- XRP investors are cashing out, making the $3 level critical.

- With the Trump pump losing its magic, will the whales step in to save the day?

Ripple[XRP] doubled in value with 72% of its recent movement trending up, boosting its market cap by 33%. Yet, it’s still 8% off its $194B peak as investors cash out.

With BTC missing a ‘Trump rally’ and caution running high, where does XRP stand in the bigger picture?

XRP stands at a crossroads

Just yesterday, Bitcoin[BTC] hit $109K, a record high, as billions poured in. The crypto market cap soared to $3.71 trillion. Fast-forward 24 hours – $502.51 million in ‘longs’ wiped out, and the market’s down 6.2%. Optimism has quickly faded.

Altcoins weren’t spared, with high-caps losing key levels. But, XRP was holding strong at $3, down just 1.22% – significantly better than its peers.

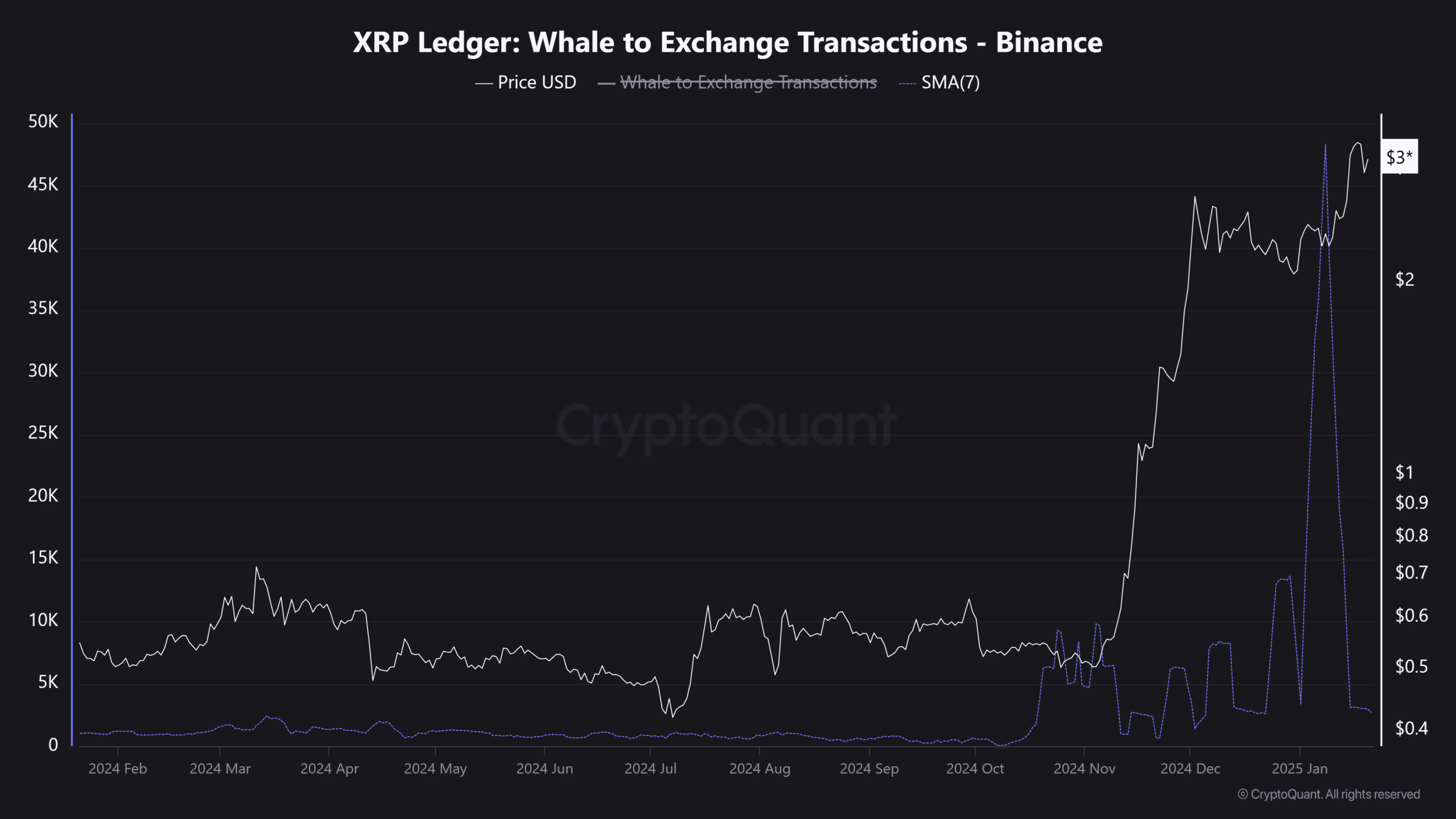

Lately, XRP has been overheating, with billions of tokens snapped up by whales since the post-election surge.

In fact, another $100 million was injected just before Donald Trump’s swearing-in. These big players were hoping to recreate the historic surge when XRP broke two major resistance levels.

