- Arbitrum has formed a falling wedge pattern on the 4-hour chart, with a breakout above the upper trendline can confirm a bullish trend.

- A recent DAO proposal could be the catalyst ARB needs to extend gains.

The cryptocurrency market has witnessed a slight rebound after altcoins crashed following Bitcoin’s [BTC] drop to a weekly low below $57K on the 15th of August.

The bearish sentiment also saw Arbitrum [ARB] post a 1.3% drop.

ARB was trading at $0.546 at the time of writing. The token has slightly bounced after dropping to a weekly low of $0.53 on the 16th of August amid high selling pressure.

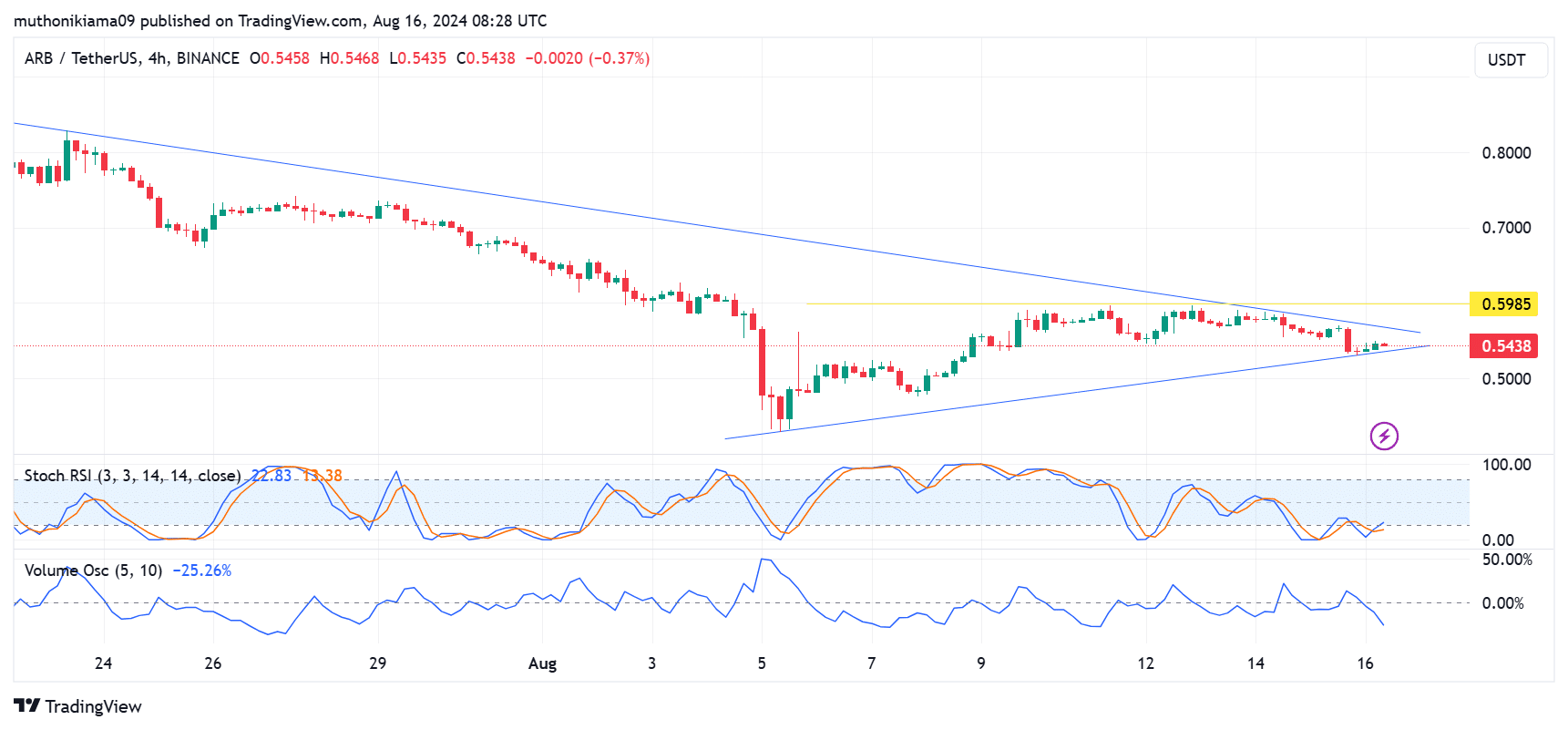

At press time, the Stochastic Relative Strength Index (RSI) at 24 was close to the oversold level. Such a low Stochastic RSI indicated that ARB was approaching its bottom.

The RSI line made a higher high as well, signaling a potential reversal. It also moved above the signal line, hinting at a weakening uptrend and the possibility for further gains.

Source: TradingView

ARB has established a falling wedge pattern on the four-hour chart. If the price breaks above the upper trendline, it will confirm a bullish trend and test key resistance at $0.59.

This could help ARB potentially reach $1 in the coming days.

However, breaking above this pattern largely depends on buying volumes. The negative Volume Oscillator raises concerns about the strength of a breakout.

Therefore, even if ARB breaks out of the falling wedge, it might fail to sustain the gains if the market remains inactive.

Is staking needed for ARB’s rally?

One of the factors that might trigger an active market around ARB and a sustained uptrend is the launch of staking on the Ethereum [ETH] layer-2 network.

The Arbitrum DAO has passed a temperature check proposal to launch staking on the network. The proposal, dubbed “Unlock ARB Utility and Align Governance,” received 91% approval from the community.

This proposal will increase ARB’s utility within the Arbitrum ecosystem.

Arbitrum is the largest layer-2 network, with a Total Value Locked of $14 billion per L2Beat data. Its TVL is over two times bigger than the second-largest layer-2, Base.

