- BTC could recover if the Fed signals a policy shift from quantitative tightening.

- Bitfinex and CryptoQuant analysts warned of weak demand and a likely ‘bear market.’

Bitcoin [BTC] has spent one week capped below $85K ahead of the Federal Open Market Committee (FOMC) meeting on the 19th of March, as analysts offer mixed views on its recovery odds.

According to Charles Edwards, Co-Founder of crypto VC Capriole Investments, the world’s largest cryptocurrency could bounce back, citing a potential bottom in the U.S. liquidity.

“This Bitcoin cycle, we have largely been battling a flat monetary cycle, versus last cycle’s strong uptrend (green). That may be about to change. We are now seeing the first signs of a potential major multi-year bottom in U.S. Liquidity, with an eve/adam bottom forming today.”

Source: Capriole Investments

Edwards added that it has been four years of quantitative tightening (QT), a Fed approach to cap U.S. liquidity and the opposite of quantitative easing (QE).

For those unfamiliar, increased U.S. liquidity implies more money circulation and is historically positive for risk assets, including BTC. However, such a macro shift depends on the Fed meeting scheduled for Wednesday.

Fed watch: BTC recovery or bear phase?

The markets have decidedly priced in a zero-interest rate cut at the next FOMC meeting. However, analysts will be keen on Fed Chair Jerome Powell’s press conference for QT clues and sentiment shift.

In their weekly market review, Coinbase analysts projected a ‘good chance’ the Fed could pause QT at the meeting.

“We think there’s a good chance of a pause or stop in QT as bank reserve levels are approaching the 10-11% of GDP threshold commonly considered sufficient for maintaining financial stability.”

For his part, renowned trader, Cryp Nuevo, expected a potential bounce from the short-term trendline support driven by a liquidity hunt at $85K-$87K around the FOMC meeting.

Source: X

Although a slight recovery is possible, some on-chain indicators signal caution, noted Bitfinex analysts and CryptoQuant founder Ki Young Ju.

Bitfinex highlighted that BTC ETF demand was too weak to boost a strong BTC recovery.

“The ongoing outflows from U.S. spot Bitcoin ETFs, which totalled $921.4 million last week, suggest that institutional buyers have not yet returned with sufficient strength to counteract selling pressure.”

