- Bitcoin holders were still profitable, which threatened more selling pressure should the market uncertainty continue.

- The MVRV ratio’s predicted dip could take Bitcoin prices below the key $59k support level

Bitcoin [BTC] saw its demand slow down in April. Demand growth and ETF inflows were down, although on a month-to-date basis, the BTC ETF inflows stood at an impressive $555 million.

The lack of movement in BTC brought doubt to investors’ minds.

Last week’s dip saw $84 million flow out of U.S. spot Bitcoin ETFs. This saw a 22% drop in assets under management (AUM) of Bitcoin-linked funds.

Two on-chain metrics indicated that we could be in for a major correction.

The theory of mean reversion and Bitcoin’s need to reset

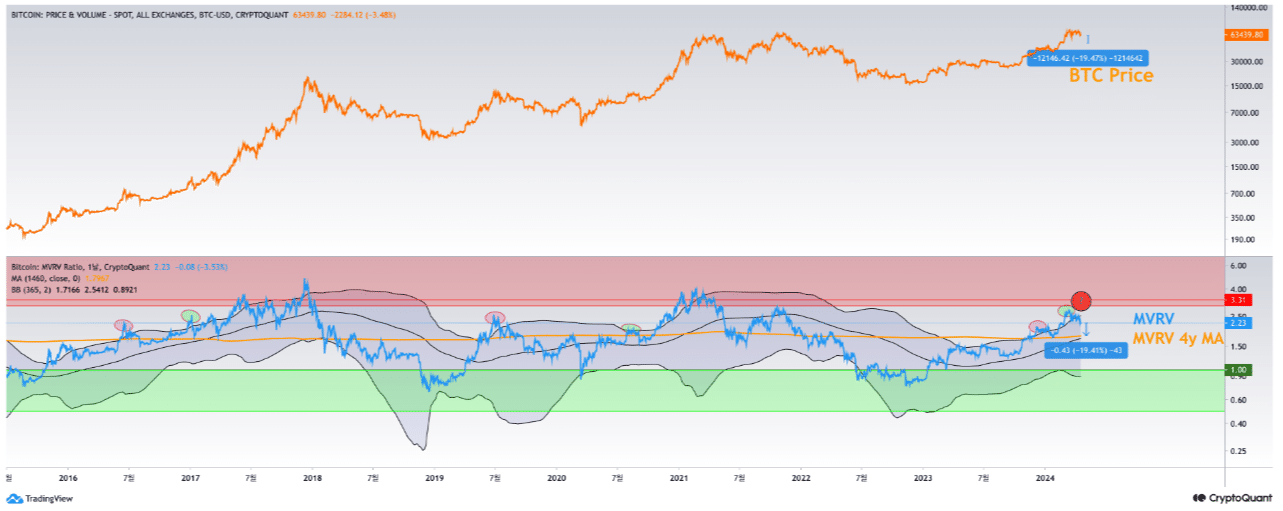

A CryptoQuant Insights post used the MVRV and Bollinger bands to theorize that a 20% correction was inbound for Bitcoin. The user combined the MVRV ratio on CryptoQuant with Bollinger Bands.

The bands are a mean reversion indicator. When the band’s extremes are breached, usually (but not every time) there is a movement toward the mean.

Source: CryptoQuant Insights

The analyst pointed out on the chart that the upper band was breached recently, but that the MVRV ratio was back with the bands. This suggested that it would move lower to the 365-period moving average.

Such a reversion would mean a 20% drop in prices for Bitcoin. The MVRV ratio, which is at 2.23, would be closer to 1.7 and such a retracement would be completely normal.

It could be the kind of reset that BTC has seen multiple times during bull markets.

