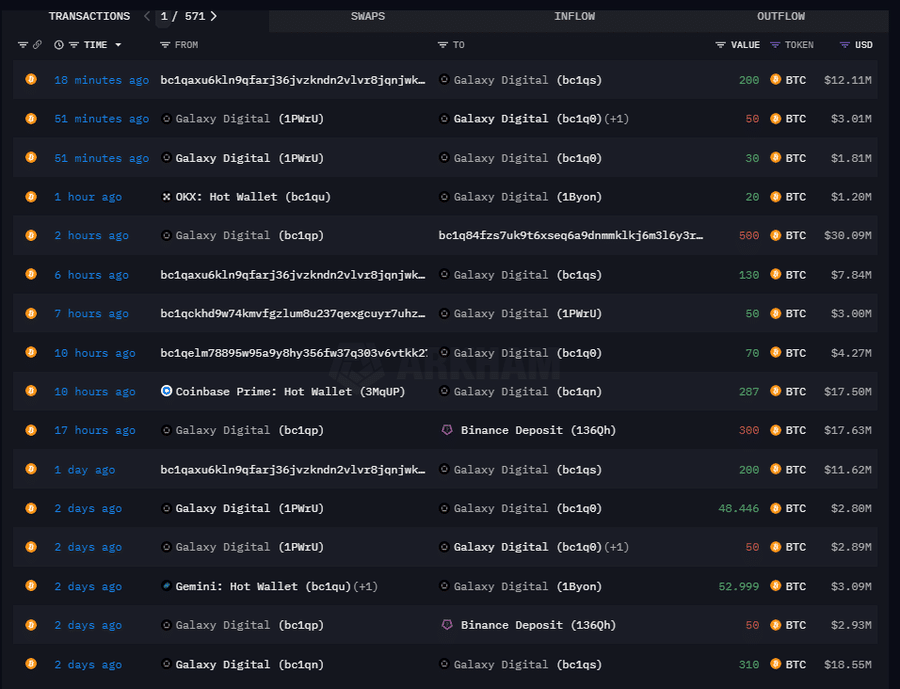

On-chain analytics firm made a post on X (previously Twitter) that digital asset and blockchain leader Galaxy Digital had accumulated a significant 4,491 BTC, worth $267.03 million, within a week from the exchanges including OKX, Coinbase, and Gemini.

With this recent accumulation, the firm now holds a massive 8,790 BTC, worth $532.38 million.

In addition to this post on X, CryptoQuant CEO Ki Young Ju also shared data supporting the same perspective on Bitcoin whales. In a post on X, Ki Young noted that whales are accumulating Bitcoin.

He added, “Six days of accumulation alerts in a row, primarily from custody wallet inflows. Nothing has changed for Bitcoin; we’re in the middle of the bull cycle.”

Ideal buying opportunity?

Bitcoin accumulation in this challenging condition is a positive sign and potentially signals an ideal buying opportunity.

Despite the significant accumulation and the bullish outlook of whales, Bitcoin remains steady and has been consolidating between $58,000 and $60,000.

At press time, BTC is trading near the $60,550 level and has experienced a price surge of over 3.35% in the past 24 hours. During the same period, its trading volume has increased by 40%, indicating higher participation among traders.

BTC’s bullish on-chain metrics

Currently, Bitcoin’s on-chain metrics are flashing bullish signals. According to the on-chain analytic firm Coinglass, BTC’s Long/Short ratio currently stands at 1.1048 (a value of ratio above 1 indicates bullish market sentiment among traders), the highest since August 2024.