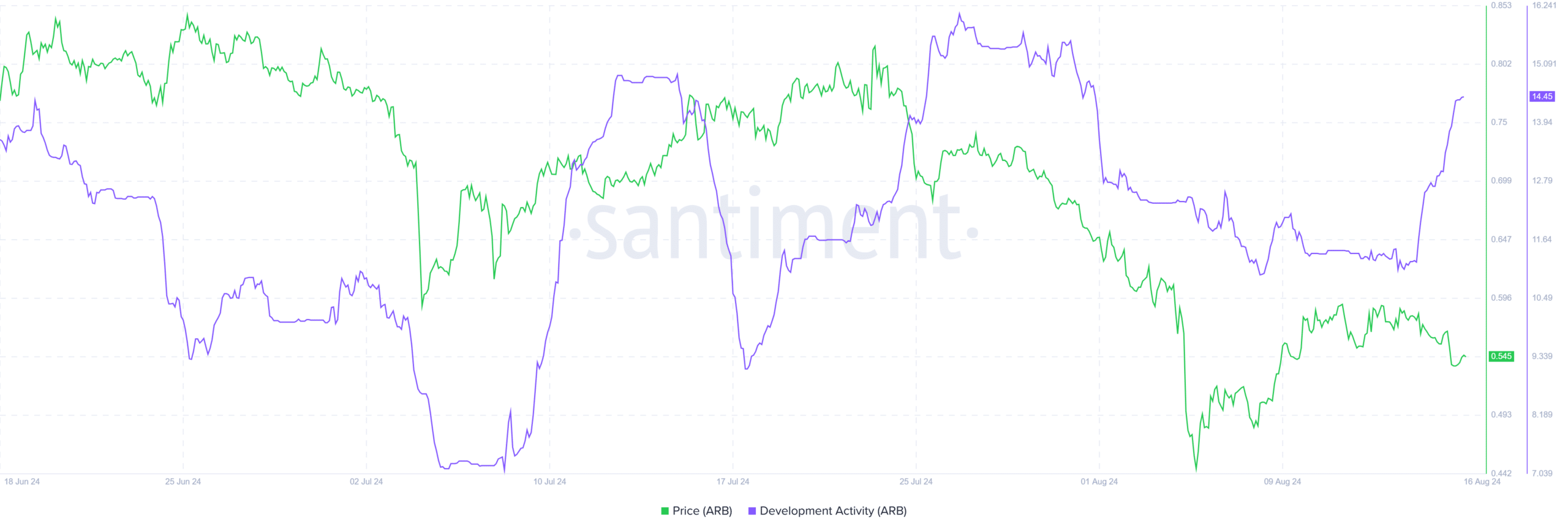

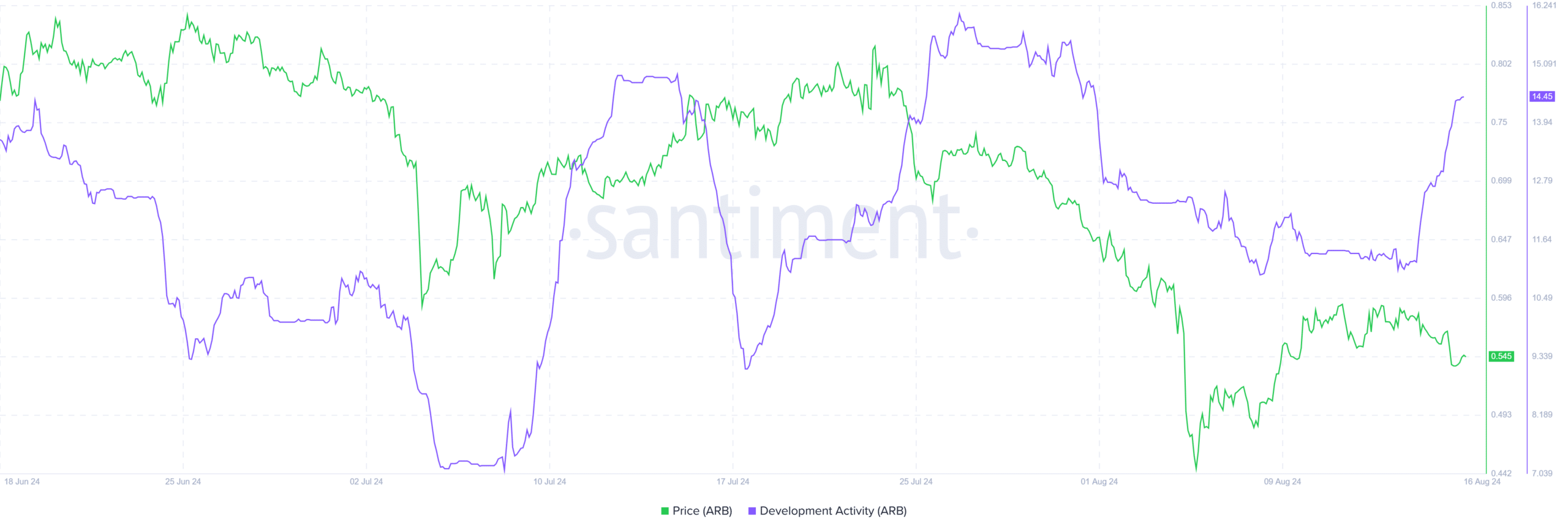

A further look at Santiment data showed that development activity has increased significantly. At press time, it was at the highest level since early August.

Historical data shows that such increases have often coincided with price growth.

