- The weekly chart indicated that DOT could see a substantial rise to $32 soon if certain conditions are fulfilled.

- Both individual investors and large-scale holders, known as whales, are expected to drive DOT’s price to new long-term highs.

Though Polkadot [DOT] has struggled with a daily decline of 4.35% and a marginal weekly decrease of 0.23%, the altcoin’s outlook remains promising.

According to the weekly timeframe, DOT was at a critical support level at press time, on the brink of breaking out of a falling wedge, targeting a peak at $32.

Why DOT might rally to $32

A combination of a falling wedge and strong historical support is setting the stage for a potential rally.

At press time, DOT was trading at a significant support level of $4.001, a point from which prices have previously rallied into higher regions. This level is also associated with substantial buying pressure.

The bullish sentiment was further supported by the formation of a falling wedge at this support level. Typically, a falling wedge suggests that the price of an asset is likely to rise once it breaches the upper boundary of the pattern.

Source: TradingView

Should DOT maintain support and successfully breach the upper region, three major long-term targets are targeted: $11.810 at the peak of the falling wedge, $23.850, and $32.780, where significant liquidity is anticipated.

Conversely, if the support fails to hold and the falling wedge breaks downward, DOT could potentially reach a new all-time low, falling below $2.000.

Bullish run around the corner

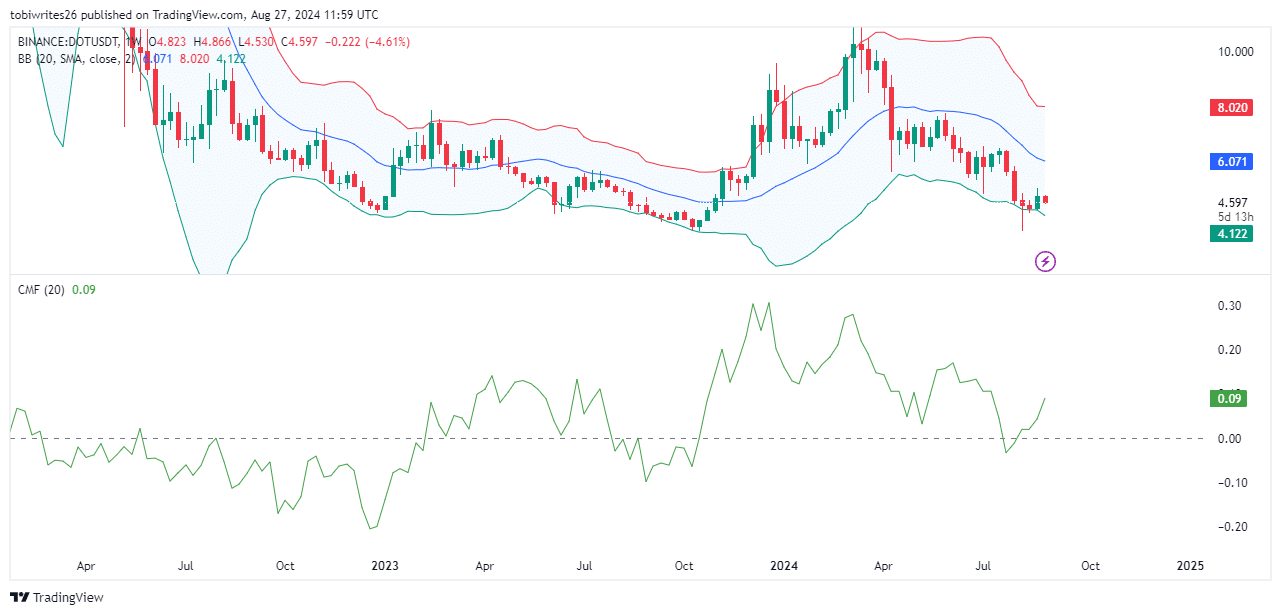

AMBCrypto’s technical analysis suggests a potential bullish run for DOT, utilizing tools like the Chaikin Money Flow and Bollinger Bands to track possible price movements.

The Bollinger Bands, defined by trendlines plotted two standard deviations away from a simple moving average (SMA) of the asset’s price, serve as indicators of market movements.

When the price approaches the lower (green) band, it often signifies an impending rally, while proximity to the upper (red) band suggests a potential price drop.

At press time, DOT was positioned near the lower band, indicating that a rally may be on the horizon, and suggesting that the support level at $4.0001 is likely to hold.

Source: TradingView

Additionally, the Chaikin Money Flow, which assesses whether money is flowing into or out of an asset by indicating buying or selling pressure, showed that investment is moving into DOT.

An influx of money typically signals increasing buying pressure, boosting market confidence in the asset and likely driving the price higher.

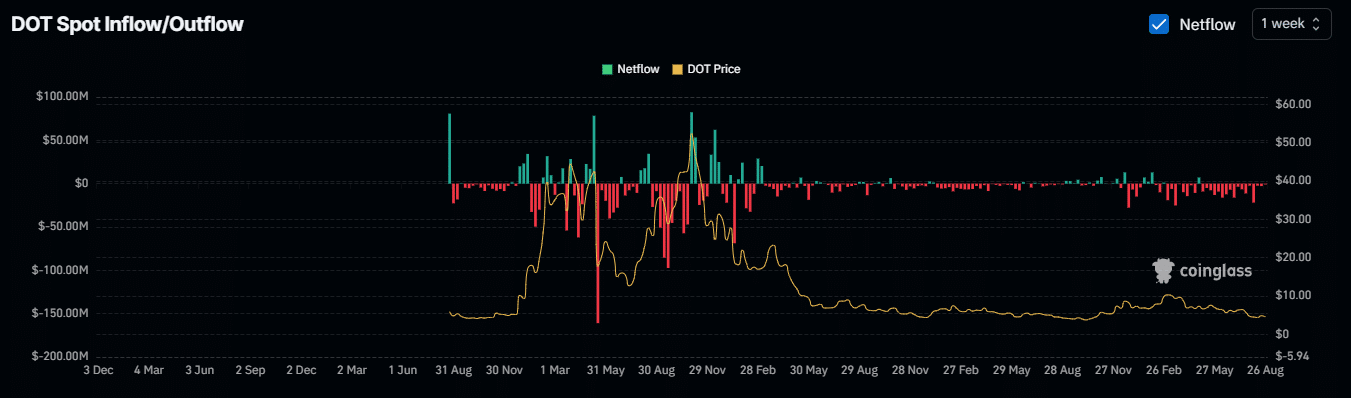

The market outlook for DOT remains bullish

According to data analyzed by AMBCrypto using Coinglass over the past week, there has been a significant outflow from exchanges, with approximately 2.833 million DOT being withdrawn.

This negative Netflow suggests that DOT holders are moving their assets from exchanges—where they can easily sell—to more secure wallets.

Source: Coinglass

The action typically reflects a bullish sentiment, indicating that investors are optimistic about future price increases and prefer to hold onto their assets.

Read Polkadot’s [DOT] Price Prediction 2024–2025

Presently, this trend underscores a growing confidence among market participants, suggesting that a rally may be imminent.

Overall, the indicators point to a bullish outlook for DOT, with expectations that it could climb to a long-term price target of $32.