Source: Coinglass

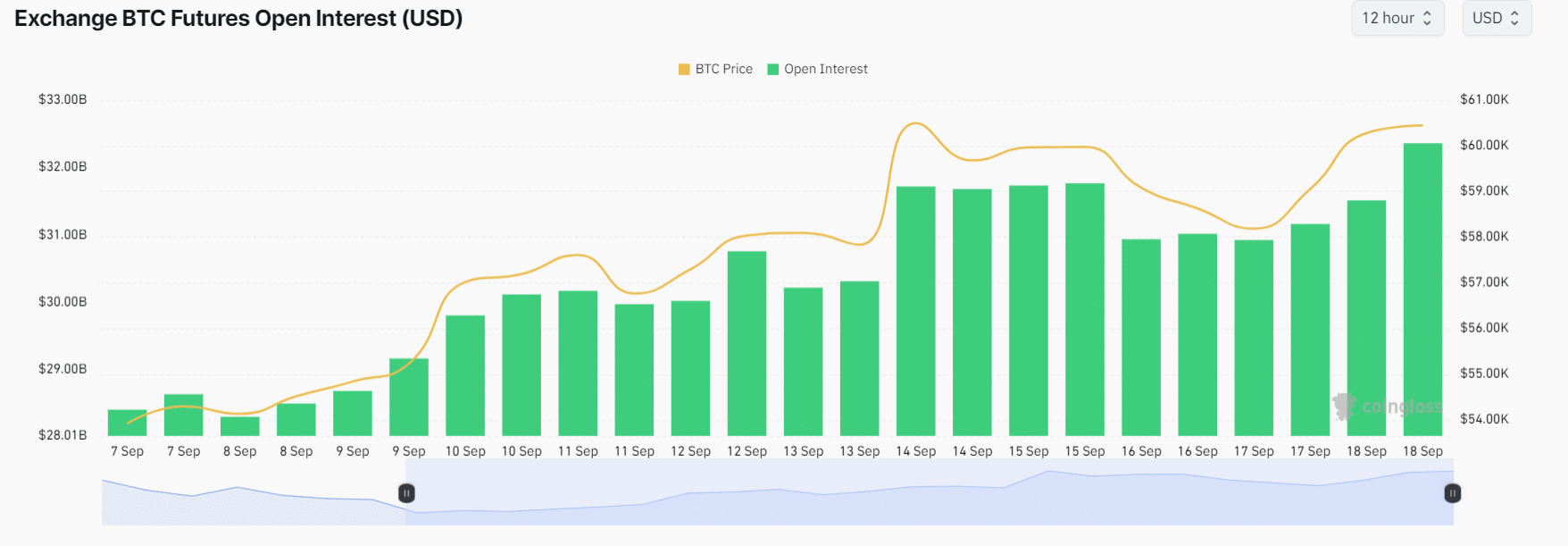

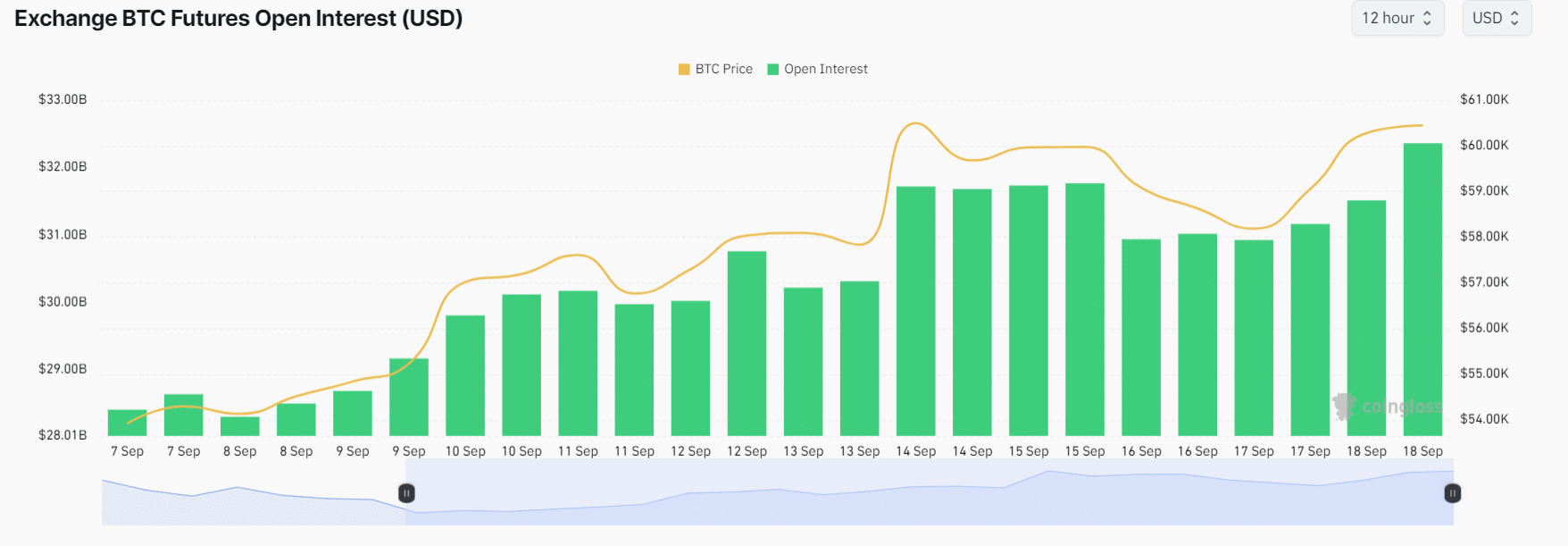

Additionally, BTC’s future open interest has increased by 6% in the last 24 hours and continues to grow, indicating rising interest from traders and investors.

Source: Coinglass

Read Bitcoin’s [BTC] Price Prediction 2024-25

Currently, 52.5% of top Bitcoin traders hold long positions, while 47.5% hold short positions, indicating that bulls are back and dominating the asset.

Meanwhile, the BTC OI-weighted funding rate stands at +0.0053% and is in the green, reflecting bullish sentiment among traders and investors.