Source: Santiment

Realistic or not, here’s ARB’s market cap in BTC’s terms

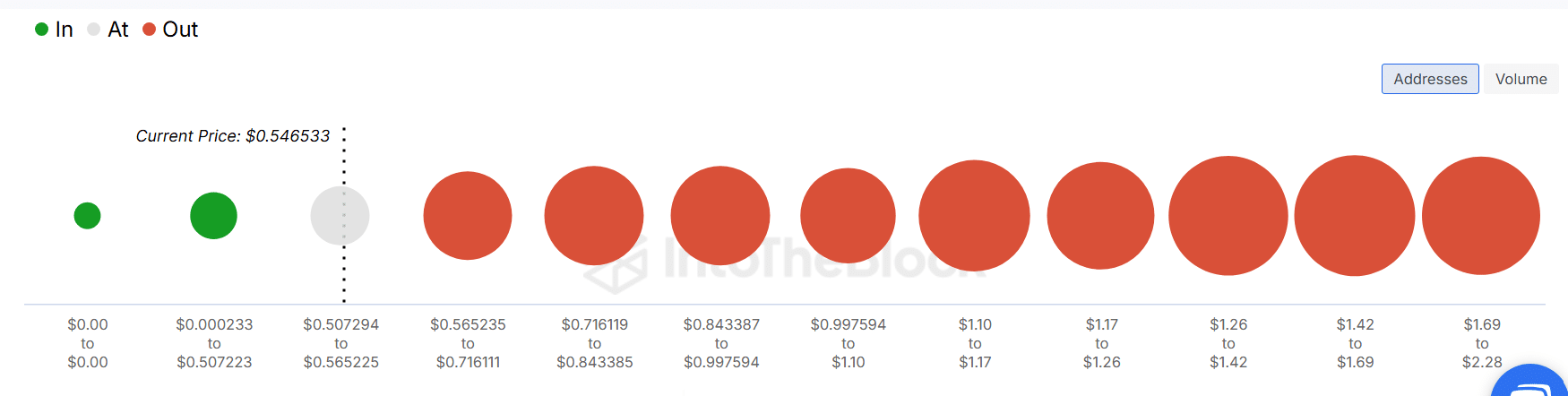

While the Arbitrum network has been dominating the layer-two sector, the ARB token has underperformed. The DAO proposal stated less than 1% of tokens are used within the ecosystem.

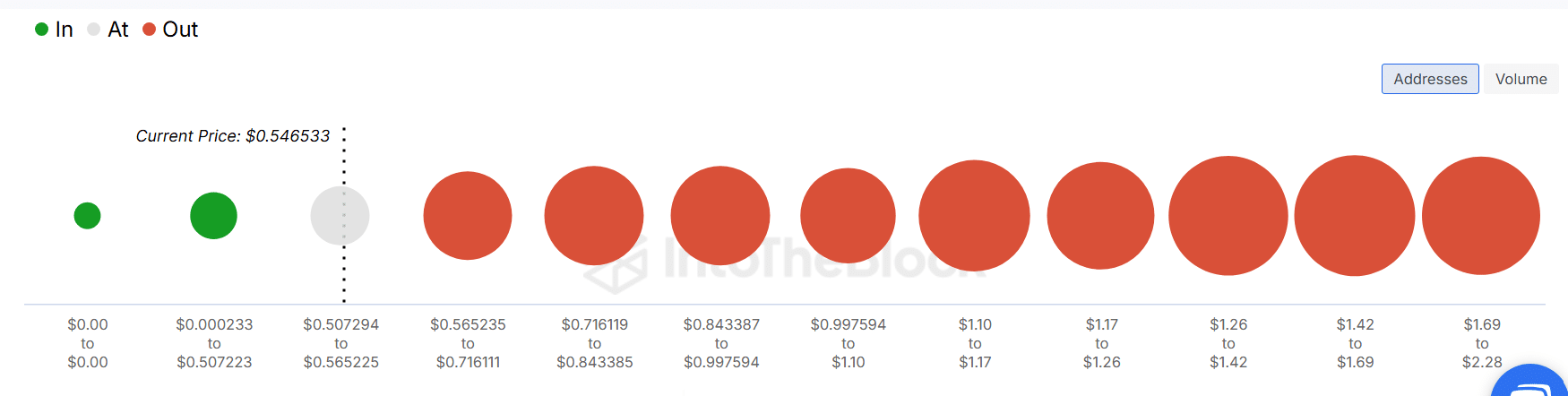

The lack of utility has seen 98% of ARB holders sit in losses at press time, per IntoTheBlock data.

Source: IntoTheBlock