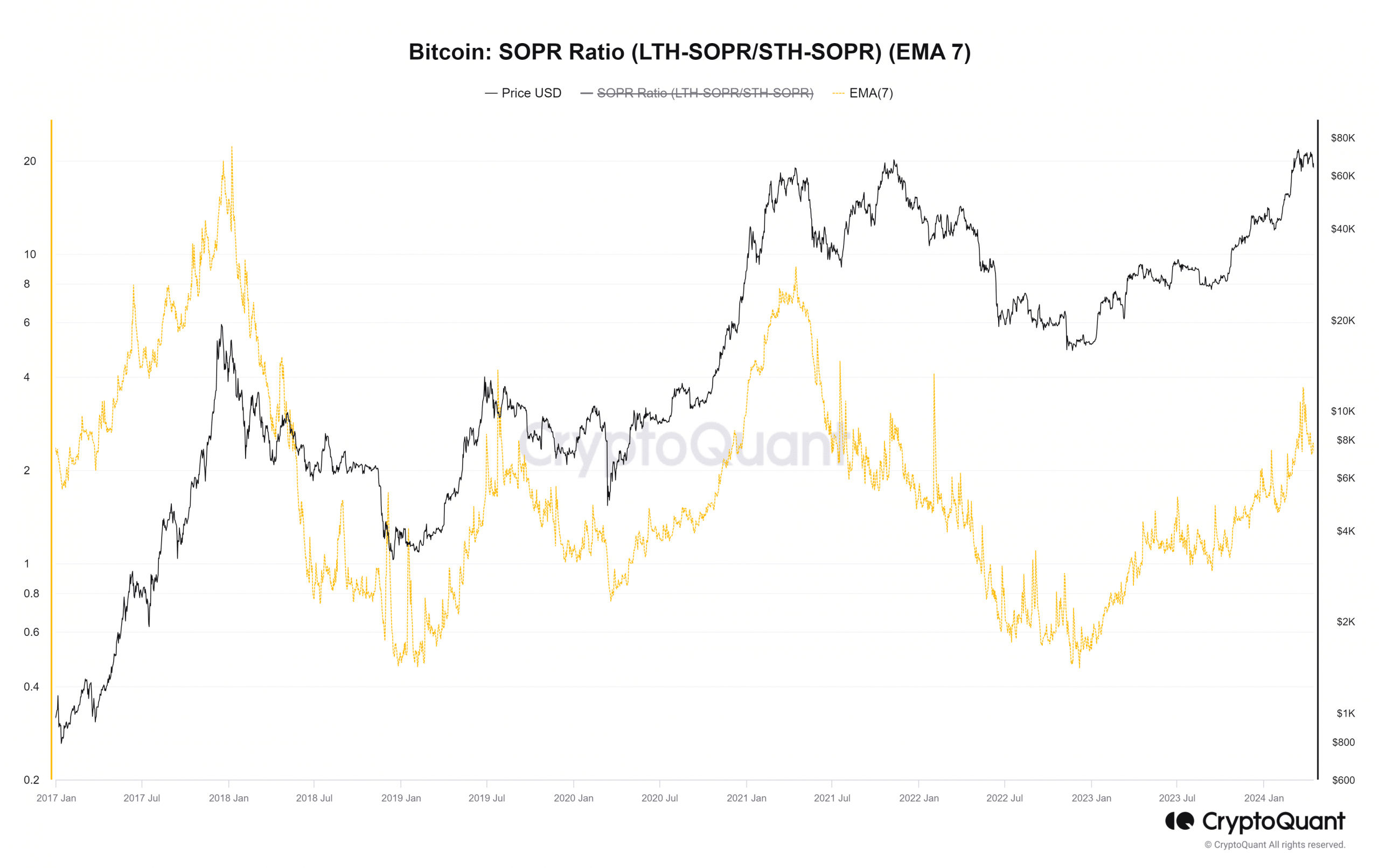

The SOPR underlined long-term holders were moving

Source: CryptoQuant

The spent output profit ratio (SOPR) indicates how profitable the market participants are. The 7-day EMA peaked at 3.7 on the 23rd of March and has dipped sharply since then.

This showed that BTC holders were at a tidy profit, even after the recent selling pressure.

In terms of value, the current situation was similar to the SOPR peak back in 2019 July, when the market rejected from a reading of 4.2. But now, the circumstances are different.

Back then, a bear market rally had ended, while now we are witnessing a bull market beginning.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Alternatively, the SOPR drop could also suggest a temporary top for Bitcoin. The market would need time to consolidate and absorb the selling pressure from fearful participants and profit-takers.

This scenario, if it plays out, would go hand-in-hand with what the MVRV Bollinger bands signal.