- There is no significant resistance level ahead, giving XRP a clear path to potentially major gains.

- However, the rally would likely be ignited once more investors enter the market.

XRP has recorded a modest surge over the past 24 hours, with the price rising by 4.56%. This keeps its weekly performance in the double digits, at 21.21%.

With no resistance or supply level ahead to trigger sufficient selling pressure, XRP holds strong potential for a major price rally.

AMBCrypto’s analysis highlights the key factors likely to influence this move and the criteria to watch.

Is this a free path for XRP?

AMBCrypto’s analysis shows no significant resistance level ahead for XRP, which could allow for a free rally.

Resistance levels typically form above current price levels and are areas where large sell orders are placed, often causing a price correction or pullback.

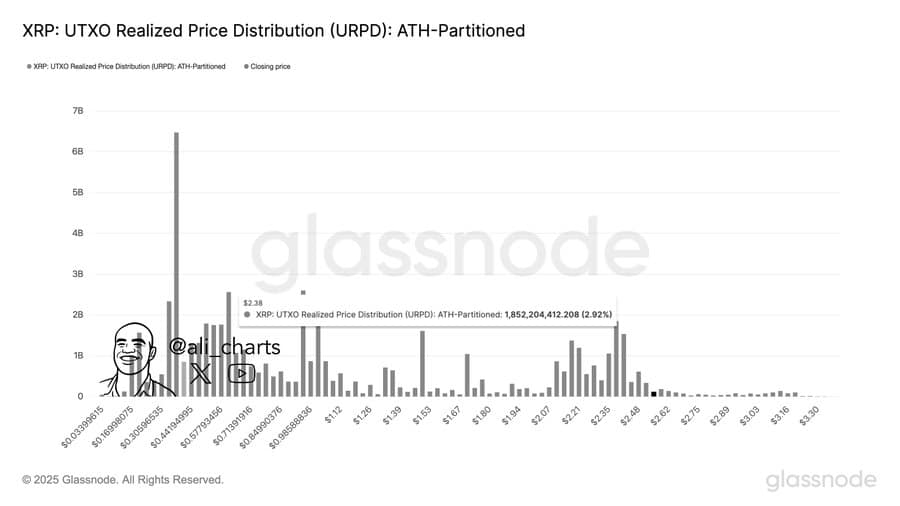

Source: Glassnode

Interestingly, even if a broader market decline forces XRP to drop, it is likely that the asset declines to a key support level at $2.38.

Buying activity remains high across the market

Buying sentiment has remained strong in both the derivatives and spot markets. This has increased the likelihood of a surge in upcoming trading sessions.

In the past week alone, a total of $48.93 million worth of XRP was withdrawn from exchanges and moved into private wallets.

Source: CoinGlass

This kind of fund movement suggests that spot traders have a long-term outlook and are accumulating XRP in anticipation of a major rally.

Additionally, in the derivatives market, both Futures and Options traders have significantly increased their position sizes as Open Interest rises.

In the Futures market, the amount of unsettled contracts has risen by 17.17% to $5.5 billion, while the Options market saw an 18.78% increase to $1.03 million.

Source: CoinGlass

However, this rise only confirms bullish intent if long traders dominate these unsettled contracts.

Using the Open Interest Weighted Funding Rate, AMBCrypto determined that these contracts are indeed dominated by bulls.

When the OI-Weighted Funding Rate stays positive, it suggests that most unsettled contracts come from leveraged buying positions expecting an XRP rally.