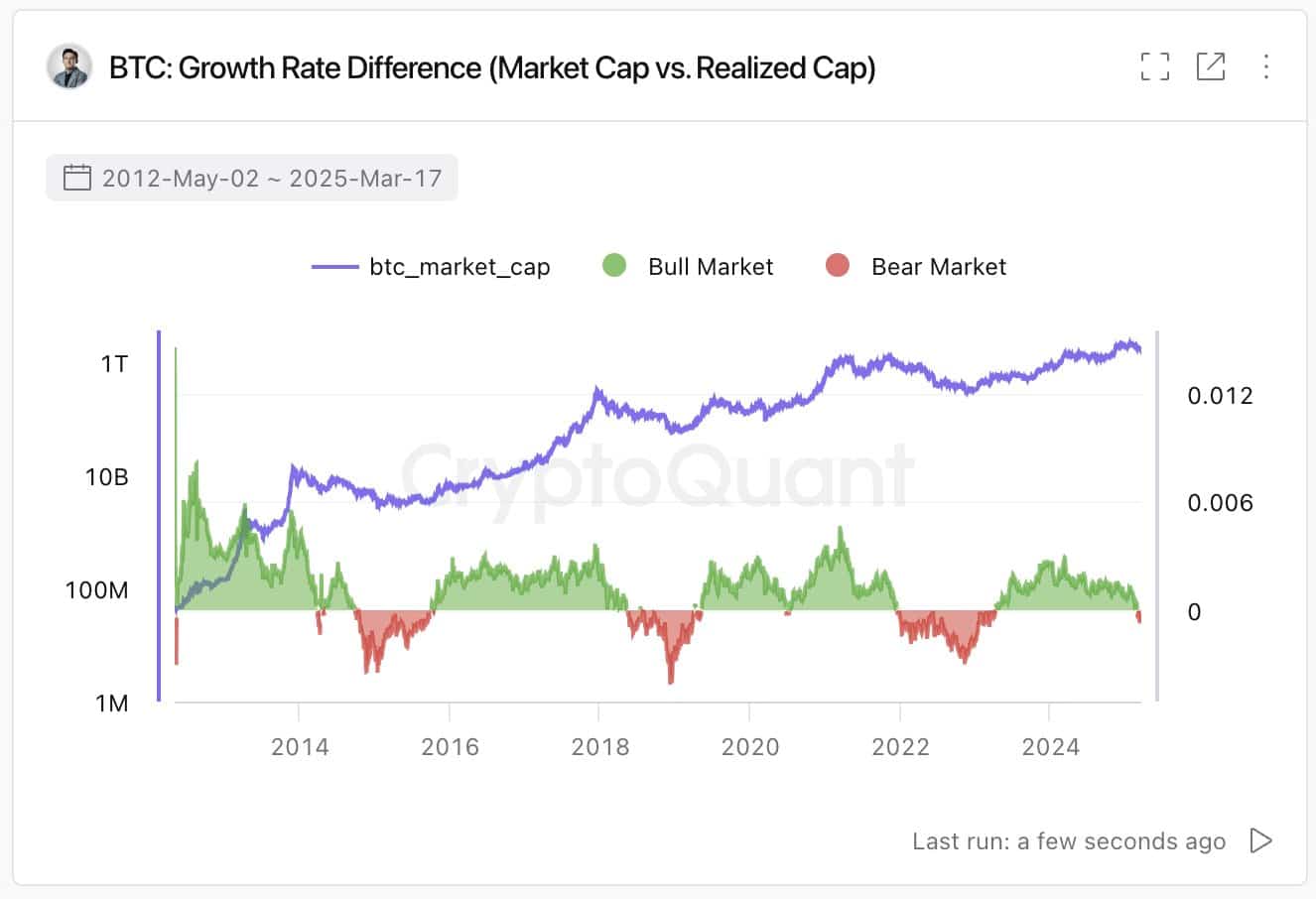

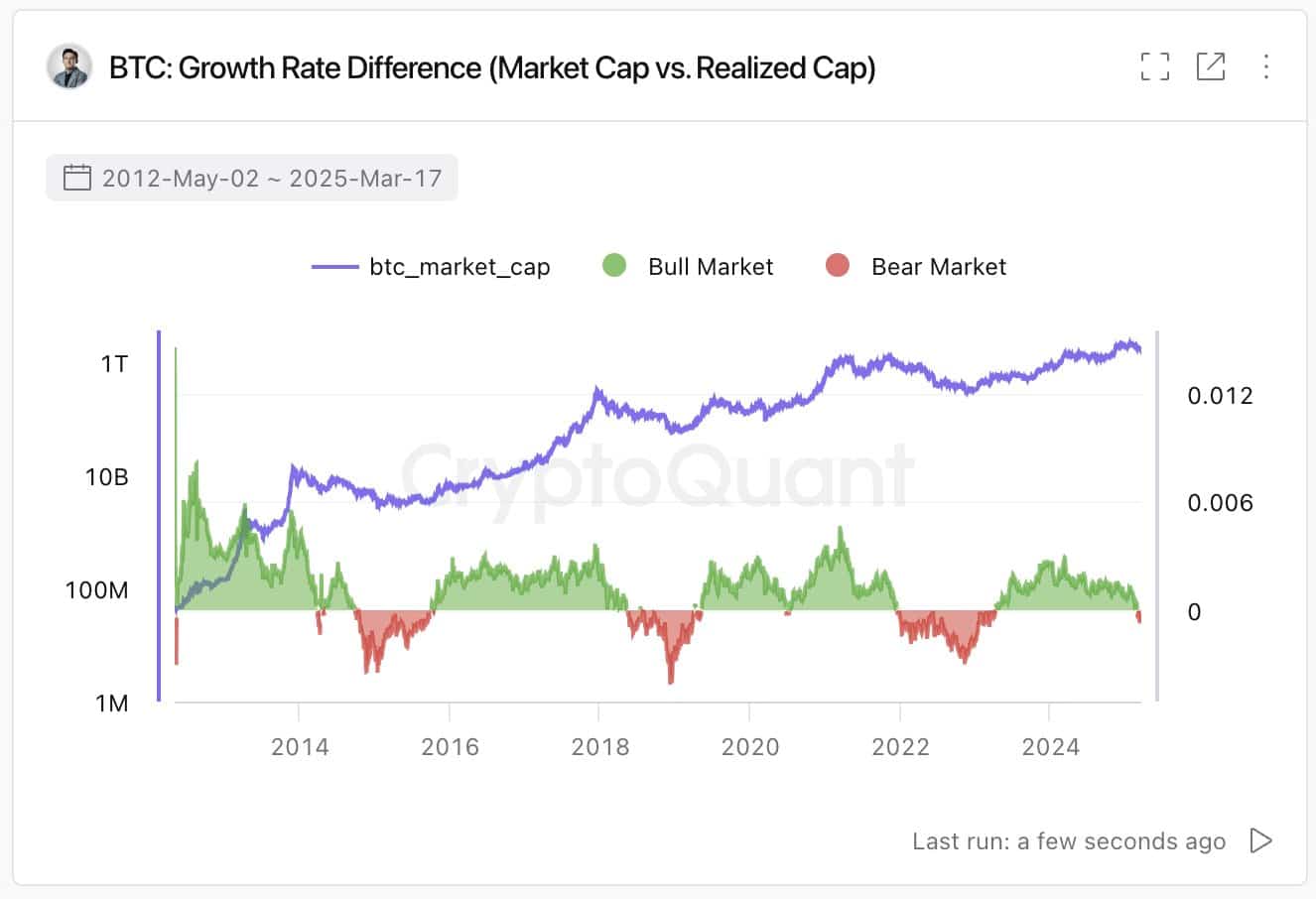

For his part, Young Ju stated that BTC has entered a bear market, citing weak ETF flows and a ‘lack of new liquidity.’

“It now looks pretty clear that we’re entering a bear market. Realized cap-based indicators show a lack of new liquidity. Massive volume around 100K failed to push the price higher, and ETF inflows have been negative for three consecutive weeks.”

Source: CryptoQuant