But now, the market’s shifting. XRP is down 11% from its yearly high of $3.40. Big players are left with a tough call – cash out or hold on, risking the next big opportunity? All eyes are on them.

Source: CryptoQuant

So far, no massive sell-off, but if XRP falls below $3, the risk of holding may push investors to protect their margins. And it doesn’t get any better – the XRP/BTC pair is trending down, with the MACD on the verge of flipping bearish.

Instead of waiting for a ‘dip,’ investors are acting fast – Binance has seen 270 million XRP flood in.

Now, there are two possibilities for a turnaround: Either the broader market rebounds and restores confidence, or big players swoop in with their classic ‘buy-the-dip’ move.

High-risk, high-reward gamble

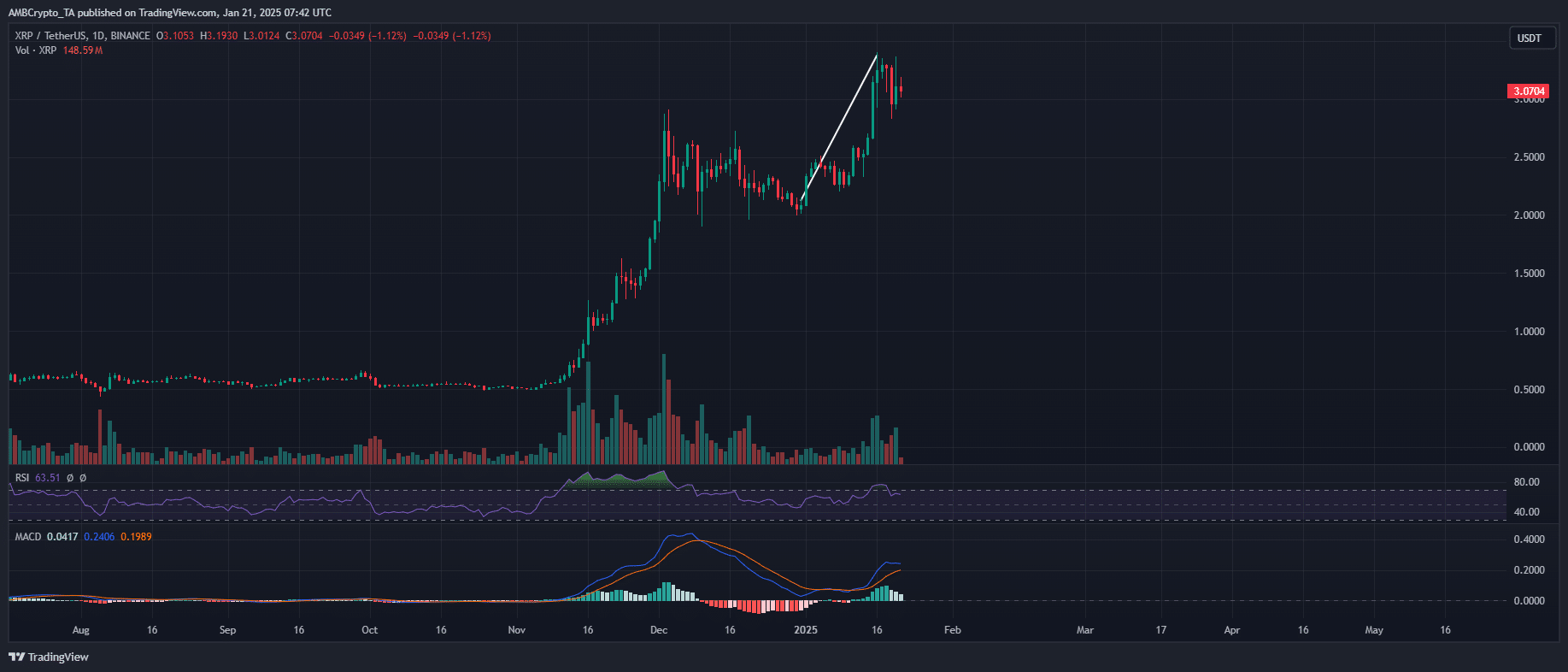

Remember the second Fed clash? As the New Year buzz injected fresh capital, Bitcoin and altcoins soared.

After the clash, BTC nosedived from $102K to $91K in just three days. Meanwhile, XRP bounced back with a 6.53% surge.

Source: TradingView

With Bitcoin’s ‘high-risk, high-reward’ appeal cooling, XRP could be set for a repeat rally or a strong short-term consolidation. Whales may be eyeing the market, ready to trigger a buying frenzy in the days ahead.

Realistic or not, here’s XRP market cap in BTC’s terms

Meanwhile, Open Interest (OI) in the futures market has dropped more than 4%.

It’s clear that ‘longs’ are either anticipating a correction or had their positions forcibly closed. This squeeze could be the market’s way of clearing the air for a fresh capital influx.

The big question now is: Will the market see massive accumulation? If it kicks in, XRP could surge toward $3.50. With history on its side, it’s a real possibility – but the next few days will be critical in shaping this move.