Conditions still remain for XRP

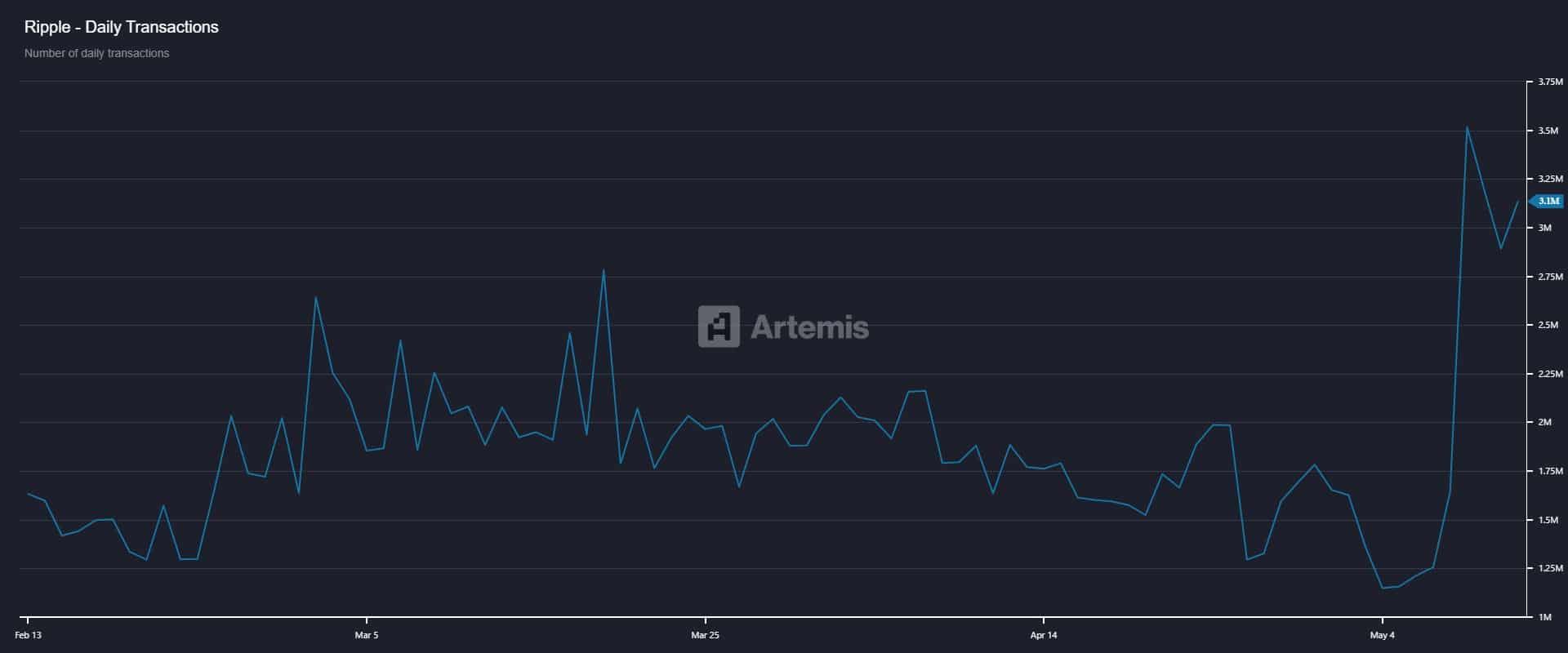

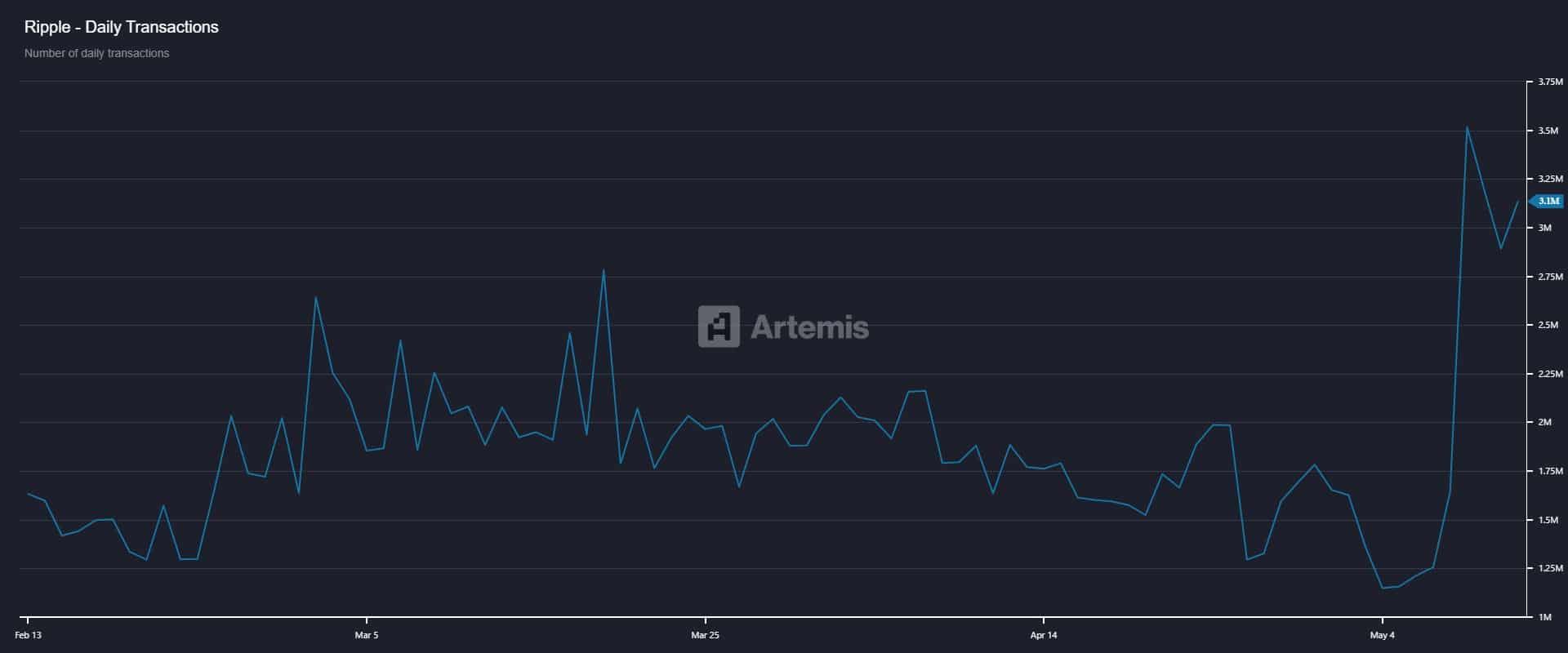

While the market appears bullish and poised for a major move, two key catalysts for triggering the rally are daily active addresses and daily transactions.

At the time of writing, both metrics have yet to reclaim previous highs, implying that the current number of investors remains lower than in the past.

Source: Artemis

This has led to reduced transactions and lower utility for XRP. If those investors return to the market, XRP could continue its upward trajectory, as they would likely begin accumulating the asset.

With no resistance or supply level ahead, XRP holds substantial potential to record some of the most significant gains in the market.